Polygon Price Analysis: MATIC Consolidates Near $0.88; Hold Or Exit?

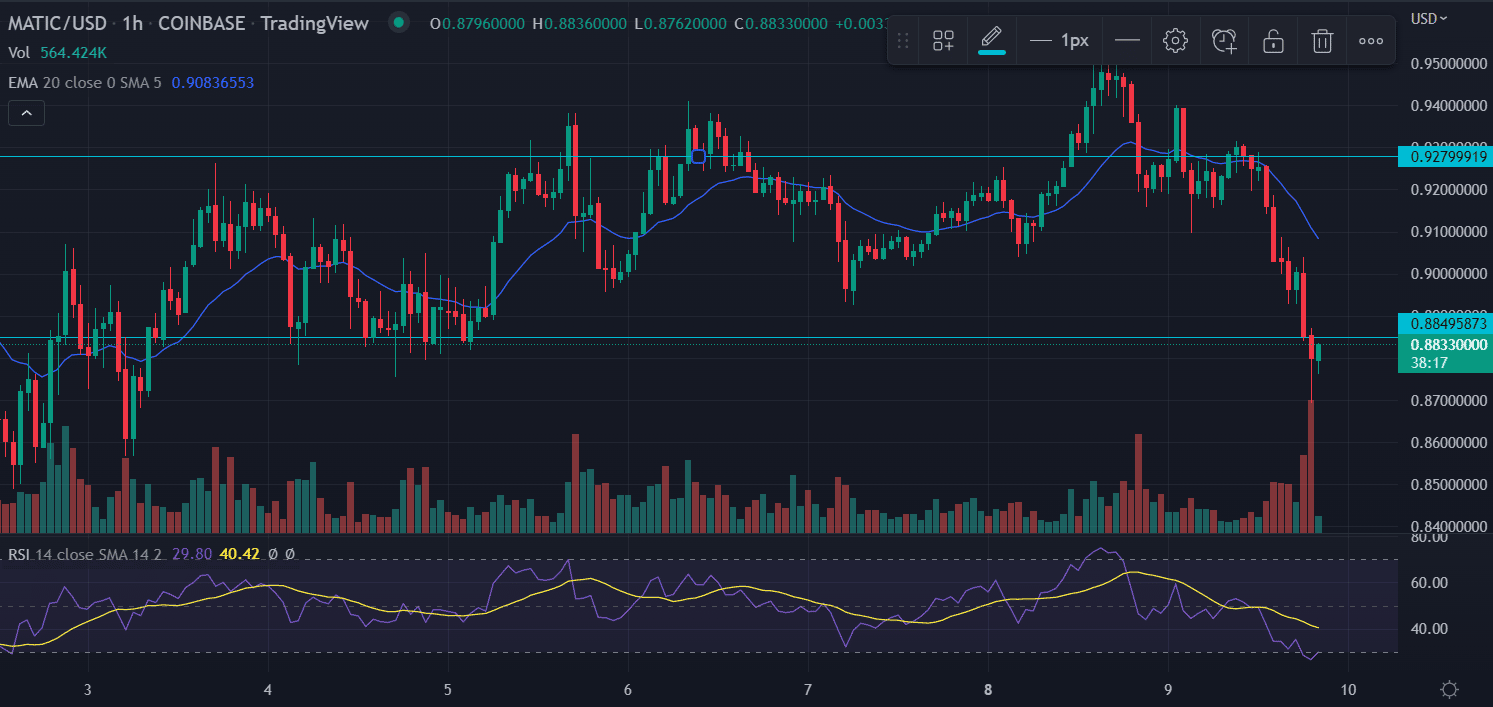

Polygon price analysis portrays consolidation at a higher level. The bulls failed to capitalize on the previous session’s gains as the price retreated below the crucial $0.95 mark. The formation of a ‘hammer’ candlestick on the hourly chart frame indicates the buying from the lower levels.

But the overall sentiment remained bearish. As of press time, MATIC/USD is reading at $$0.88, down 5.88% for the day. Further, the 24-hour trading volume gained 8% to $425,260,970 as per CoinMarketCap data. A jump in volume with a decline in price is a bearish sign.

- Polygon price erases all the previous gains and trades with a bearish bias.

- If the price drops below $0.88 it would bring more downside to MATIC.

- Short-term support was placed near the $0.86 level.

Polygon extends consolidation

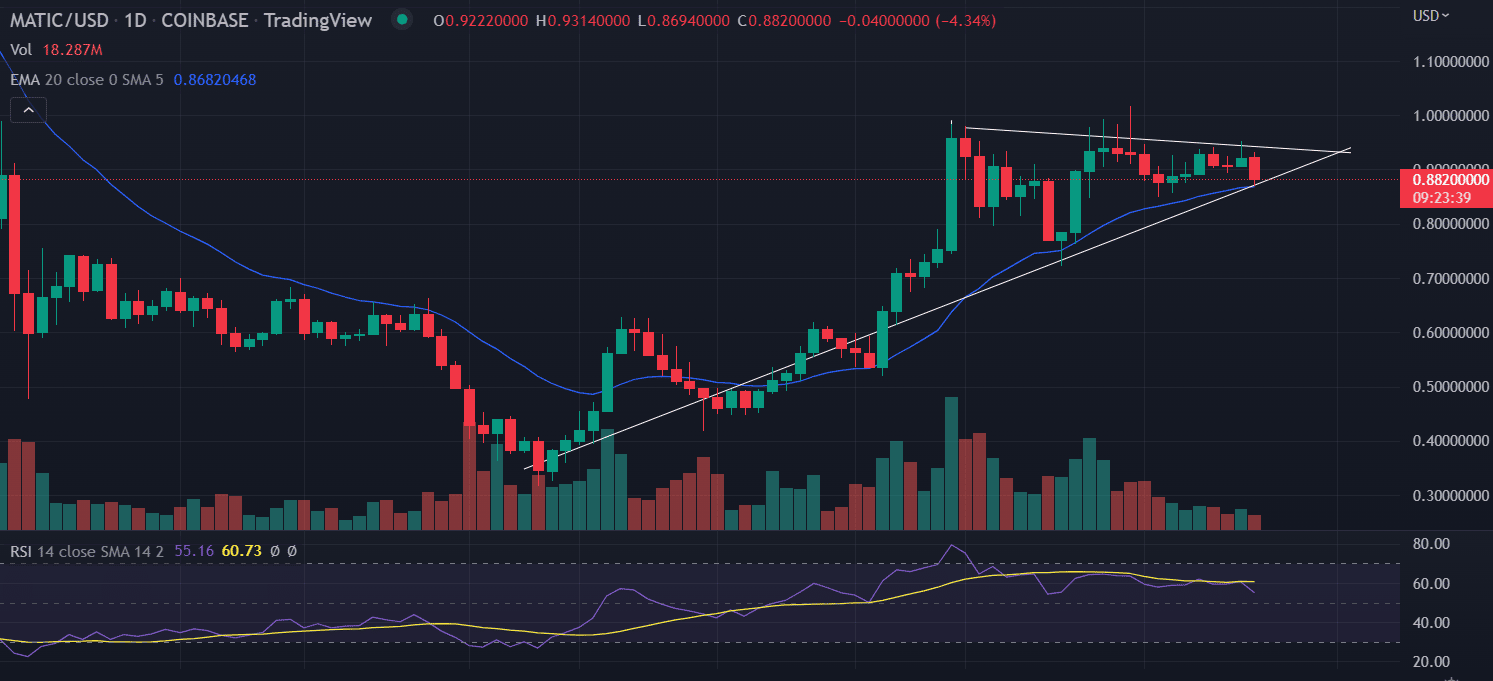

On the daily chart, the Polygon price traded in a range-bound manner from May 11 to July 17 while holding below $0.714. On July 18, the price gave a breakout above that range and gave a bullish momentum of up to $0.976.

The price trades along the bullish trend line from the lows of $0.41 since June 30. After making a swing high of $0.98, the price started to consolidate forming a symmetrical formation. Further, MATIC formed a “Double Top” pattern. According to this formation, if the price closes below $0.88, then we can expect a good fall of up to $0.79.

In addition to that, the trading volumes are trading below average for the past 3 weeks, as shown in charts, along with price trading in a range or slightly uptrend.

Polygon price is taking good support near the 20-day exponential moving average. That support is the only thing, that holds MATIC to don’t fall sharply in near future.

The RSI (14) is declining, indicating a probable downside momentum in the asset.

On the one-hour chart, the price fell shortly from the short-term consolidation that extends from $0.92 to $0.88. In today’s session, the price broke below the range for a brief period of time and is attempting to bounce back.

Also read: https://coingape.com/eth-whale-adds-312-billion-shiba-inu-tokens-amid-price-dip/

The momentum oscillator, RSI traded near the oversold territory, pointing to a sharp pullback in the price. Closing above $0.89 on an hourly basis could result in testing $0.90.

On the other hand, any downtick in the RSI would amplify the selling toward $0.85.

Conclusion:

Polygon price analysis suggests an extended consolidation in a range of $0.88-$0.90. The technical indicators suggest waiting for the construction levels before placing aggressive bids.

- Breaking: Bitcoin Bounces as U.S. House Passes Bill To End Government Shutdown

- Why Is The BTC Price Down Today?

- XRP’s DeFi Utility Expands as Flare Introduces Modular Lending for XRP

- Why Michael Saylor Still Says Buy Bitcoin and Hold?

- Crypto ETF News: BNB Gets Institutional Boost as Binance Coin Replaces Cardano In Grayscale’s GDLC Fund

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks

- XRP Price Risks Slide to $1 Amid Slumping XRPL Metrics and Burn Rate

- Gold and Silver Prices Turn Parabolic in One Day: Will Bitcoin Mirror the Move?

- Cardano Price Prediction as the Planned CME’s ADA Futures Launch Nears

- HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Sparks Prediction-Style Trading Boom

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery