Is Pepe Coin Price Set for 50% Crash as Whale Dumps 1,000,000,000 Tokens?

Highlights

- Pepe Coin price is at risk of a bearish breakdown as whales sell.

- One whale sold 1 trillion tokens taking a small loss.

- The coin has formed a head and shoulders pattern on the three-day chart.

Pepe Coin (PEPE) price has risen 15% over the last four consecutive days, moving from a low of $0.00001040 to $0.00001200 and currently trades at $0.00001200 as of June 9. The frog-based meme token is at a risk of a correction amid technicals flashing a bearish pattern and whales selling their holdings.

Pepe Coin Price at Risk as Whales Dump 1 Trillion Tokens

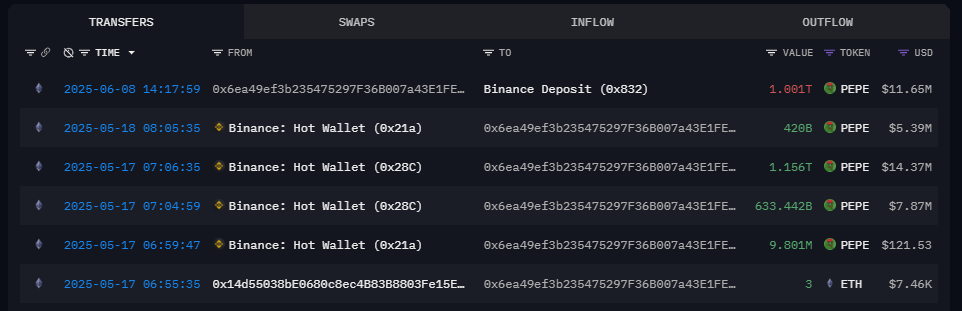

One whale may have sold 1 trillion PEPE tokens after transferring them to Binance. The Data Nerd, an on-chain analyst, pointed out that an address transferred $11.65 million worth of meme coins to Binance. Although it is unclear if the whale sold their holdings, The Data Nerd notes that if sold, the entity would realise a loss of $867K.

Other whales have been selling Pepe Coin as noted by Santiment data. The Supply Held By Whales metric outlines that this cohort’s holdings have retreated from a year-to-date high of 165 trillion tokens to 134.98 trillion tokens, hitting November 16 levels. This development is bearish and suggests that these investors are not confident in the future price action of Pepe Coin to hold the tokens.

Nansen numbers show that smart money investors have also dumped the token. They now hold 247 billion tokens, down from 259 trillion on May 21. Nansen defines these investors as those who have experience and a track record of success.

The Network Realized Profit/Loss indicator also paints a bearish picture. This metric shows investors sold their holdings for -3.83 million loss. This is a sign capitulation and occurs when the price undergoes huge corrections in short spans.

With blockchain data pointing to a bearish investor signs, what does technical analysis hold for the token? A potential bounce that overcomes the downtrend or crash fueled by whale selling spree?

PEPE Technical Analysis Hints 50% Crash

The three-day chart shows that the Pepe coin price has declined from last month’s high of $0.00001632 to $0.00001200 as of today. This drop coincided with the recent crypto market sell-off.

While Pepe has risen in the past four days, the risk is that it has formed a multi-year head-and-shoulders pattern, a common bearish reversal setup. This technical formation comprises a head, which, in this case, is at its all-time high of $0.00002838. It also has a neckline, which is at $0.000005716, its lowest level in March this year, and August and April last year. The two shoulders are approximately at $0.00001632.

If Pepe Coin price produces a decisive three-day candelstick close below the neckline, it will confirm a breakout. In such a case, the setup forecasts a 53% crash to $0.000001011. This theoretical target is obtained by adding the head’s height from the neckline to the breakout point.

Although the on-chain data and technicals point to a bearish otulook for Pepe Coin price, the head-and-shoulder pattern will face invlaidation if it flips the $0.00001632 resistance into a supprot floor. A decisive three-day candelstick close above this level could further propel PEPE token up by 30% to $0.000002170.

Frequently Asked Questions (FAQs)

1. Why is Pepe coin price at risk of a big drop?

2. Why are whales selling Pepe?

3. How low can Pepe price drop?

- Is Bhutan Selling Bitcoin? Government Sparks Sell-Off Concerns as BTC Crashes

- ‘XRP Treasury’ VivoPower Abandons Crypto Strategy Amid Market Crash, Stock Price Dumps

- Bitcoin Crashes to $65K as Crypto Market Erases $2T in Market Cap Since October Record High

- Trump’s World Liberty Financial Dumps Bitcoin as BTC Falls Back to 2021 ATH

- CLARITY Act Markup Still On Course as Senate Puts Crypto Bill on Schedule, Lummis Assures

- Dogecoin, Shiba Inu, and Pepe Coin Price Prediction as Bitcoin Crashes Below $70K.

- BTC and XRP Price Prediction As Treasury Secretary Bessent Warns “US Won’t Bail Out Bitcoin”

- Ethereum Price Prediction As Vitalik Continues to Dump More ETH Amid Crypto Crash

- Why XRP Price Struggles With Recovery?

- Dogecoin Price Prediction After SpaceX Dogecoin-Funded Mission Launch in 2027

- Solana Price Crashes Below $95 for the First Time Since 2024: How Low Will SOL Go Next?