Ethereum Price Prediction As Buyers Escape Two-Months Consolidation; Time to Regain $2000?

Ethereum Price Prediction: Fueled by optimism over the potential approval of a Bitcoin spot ETF, the crypto market has seen a surge in buying activity over the past week. As Bitcoin touched the $35,000 mark for the first time in 2023, the ripple effect extended to altcoins which resulted in an extended recovery sentiment. Thus, the second largest cryptocurrency Ethereum broke through its last swing high resistance at $1,745, signaling more room for an upward journey.

Also Read: 80% of Bitcoin Holders in Profit, What’s Next? Caution or BTC Price Rally?

Is ETH Price Heading to $2000?

- An upside breakout from the $1745 barrier prepares the ETH price for a 12.5% jump

- A bullish crossover between the 20-and-50-day EMA could boost the market buying pressure.

- The intraday trading volume in Ether is $6.6 Billion, indicating a 34% gain.

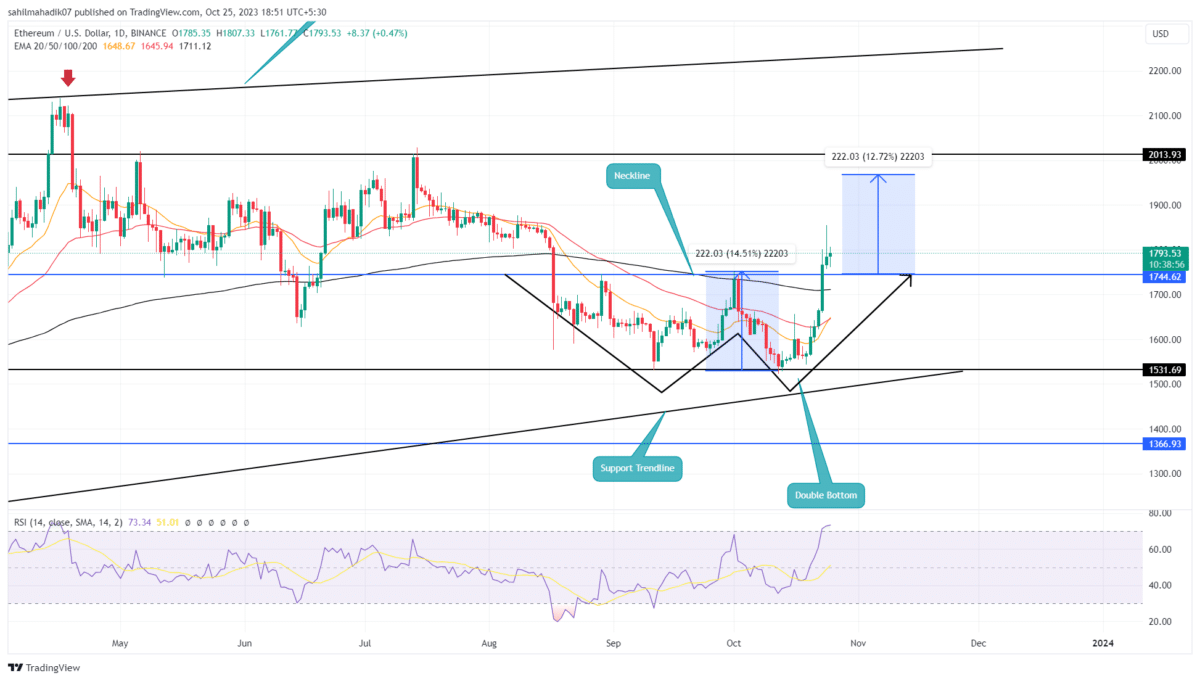

The ETH price has been on a seven-day ascent, climbing from an October 19 low of $1,643 to its current trading price of $1,786—a notable 14.10% gain. This upswing enabled Ether to shatter a crucial two-month resistance at $1,745 on October 23, liberating the coin from a sideways range and completing a bullish reversal pattern known as a double bottom.

Despite the rally, the presence of supply pressure near the $1,800 level suggests a possible short-term pullback to retest the $1,745 support. Should the Ethereum price successfully validate this level as new support, it would pave the way for an extended rally targeting the $1,970 to $2,000 range.

According to Dow Theory, breaking past the last high resistance of $1,745 could indicate an early sign of a trend reversal for Ethereum.

Global In/Out of the Money Metric

As for on-chain analytics, the Global In/Out of the Money (GIOM) metric reveals that 62.13% of Ethereum addresses are currently in the money, realizing profits, while 34.19% are out of the money and experiencing losses. This suggests that a significant majority of ETH holders are in a profitable position, reducing the likelihood of fear selling in the near term.

- Relative Strength Index: the daily RSI above 70% marks reflects the active bullish momentum in the crypto market.

- Exponential Moving Average: For the anticipated pullback, the 200 EMA slope wavering around the $1730 mark could offer strong support.

Recent Posts

- Price Analysis

Will Solana Price Hit $150 as Mangocueticals Partners With Cube Group on $100M SOL Treasury?

Solana price remains a focal point as it responds to both institutional alignment and shifting…

- Price Analysis

SUI Price Forecast After Bitwise Filed for SUI ETF With U.S. SEC – Is $3 Next?

SUI price remains positioned at a critical intersection of regulatory positioning and technical structure. Recent…

- Price Analysis

Bitcoin Price Alarming Pattern Points to a Dip to $80k as $2.7b Options Expires Today

Bitcoin price rebounded by 3% today, Dec. 19, reaching a high of $87,960. This rise…

- Price Analysis

Dogecoin Price Prediction Points to $0.20 Rebound as Coinbase Launches Regulated DOGE Futures

Dogecoin price has gone back to the spotlight as it responds to the growing derivatives…

- Price Analysis

Pi Coin Price Prediction as Expert Warns Bitcoin May Hit $70k After BoJ Rate Hike

Pi Coin price rose by 1.05% today, Dec. 18, mirroring the performance of Bitcoin and…

- Price Analysis

Cardano Price Outlook: Will the NIGHT Token Demand Surge Trigger a Rebound?

Cardano price has entered a decisive phase as NIGHT token liquidity rotation intersects with structural…