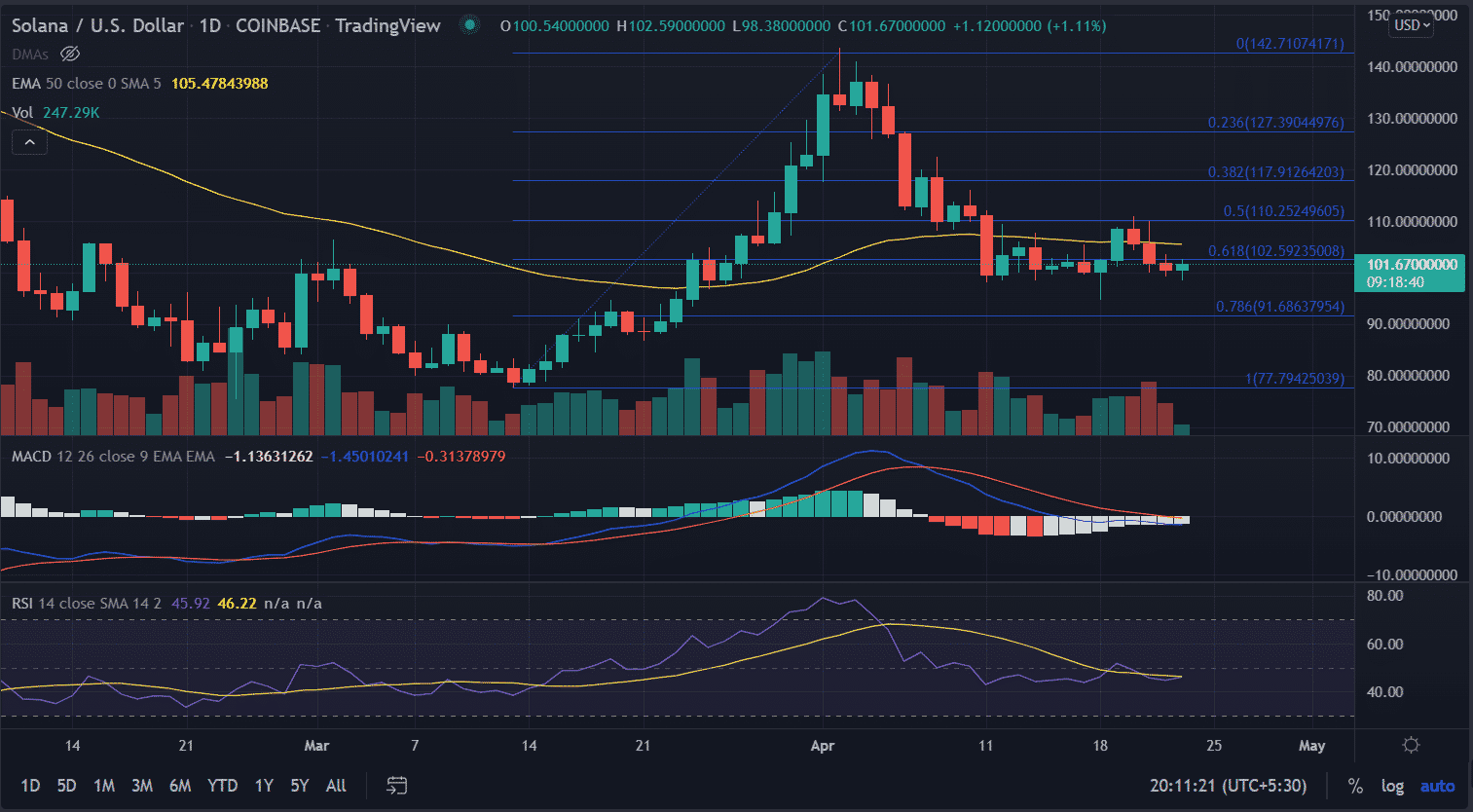

SOL Price Prediction: SOL Price Challenges 0.5% Fibonacci Retracement Near $110.

SOL price manages to print some gains on Saturday but within the limited price action. The recent downswing has pushed it to the vital support level near $98 indicating a bearish outlook. However, the formation of several ‘Doji’ candlesticks suggests indecision among traders as to what will happen next in the price.

- SOL price continues to consolidate below $102 with a neutral bias.

- A sustained buying pressure would challenge the 0.5% Fibonacci retracement near $110.

- The price exhibits strong support around the $95-$98 trading zone.

SOL price glides into a consolidation

On the daily chart, the SOL price dropped 31% from the swing highs of $143.57, after the formation of a ‘hanging man’ candlestick pattern due to the considerable drop in the buying momentum. Now, the price has been in a short-term consolidation phase since it tested the swing low’s around $98.0 on April 11.

Currently, the price is hovering near the reliable support around $100.0 still below the critical 50-day ema (Exponential Moving Average) at $105.48. An acceptance above this moving average will open the gates for the highs of April 20 at $110.20, this also coincides with the 0.5% Fibonacci retracement.

On the flip side, a daily close below the low of the session would invalidate the bullish theory for the price. In that case, the bears would drag the price toward the lows of April 18 at $94.69. In addition to that, a resurgence in the selling pressure would push the price to the horizontal support zone at $90.0.

As of publication time, SOL/ USD is exchanging hands at $101.83, up 1.64% for the day. The seventh-largest cryptocurrency by the market cap is sustaining the 24-hour trading volume at $1,024,118,376 as updated by the CoinMarketCap.

Technical indicators:

MACD: The moving average convergence divergence hovers below the midline with a receding bearish momentum.

RSI: The relative strength index oscillates near the average line with no clear directional bias.

- Strategy’s Michael Saylor, CEO Phong Le Assure More Bitcoin Buy, No Liquidations Until $8K

- Crypto Market Braces for Deeper Losses as BOJ Board Pushes for More Rate Hikes

- Crypto Prices Drop as U.S. Urges Citizens To Leave Iran

- Japan’s Metaplanet Pledges to Buy More Bitcoin Even as BTC Price Crashes to $60k

- Is Bhutan Selling Bitcoin? Government Sparks Sell-Off Concerns as BTC Crashes

- Will Cardano Price Rise After CME ADA Futures Launch on Feb 9?

- Dogecoin, Shiba Inu, and Pepe Coin Price Prediction as Bitcoin Crashes Below $70K.

- BTC and XRP Price Prediction As Treasury Secretary Bessent Warns “US Won’t Bail Out Bitcoin”

- Ethereum Price Prediction As Vitalik Continues to Dump More ETH Amid Crypto Crash

- Why XRP Price Struggles With Recovery?

- Dogecoin Price Prediction After SpaceX Dogecoin-Funded Mission Launch in 2027