Is Bitcoin Price Set for Major Recovery as December Rate Cut Chances Hit 80.9%?

Highlights

- Fed officials support a December rate cut, strengthening the broader Bitcoin price outlook.

- A top analyst’s reversal structure mirrors 2021, signaling improving conditions for BTC.

- Daily chart reaction shows firm channel support as long-term BTC price performance steadies.

The Bitcoin price starts the week with a calmer tone as markets settle after a turbulent stretch. Sentiment picks up slightly as traders shift their focus toward fresh macro expectations and easing probabilities.

Furthermore, the broader environment now reflects a more measured approach, with investors weighing both risk and opportunity. Meanwhile, pockets of stability begin to appear across the charts as short-term signals strengthen and volatility compresses.

Fed Cut Odds Shape BTC’s Path As Macro Winds Shift

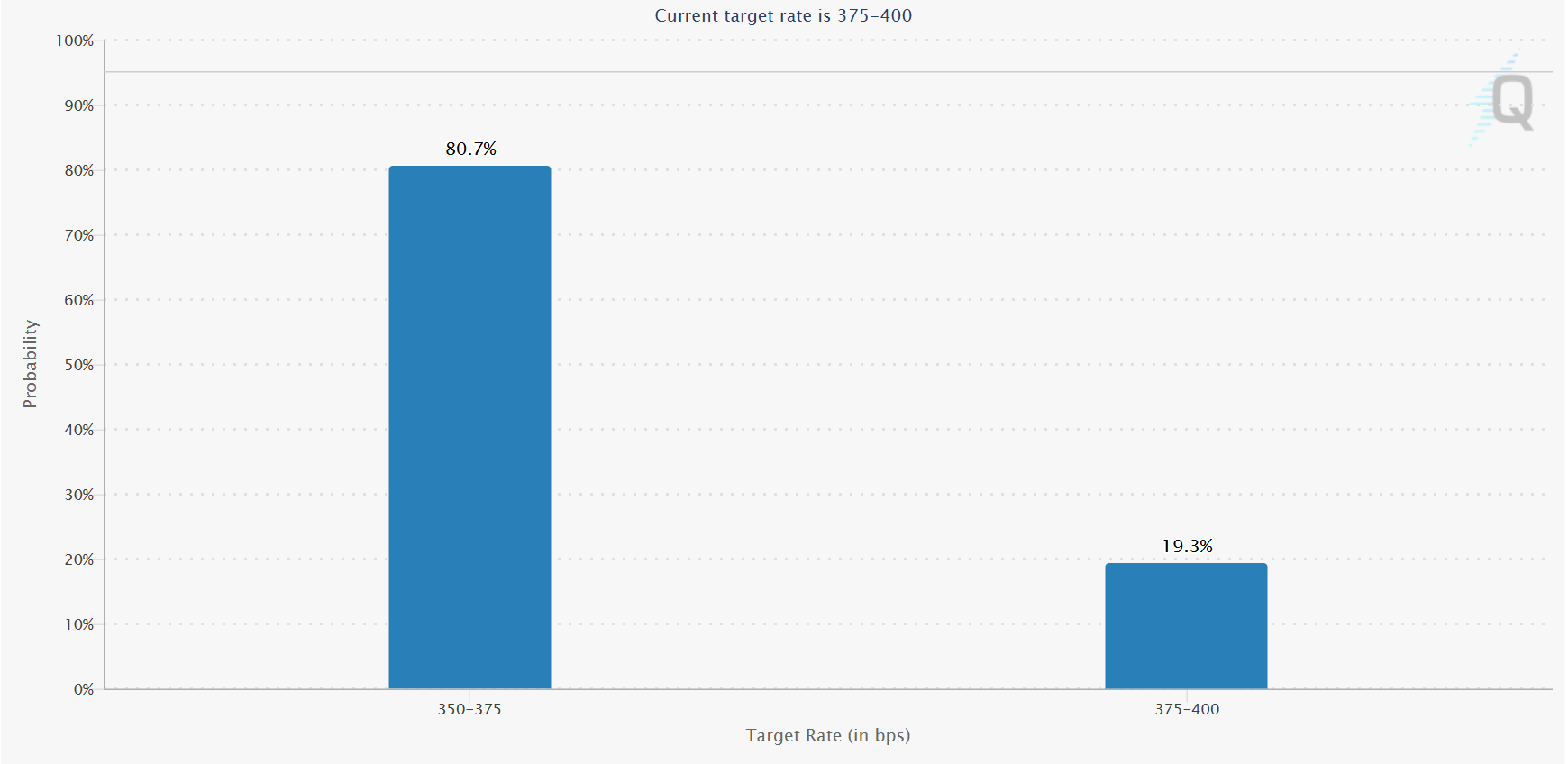

Fresh rate expectations influence the BTC price as markets assign an 80.7% chance of a cut toward the 350–375 bps range. The surge comes days after Fed Governor Chris Waller advocated for a December rate cut, citing labor-market weakness.

This sharp tilt toward easing supports risk assets during a period of cautious rebuilding. Meanwhile, the current Bitcoin value trades at $87,456, offering a clear benchmark for market reactions when macro signals shift.

Furthermore, easing expectations create room for BTC to regain stability after weeks of pressure. Traders study how these odds align with the broader structure, especially as liquidity improves across key pockets of the market. Additionally, each shift in policy expectations often triggers faster adjustments in crypto due to its sensitivity to macro liquidity.

These combined signals now define a critical window for the coming weeks. BTC price reactions will likely continue to follow macro cues closely, and this alignment strengthens the potential for a steady rebound if conditions remain supportive.

Reversal Structure Resurfaces As Bitcoin Tests A Pivotal Breakout Zone

A top analyst highlights a structure that mirrors the 2021 bear setup, and the resemblance appears striking. The descending trendline, compression slope, and support behavior align closely with that earlier cycle.

However, Bitcoin now protects the $82K region instead of slicing below it, and this creates a stronger base for a possible reversal. Each small rise also forms a cleaner staircase pattern compared to the sharp breakdown seen in the previous cycle.

Additionally, the chart displays a potential reversal pocket where BTC coils beneath the trendline. The shape shows controlled intent rather than panic-driven swings.

Furthermore, this symmetry builds confidence as Bitcoin moves into a zone where breakouts historically shift broader sentiment. The gentler retest also reduces structural stress, giving BTC more breathing room.

This setup now carries meaningful weight. A break above the trendline could shift the wider narrative into a constructive phase, especially as the structure aligns with key cyclical markers.

Bitcoin Price Eyes Breakout As Daily Chart Flashes Fresh Strength

The 1-day chart presents a clean reaction near the lower channel boundary. Bitcoin tapped the $84,600 region and bounced with noticeable precision. Meanwhile, the upper boundary sits near $93,534, marking the next key breakout point that could spark stronger continuation.

Furthermore, the MFI stays at 16, placing BTC deep in oversold territory. This value supports the idea of a steady recovery attempt as pressure eases. The green projection on the chart outlines a staged move toward $108,020 and later $125,000, with each phase respecting clear resistance shelves.

Additionally, this structure favors controlled advances rather than aggressive spikes. BTC forms cleaner higher lows, and these steps build a stronger base for long-term BTC price performance. The interaction between oversold readings, channel boundaries, and projected paths creates a cohesive recovery map.

To conclude, Bitcoin enters a more constructive phase after defending its lower channel. Fed cut expectations strengthen this outlook and support gradual price rebuilding. A top analyst’s structure comparison adds further confidence with its clean cycle resemblance. Overall, BTC prepares for a clearer upside path as technical and macro signals begin to align.

Frequently Asked Questions (FAQs)

1. Why does the Fed’s policy stance matter for Bitcoin?

2. What makes the current BTC structure different from the 2021 setup?

3. How does the MFI reading contribute to market sentiment?

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 5 Reasons Ethereum Price Is Down Today

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?