Pi Network Price at Risk of a 35% Crash as CEX Reserves Jump

Highlights

- Pi Network price remains in a consolidation phase this month.

- Technical analysis points to an eventual 35% crash to its lowest point last week.

- Pi crypto volume has crashed, while exchange inflows have soared.

Pi Network price continues its consolidation today, June 16, as traders wait for a catalyst. The Pi crypto token trades at $0.6, and there are odds that it may crash by 35% and retest its lowest point last week. Its volume has plunged, a sign of low demand, while inflows into centralized exchanges have jumped.

Pi Network Price Technical Analysis Points to a Crash

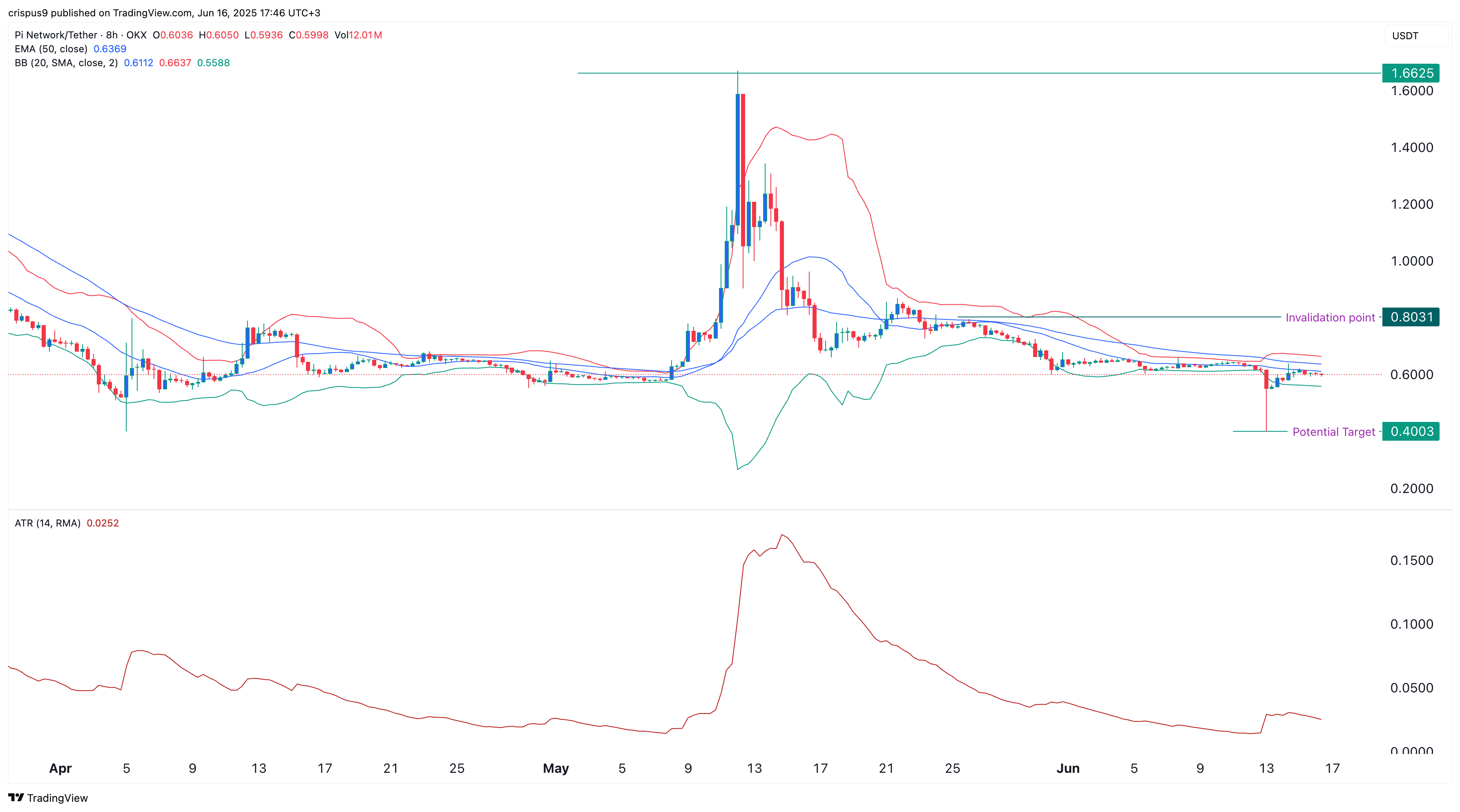

The eight-hour timeframe shows that the Pi Network price has largely moved horizontally since May. This consolidation happened after it plunged following its surge in May when the developers promised a major announcement.

Technicals suggest that the PI crypto token’s volatility has dried. The spread between the three lines of the Bollinger Bands indicator has narrowed substantially, while the Average True Range (ATR) has plunged.

Bolnger Bands and the ATR are the most popular volatility indicators in technical analysis. The ATR quantifies the average range of a price movement, accounting for gaps and other fluctuations. A declining ATR is a sign that the volatility has dropped.

