Ethereum Price Analysis: ETH Consolidates Near $1,500; Time To Buy Or Sell?

A rebound in the US dollar index weighs on the prospects of the second largest cryptocurrency. The Ethereum (ETH) price printed modest losses on Thursday. The formation of three consecutive ‘Doji’ candlesticks indicates indecision among traders.

- ETH price consolidates near $1,500 following two-day negative moves.

- Despite the price, correction bulls managed to hold the price near the crucial support level.

- The RSI drops from the oversold zone hint at the probable consolidation before the next directional setup.

As of press time, ETH/USD reads at $1,494.97, down 1.69% for the day.

ETH price consolidates before the next big move

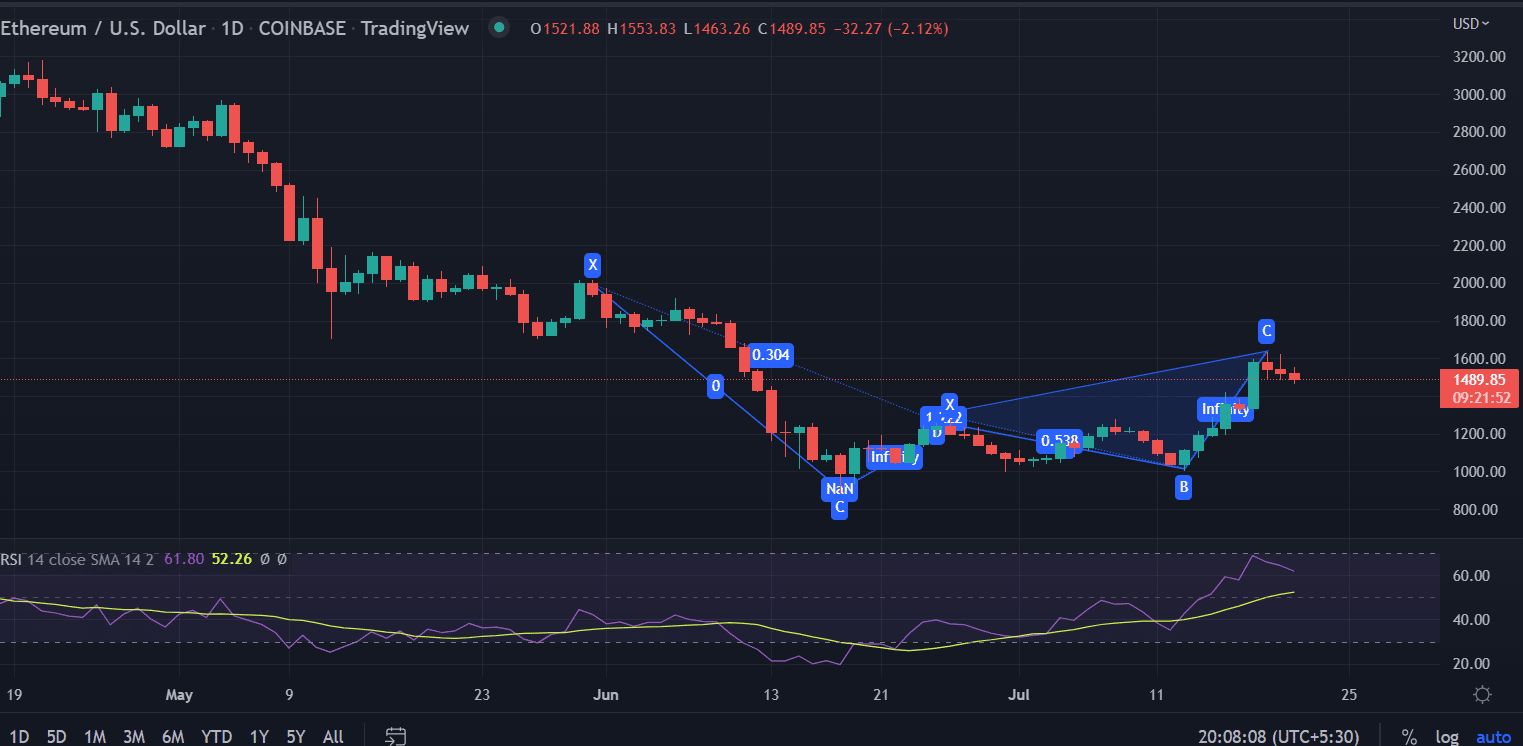

On the daily time frame, the ETH’s recent price action could be predicted bearish as it is not able to break its previous swing highs. Furthermore, the formation of a bearish Harmonic pattern, known as the Gartley pattern makes bears hopeful. It’s a short-term reversal pattern, which occurs when the price starts to fall from 78.6% of the Fibonacci retracement of its previous trend.

As per the mentioned price pattern we can expect a downside move toward $1430.

In addition to that for the three days, ETH is forming an inside candle of a big bullish candle, indicating sideways movement. Now, if the price breaks 50% of the bullish green candle and closes below that level, then we can expect the continuation of the prevailing downside trend.

Let’s is what’s forming on the hourly chart?

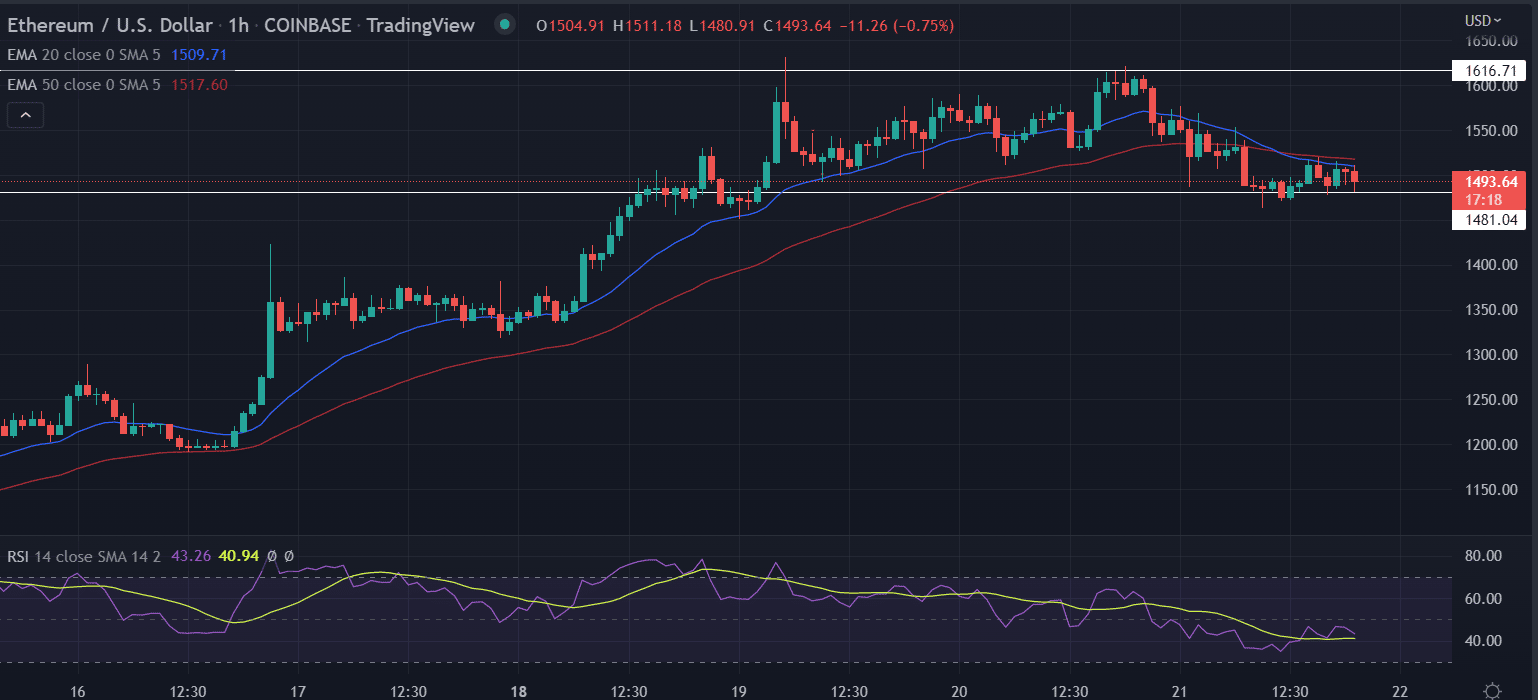

The trend is expected to change in a shorter time as well. The asset is making higher highs and higher lows. Near the highs, the price entered into consolidation. Next, a double-top structure broke down to lower levels. Near the mentioned level, investors started distributing ETH resulting in shorting opportunities.

Further, the 20-day EMA bearish crossover to the 50-day EMA strengthen the bearish sentiments in the asset.

On the contrary, a daily close above $1,500 would invalidate the bearish theory.

Conclusion:

ETH is slightly sideways to bearish on multiple time-frame. An acceptance below $1,500 on the daily basis could start a fresh selling spree.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k