Pi Network Price Risky Pattern Points to Crash as 14M Coins Leave OKX

Highlights

- Pi Network price is at risk of more downside in the near term despite rising exchange outflows.

- The token has formed a bearish flag pattern on the daily chart.

- The number of new tokens entering the market continues to increase this year because of its token unlocks.

The Pi Network price has been left behind in the ongoing crypto market bull run. It was trading at $0.2500 on Monday and has formed a highly bearish chart pattern despite some notable bullish developments, including exchange outflows and the recent DEX and AMM testnet launch.

Pi Network Price Has Formed a Risky Chart Pattern

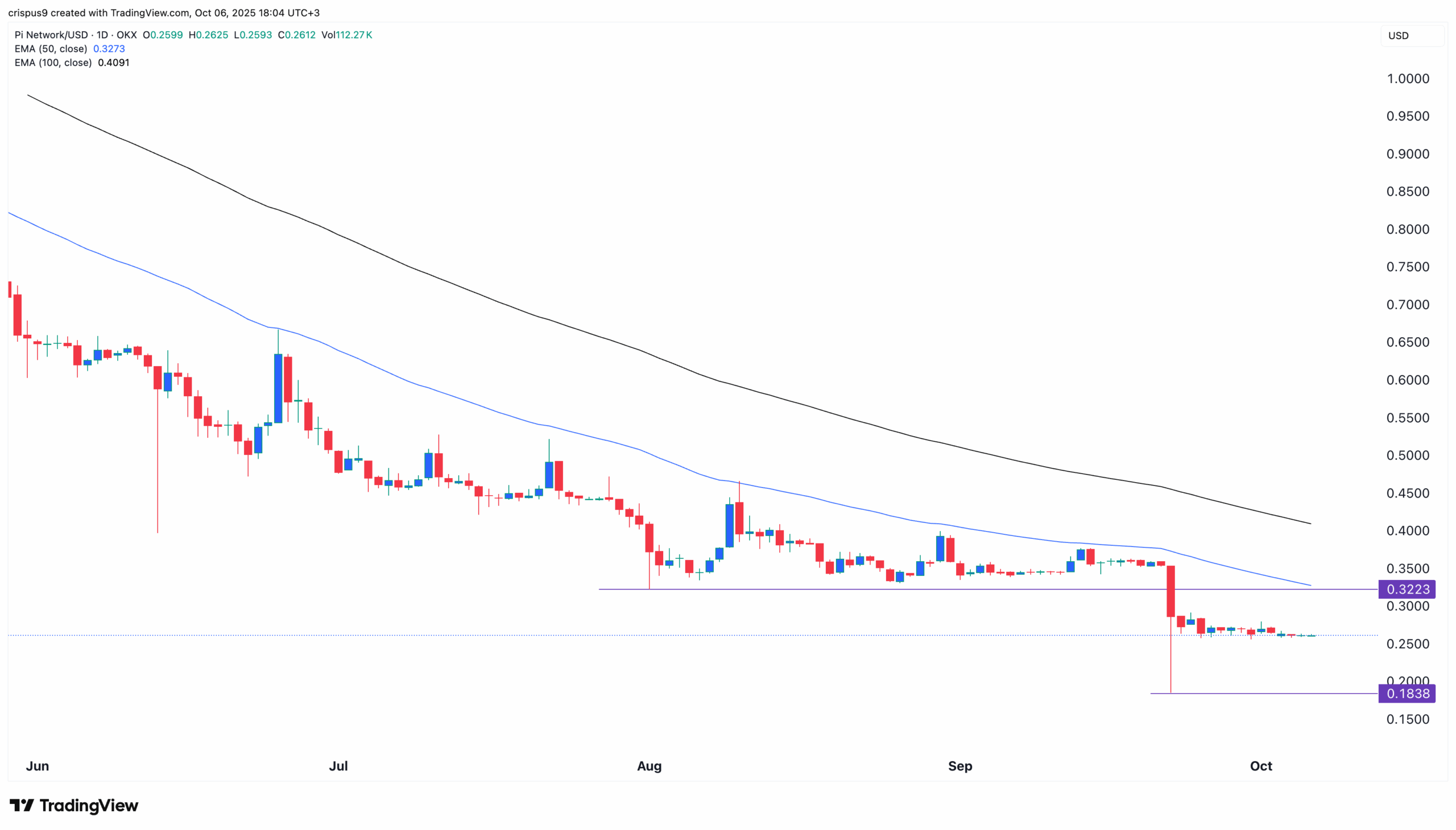

The daily timeframe chart reveals that the Pi Network price crashed to an all-time low of $0.1838 in September as most coins plunged.

It then bounced back but stalled at the important resistance level at $0.2500x where it has remained since then. The coin has now formed a bearish flag pattern, which is made up of a vertical line and a consolidation.

This pattern, together with the fact that it remains below the 50-day and 100-day Exponential Moving Averages (EMA), mean that bears are in control. It has also plunged below the crucial support at $0.3223, where it formed a double-bottom pattern in August and September.

Therefore, the most likely Pi Coin price forecast 2025 is highly bearish, with the next key support level being the all-time low of $0.1838, which is about 20% below the current level. Moving below that level will point to more sell-off to the psychological level at $0.1500.

On the flip side, a move above the crucial resistance level at $0.3223 will invalidate the bearish forecast and point to more gains in the coming weeks.

Millions of Pi Coins Have Left OKX

Pi Network price has crashed despite some important bullish catalysts. One of these catalysts is that on-chain data shows that millions of coins left exchanges, especially OKX on Monday.

Exchange outflows is usually a positive thing in the crypto market as it signals that investors are highly bullish on a coin. It. It normally means that these investors are optimistic that the coin will rebound over time.

Pi Network price has also wavered even after the Core Team made a major announcement on decentralized exchanges (DEX), liquidity pool, and automated market maker (AMM) tools on the testnet. The tools have launched on the testnet ahead of an eventual launch either this year or in 2025. This feature enables developers to create a DeFi networks in the Pi Network ecosystem.

There are potential reasons why the Pi Network price has moved sideways despite these developments. One of them is that the mysterious anonymous whale, who was accumulating it has stopped buying in the past two weeks.

Another one main reason why the Pi Network price remains under pressure is that demand remains weak as evidenced by the daily volume of less than $30 million and the increasing supply because of the daily unlocks.

Frequently Asked Questions (FAQs)

1. What is the most likely Pi Network price forecast?

2. What is the most likely Pi Coin price target?

3. Is Pi Network Coin a good buy today?

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k