The Bollinger Bands indicator is calculated by first establishing the moving average and then its positive and negative standard deviations. In most cases, an asset often makes a bullish or bearish breakout when the spread of the three lines narrows.

In Pi Network’s case, there is a likelihood that it will have a bearish breakout since it remains below the 50-period moving average. If this happens, the next Pi crypto price target to watch will be last week’s low of $0.40, which is about 35% below the current level.

The bearish Pi crypto price forecast will become invalid if it rises above $0.8031, the highest swing on May 26. A move above that level will point to more gains, potentially to the psychological point at $1.

Pi Crypto Volume Has Crashed While CEX Reserves Have Risen

The likely bearish catalyst for the Pi Network price is that demand has dropped in the past few months. CoinMarketCap data shows that the 24-hour volume tumbled by 44% to $59 million. Pi had a daily volume of over $3 billion during its peak. This demand drop is happening at a time when token unlocks are rising, with millions of tokens being released each day.

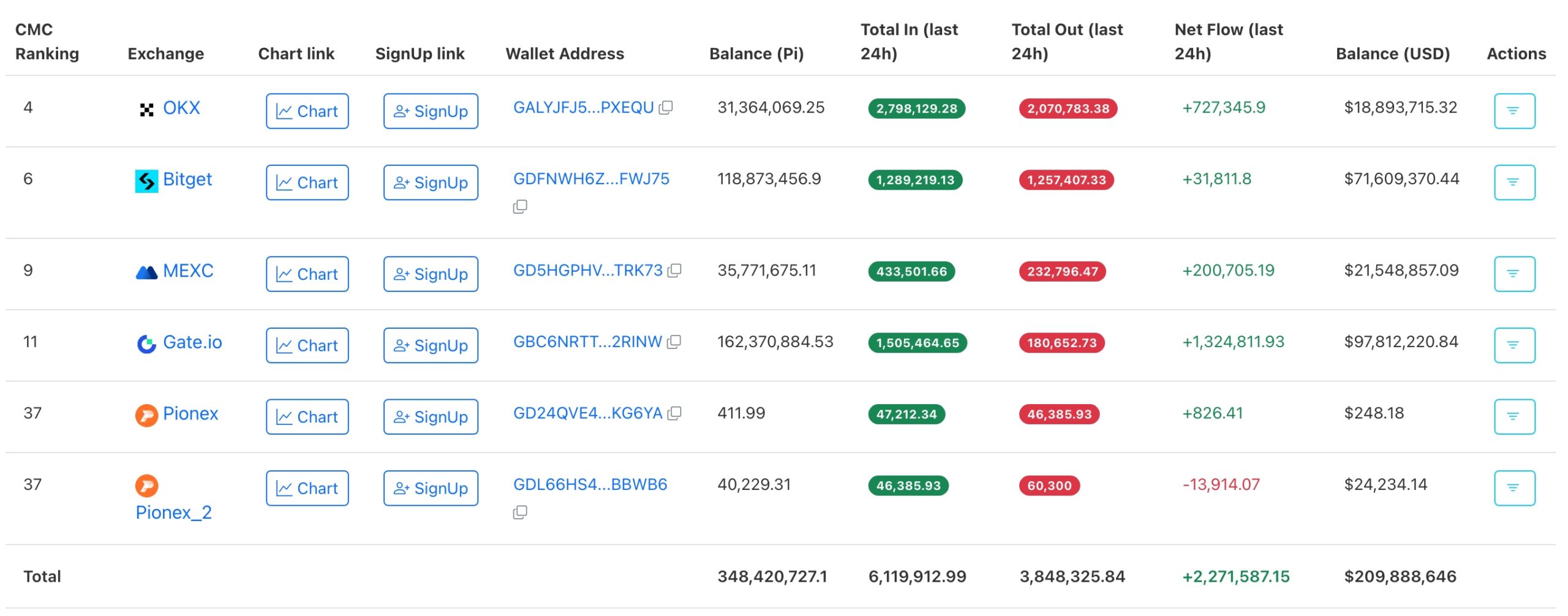

More data reveals that investors are moving their tokens from self-custody and dumping them into exchanges. Traders deposited 6.11 million tokens into exchanges in the last 24 hours and moved out 3.8 million. This led to a netflow of over 2.27 million tokens. An increase in exchange inflows is a sign that these investors are dumping them.

Still, there is a risk in shorting Pi Network. For one, an exchange listing by a company like HTX, Upbit, or Binance can happen at any time, leading to a triple-digit short squeeze.

The other risk is that the Pi Day 2 is coming next week, which may lead to major announcements that may push it higher.

Frequently Asked Questions (FAQs)

1. Why is Pi Network price at risk of a 35% crash?

2. Can Pi crypto price jump to $1?

3. Will Binance list Pi Network token?

- Top 5 Reasons Ethereum Price Is Down Today

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Taps XRPL for Euro Stablecoin With Ripple Support

- Kalshi Better at Predicting FOMC Rate Decisions, US CPI Than Fed Funds Futures: FED Research

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum