Ethereum Price As Stablecoin Volume Hits ATH of $2.82T Despite Struggling Crypto Market- Is a Recovery In Sight?

Highlights

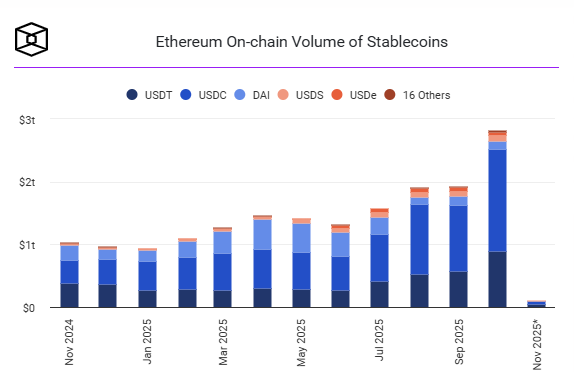

- Stablecoin trading on Ethereum hit a record $2.82 trillion in volume.

- Investors shifted to stablecoins amid rising crypto market caution.

- ETH nears oversold zone; rebound possible if $3,650 holds.

Ethereum price has remained under pressure, but stablecoin activity on its network surged to new highs in October.

Ethereum-based stablecoins recorded a massive $2.82 trillion in on-chain trading volume, up 45% from September. This is the largest monthly volume on record. The most traded was USDC where it generated 1.62 trillion.

Ethereum Stablecoin Volume Hits Record High

Analysts highlight greater market caution as a major factor behind this explosion in stablecoin use. To the extent that investors sought to mitigate risk and gain liquidity in the face of more widespread crypto contraction, they relied on stablecoins.

Reports indicate that the proportion of stablecoin protocol revenue to crypto protocol revenue was 65-70% in October, with most of the revenue coming through interest on low-risk assets.

Notably, despite the stablecoin boom, major crypto market coins like Bitcoin and Ethereum saw value declines. Ethereum fell by 16.4%, while Bitcoin dropped 11.5% during the same period. The contrast highlights the growing role of stablecoins as safe havens during market turbulence.

Analyst Predicts ETH Price Rally Amid Crucial Support

A crypto analyst has pointed out that the Ethereum price is in a test of key support area at the present.

In his analysis, the rebound to the $4,000 mark is a possibility in the week, assuming that this level will hold firm. The chart that he provided reveals that there is a lot of buying interest in this zone, and this will give an upward movement in case buyers intervene with sufficient volume.

Yet, analysts cautioned that Ethereum would plunge downwards should it lose this support. ETH can then decline to the level of the $3,500 mark, which would indicate a more profound correction.

$ETH is now at its crucial support zone.

If this level holds, Ethereum could rally towards $4,000 this week.

If ETH fails to hold this, expect a dump below the $3,500 zone. pic.twitter.com/Y0W5KC20EV

— Ted (@TedPillows) November 3, 2025

Will Ethereum Price Hold Support Level?

As of November 3, the ETH price traded at $3,702, showing a decline of 4% in the last 24 hours. The cryptocurrency has been unable to remain above the major support of $3,800 as it has become a short-term resistance.

The ETH price has been in a process of trading downside after failing recurrently to reach the $4,000 level. Recent price action indicates that the sellers are taking back power and the asset is drifting closer to the $3,650- $3,700 support area. Any decisive drop below this region can subject ETH to the subsequent significant level at $3,500.

On the positive side, a further break over $3,800 may stimulate a challenge to the $4,000 limit. Should strength continue to rise above that, the Ethereum could go to $4,300 in the next few sessions.

Thus, the future Ethereum outlook continues to show optimism as bulls anticipate further momentum.

The Relative Strength Index (RSI) is close to 32, and it indicates that Ethereum is close to oversold.

In the meantime, the MACD indicator is still in the negative region. The MACD line has passed below the signal line, which shows that the market is still dominated by the bearish momentum. The histogram might be narrowing, which may indicate that there would be a potential recovery attempt in later this week.

Frequently Asked Questions (FAQs)

1. How much on-chain trading volume did Ethereum stablecoins record in October?

2. Which stablecoin dominated Ethereum’s trading activity?

3. Why are stablecoins becoming more popular on Ethereum?

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand