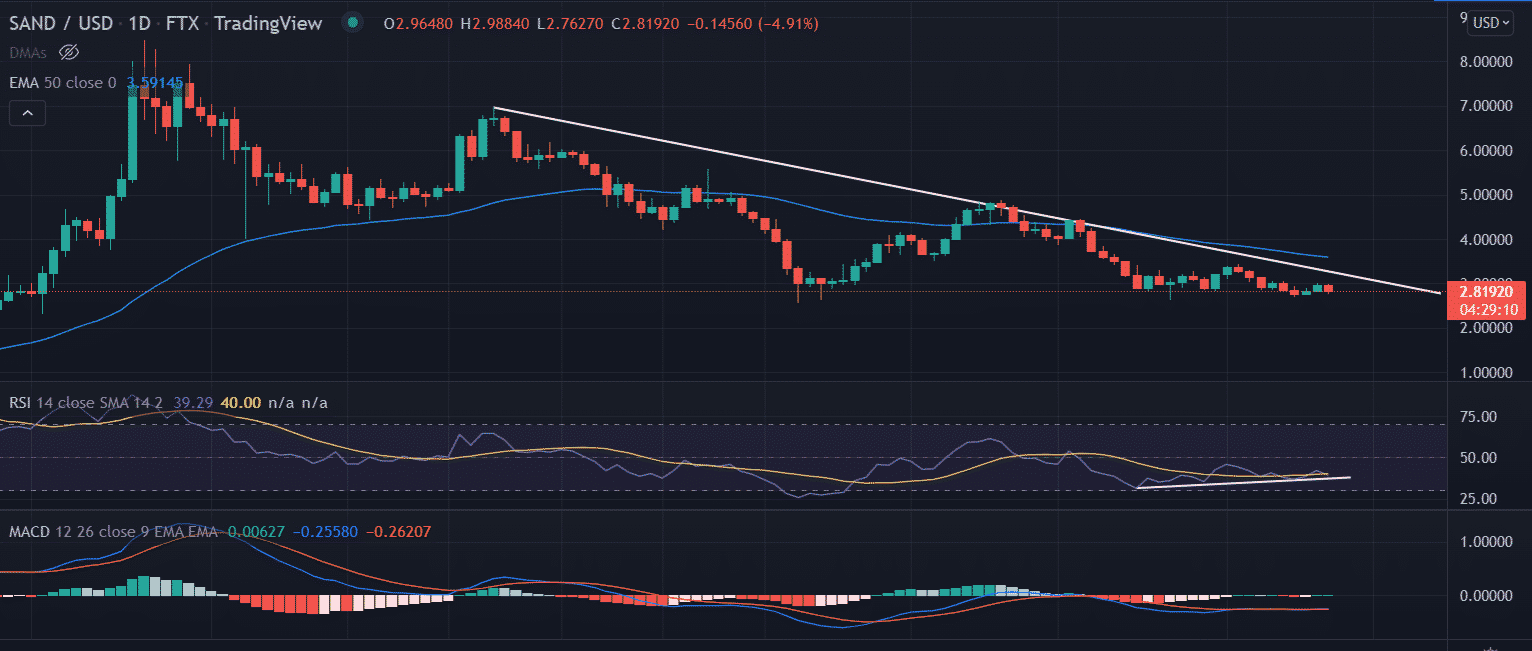

SAND Price Prediction: Face Upside Risk Of 40% But Upside Remains Capped Near $4.0

SAND price edges lower and continues to consolidate within the prevailing technical pattern. SAND might look out for some signal to heads toward an upswing at the descending trend line.

- Sandbox price trades on the negative side on Thursday.

- SAND respects the vital support of around $2.80 as found in multiple bottoms.

- Expect more gains if slice above the descending trend line on a daily basis.

SAND price consolidates near $2.80

On the daily chart, SAND price is trading in a long-term downside trend and continues to move sideways lately. Despite, the recent consolidation, the token may retest the bearish slopping line, which is extending from the highs of December 26 at $6.96.

In an attempt, the price will tag the immediate upside filter at $3.20.

Furthermore, the SAND price faces the next upside hurdle at the 50-day EMA (Exponential Moving Average) at $3.60. An additional resistance barrier may emerge at the psychological $4.0 level.

In addition to that if the asset manages to give a decisive close above the highs of February 16 at $4.45 then it could take out the ultimate target of $5.0.

Alternatively, a surge in the bearish sentiment could force the SAND price to smash the critical support level of $2.80. In that scenario, the price could revisit the lows last seen in November at $2.03. An increase in the selling pressure could push SAND’s price to $1.50.

Technical indicators:

RSI: The daily Relative Strength Index forms a bullish divergence with the price since February 21. But the price fails to capitalize on the formation.

MACD: The Moving Average Convergence trades near the oversold zone with a neutral stance. Any uptick in the indicator could push the price higher.

As of press time, SAND/USD is trading at $2.82, down 4.72% for the day.

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter