Syscoin (SYS) Price Analysis: Why SYS Offers Good Buying Opportunity Above $1.32?

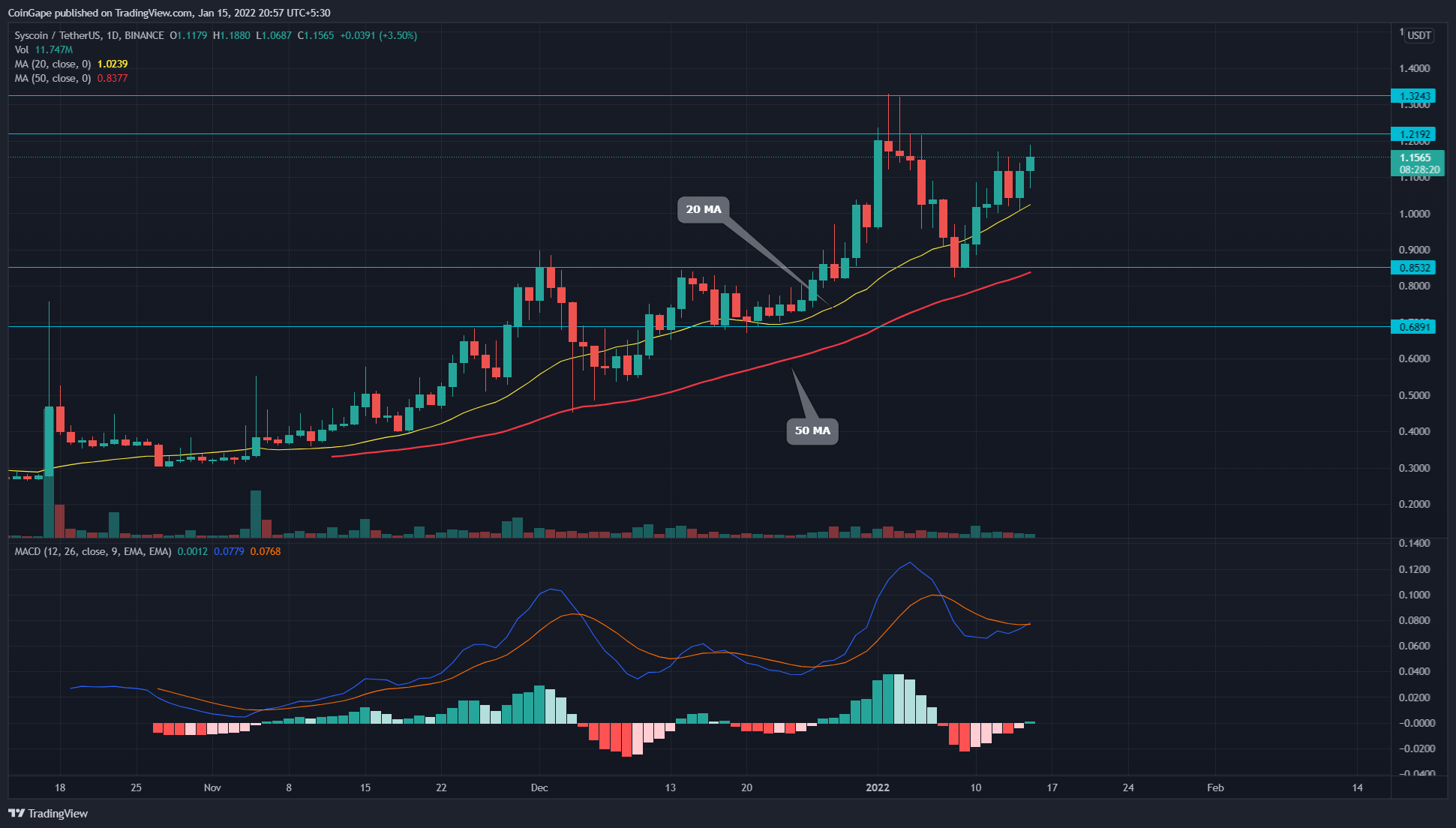

Overall trend for Syscoin price is strongly bullish right now. SYS provides occasional pullbacks and keeps climbing higher levels. After its recent correction rally to the $0.85 support, the coin aims to rechallenge the $1.32 resistance, hoping to continue this uptrend.

Key technical points:

- The 20 and 50 EMA line provides strong support to the SYS price.

- The intraday trading volume in SYS is $41.3 Million, indicating a 48.2% hike.

The Syscoin price shows a steady rally of a new higher high and higher low in its technical chart. The coin made a new All-Time high around the $1.32 mark on January 2nd. However, as displayed by several higher price rejection candles, the intense supply pressure at this level immediately rejects the price.

During this correction phase, the SYS/USD price was discounted by 35% and dropped to the $0.85 mark. The SYS price achieved sufficient support from this level, initiating a new recovery rally.

The majority of pullbacks in SYS are bouncing back from the 20 MA line. However, even when SYS price has breached this 20 MA support, this trending coin has not violated 50 MA. Therefore, until the price is sustaining above these MA lines, the crypto traders can maintain a bullish sentiment.

The Moving average convergence divergence indicator shows MACD and the signal line provides a bullish crossover above the neutral zone(0.0), indicating a buy signal.

SYS Price Could Retest $0.132 Mark

The V-shaped recovery in the SYS price is charging towards the ATH resistance near $1.32. The price is currently trading at the $1.17 mark, projecting a 42% gain from the previous higher low of $0.82.5. Once the price gives a proper breakout from the ATH resistance, the crypto traders can grab a long opportunity.

The trend-based Fibonacci extension level indicating the overhead resistance for SYS price above the $1.2 resistance is $1.48, followed by $1.66. The Relative Strength Index(20) slope has reclaimed the 20-SMA line and is steadily approaching the overbought region.

- $800B Interactive Brokers Launches Bitcoin, Ethereum Futures via Coinbase Derivatives

- Michael Saylor Says Strategy Won’t Sell Bitcoin Despite Unrealized Loss, Will Keep Buying Every Quarter

- BlackRock Bitcoin ETF (IBIT) Options Data Signals Rising Interest in BTC Over Gold Now

- XRP and RLUSD Holders to Access Treasury Yields as Institutional-Grade Products Expand on XRPL

- Prediction Market News: Polymarket to Offer Attention Markets Amid Regulatory Crackdown

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?