Solana Token Price Coils Up as $120M SOL Exits Exchanges Ahead of Alpenglow Upgrade

Highlights

- Solana token price is on the verge of a big breakout as exchange outflows rise.

- The developers have announced the Alpenglo upgrade that will change how it works.

- Technicals point to an upcoming golden cross pattern on the daily chart.

Solana token price continues to waver this week as the consolidation that started last week continues. SOL was trading at $168 at press time, down by 8.7% from its monthly high. Despite this, the coin is about to form a golden cross pattern, the Alpenglow upgrade is coming, and $120 million tokens have fled exchanges, pointing to an eventual comeback.

Solana Token Price to be Boosted by Exchange Outflows

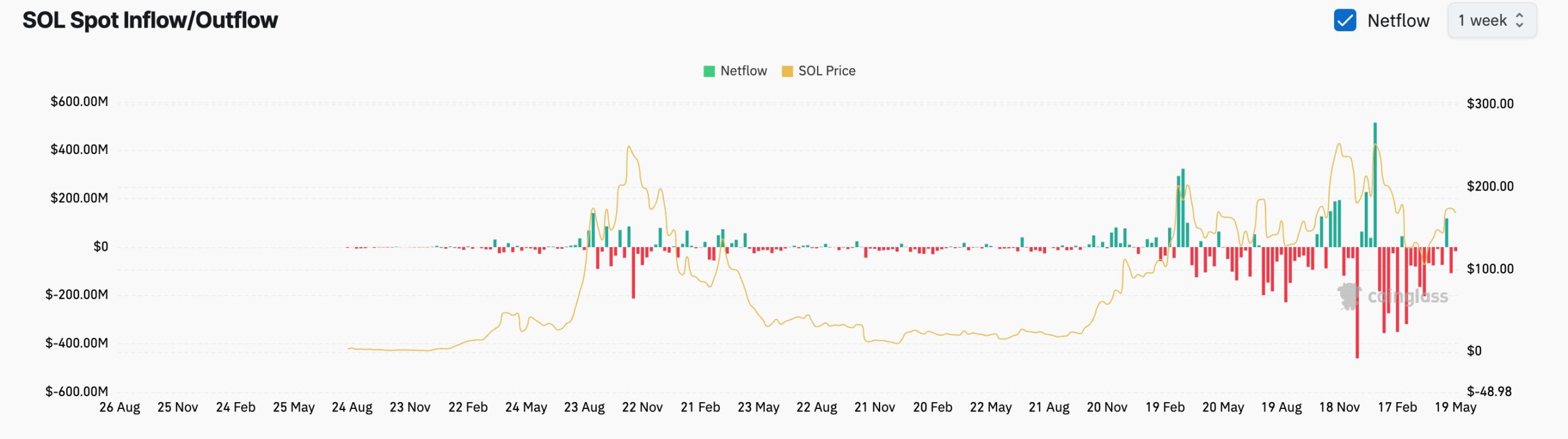

A potential catalyst that may push the Solana token price higher is that investors are not selling their coins after the 76% surge from its lowest point in April. Instead, more coins continue leaving exchanges for self-custody.

CoinGlass data show that tokens worth $16 million have left exchanges this week after $107 million left last week. This brings the total exchange outflows in the last two weeks at $123 million. This increase has helped to offset the $116 million coins that entered exchanges last week.

Exchange outflows happen when SOL holders move their tokens from exchanges to self-custody wallets. In most cases, outflows lead to a higher price because it signals that investors expect the coin to keep rising. A big increase in exchange inflows signals that investors are selling their coins, leading to a lower price.

Alpenglow Upgrade Could Be a SOL Catalyst

A potential catalyst for the Solana price is the upcoming Alpenglow upgrade, which some have noted will be the biggest one ever. Its goal will be to replace the Proof of Authority model with a consensus one that brings in near-instant finality.

Alpenglow will also replace TowerBFT, where a group of nodes agree on a piece of information even when some are lying. It will replace these features with Votor, a system that can finalize transactions in less than 150 milliseconds. Rotor will be a data relay system that will replace Turbine, the current mechanism. The date of the Alpenglow upgrade has not been revealed. However, the Solana token price will likely surge ahead of that upgrade.

Solana Price Technical Analysis: Golden Cross Nears

The daily chart reveals that the value of SOL may be on the verge of a big move ahead. It is slowly forming a falling wedge pattern, which happens when there are two descending and converging trendlines. This pattern results in a strong breakout when the two lines near their convergence.

Solana is also about to form a golden cross pattern as the spread between the 50-day and 200-day Weighted Moving Averages (WMA) has narrowed. A successful crossover would likely trigger more upside. For example, the SOL price surged by 65% the last time that the golden cross happened.

Therefore, the most likely SOL price forecast is bullish, with the initial target being at $265, the highest point in November 24. This target is about 55% of the current level.

A drop below the 50-day moving average will end the bullish outlook, and expose it to the risk of falling to the psychological point at $100.

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- $40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k

- ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch