Solana Price Faces $111M Long Liquidations Before $174 Retest – Key Levels to Watch

Highlights

- Solana price faces $111M long liquidations if it drops below $160 to $158.

- If SOL loses the $160 support level, it may spark a steep decline towards $133.

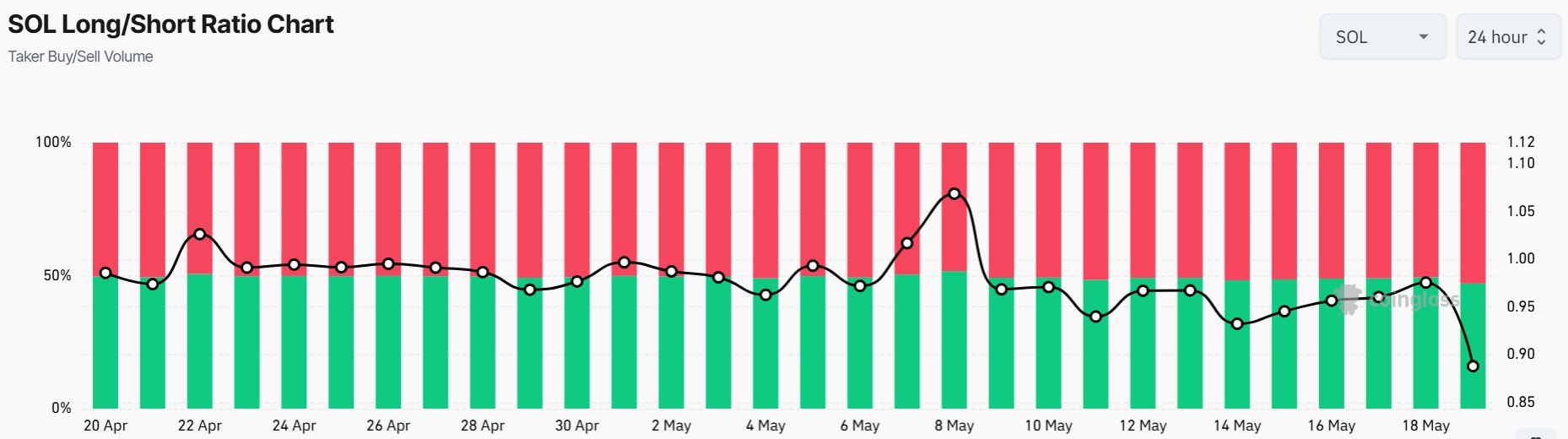

- The long/short ratio shows that traders are increasingly opening short positions on SOL, highlighting a bearish sentiment.

Solana (SOL) is on a steep downtrend today, May 19, amid a 6% decline that has caused $24M in total liquidations. Out of these liquidations, 80% were long positions, and this caused a spike in selling activity, which fueled a decline in Solana price from an intraday high of $176 to a low of $159.

At press time, SOL trades at $160, and unless the trend reverts to bullish, more long positions risk closure, which may wipe out the gains made in the last one month.

Solana Price Risks $111M Long Liquidations Below $160

Solana’s liquidation map shows that $111 million in cumulative long leverage is positioned around $158, which is slightly below the current price of $160.

The above data shows that if the Solana price drops to this level, it will cause a cascade of long liquidations that could intensify the selling pressure due to long buyers closing their positions. This downtrend may push SOL to multi-week lows.

Conversely, there is a looming short squeeze if buyers step in now to buy the dip after the recent crypto market crash. If Solana price can bounce to $164, $139M short positions will be closed, and the resulting buying pressure will extend the upward rally.

Moreover, traders are increasingly opening short positions on Solana, which is raising the chances of a short squeeze happening. The long/short ratio has plunged to 0.89, its lowest level in over a month, as short sellers open new SOL positions.

At the same time, data from Coinglass shows that SOL funding rates have also flipped negative, signaling that short sellers are paying to maintain their positions.

Key Levels to Watch as Solana Eyes $174 Retest

The one-day Solana price performance chart shows that the altcoin might soon retest the $174 resistance level and enter a bullish zone that may aid the next run-up towards $200.

If SOL can defend the $160 support level successfully, it will support a bullish Solana price forecast and aid the next bullish leg. However, currently, the RSI shows that bears are about to take control of the price action after dropping to 52. If it declines to below 50, it will indicate show a bearish momentum is now in play, reducing the chances of SOL resuming its previous upward trend.

The AO histogram bars are also red, showing that the bullish sentiment towards Solana is weak. If this indicator crosses below the zero line, it may cause a decline in SOL price to the support level at $133.

This technical outlook shows that the worst may not be over yet for SOL, and the altcoin may enter a downward trend. However, if the broader market recovers and traders looking for quick profits start to accumulate, it may trigger a short squeeze to a growing number of short positions, and this will bare a bearish impact on Solana price.

Frequently Asked Questions (FAQs)

1. What do the $111M looming long liquidations mean for Solana price?

2. Can SOL price retest the $174 resistance level?

3. What is the next support level for SOL if it drops below $160?

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k