Stacks Price Prediction: What’s Ahead For $STX After 30% Surge in a Week?

Stacks Price Prediction: As the crypto market shows signs of recovery, the Stacks (STX) coin has been a standout performer, rallying significantly on the daily chart. From its October 13th low of $0.48, the coin’s price has surged by 35%, currently trading at $0.64. This rally was further bolstered by a bullish breakout from the upper trendline of a symmetrical triangle pattern on October 16th, signaling a new recovery trend.

Also Read: “Rich Dad Poor Dad” Author Predicts $135K Bitcoin Price

Is STX Price Heading to $0.7?

- The higher price rejection candle near $0.65 indicates a minor pullback in plausible.

- A bullish crossover between 50-and-100-day EMA should increase the buying pressure in the market.

- The intraday trading volume in the STX is $76.6 Million, indicating a 60% loss.

Source- Tradingview

Source- Tradingview

For the last two months, the Stacks coin price has been trading within this symmetrical triangle, mostly exhibiting sideways movement. However, with the crypto market leaning bullish, the Stacks coin broke out from the upper trendline, pushing its price to $0.64.

Influenced by this pattern, the price could rise another 8% to reach the $0.7 mark. In the daily time frame, we can observe that the prior downtrend in Stacks price has shifted to a sideways movement after reaching the psychological support at $0.4.

This change indicates an exhaustion of bearish momentum and an increase in buying activity at discounted levels. With sustained buying, we might see the formation of a “rounding-bottom pattern”, which could potentially push the price to $1.3 if it plays out.

This pattern spotted at major market bottoms could bolster buyers for an extended uptrend.

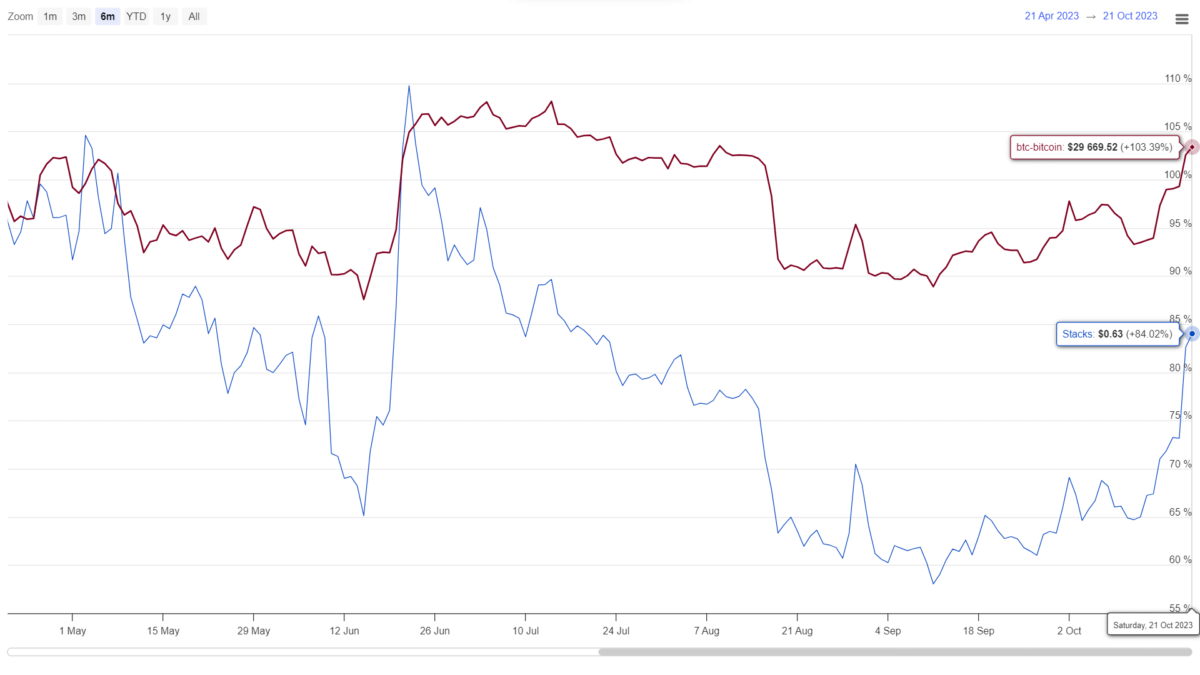

STX vs BTC Performance

Over the past six months, both Stacks and Bitcoin have primarily traded sideways. However, a closer examination reveals that Stacks has experienced higher volatility compared to Bitcoin’s more stable price action. This means that Stacks’ ongoing recovery could offer more dynamic opportunities for short-term, aggressive traders but might be a roller-coaster experience for those who are risk-averse.

- Average Directional Index: The ADX slope uptick near 26% indicates the buyers have sufficient momentum to prolong the recovery trend.

- Exponential Moving Average: The coin price trading above the 20-50-100-and-200-day EMAs indicates the overall market sentiment is bullish.

- Why Is The BTC Price Down Today?

- XRP’s DeFi Utility Expands as Flare Introduces Modular Lending for XRP

- Why Michael Saylor Still Says Buy Bitcoin and Hold?

- Crypto ETF News: BNB Gets Institutional Boost as Binance Coin Replaces Cardano In Grayscale’s GDLC Fund

- Fed Rate Cut: Fed’s Barkin Signals Support for Rate Pause Amid Inflation Concerns

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks

- XRP Price Risks Slide to $1 Amid Slumping XRPL Metrics and Burn Rate

- Gold and Silver Prices Turn Parabolic in One Day: Will Bitcoin Mirror the Move?

- Cardano Price Prediction as the Planned CME’s ADA Futures Launch Nears

- HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Sparks Prediction-Style Trading Boom

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery