Terra Classic Price Prediction: $0.0002 Breakdown Puts $LUNC at a Risk of 15% Fall

Terra Classic Price Prediction: The Bitcoin price recovery recently hit a standstill near the $44,500 level, ushering in a period of uncertainty across the crypto market. This indecisiveness took a major toll on the LUNC price as it witnessed a sharp reversal from $0.00028 resistance and plunged below $0.0002. Although this drop is steep, it stays within the safety bounds of the Fibonacci retracement levels, indicating the recovery is intact.

Also Read: Terra Luna Classic L1TF Successfully Completed v2.3.2 Upgrade, Will LUNC Price Rally?

Will LUNC Price Rebound from $0.0002 Support?

- The combined support of $0.0002 and 38.2% FIB offers strong support to buyers.

- A healthy retracement in LUNC price significant in the long term remains intact.

- The intraday trading volume in the LUNC coin is $575 Million, indicating a 41% loss.

In the past five days, the Terra Classic price has undergone a correction phase, leading to a 28% drop in its value from $0.000028 to $0.0002. This downturn has found support at the 38.2% Fibonacci retracement level, a position often deemed healthy for sustaining a long-term rally.

If the LUNC price manages to remain above this threshold, a potential reversal could propel the price back to the $0.28 swing high, with a breakout above this level providing stronger confirmation of an uptrend.

Conversely, if the downward trend persists, the next significant support could be at the 50% Fibonacci level, around $0.000167. A breach below this level might indicate diminishing bullish momentum and raise concerns about the sustainability of the recovery trend.

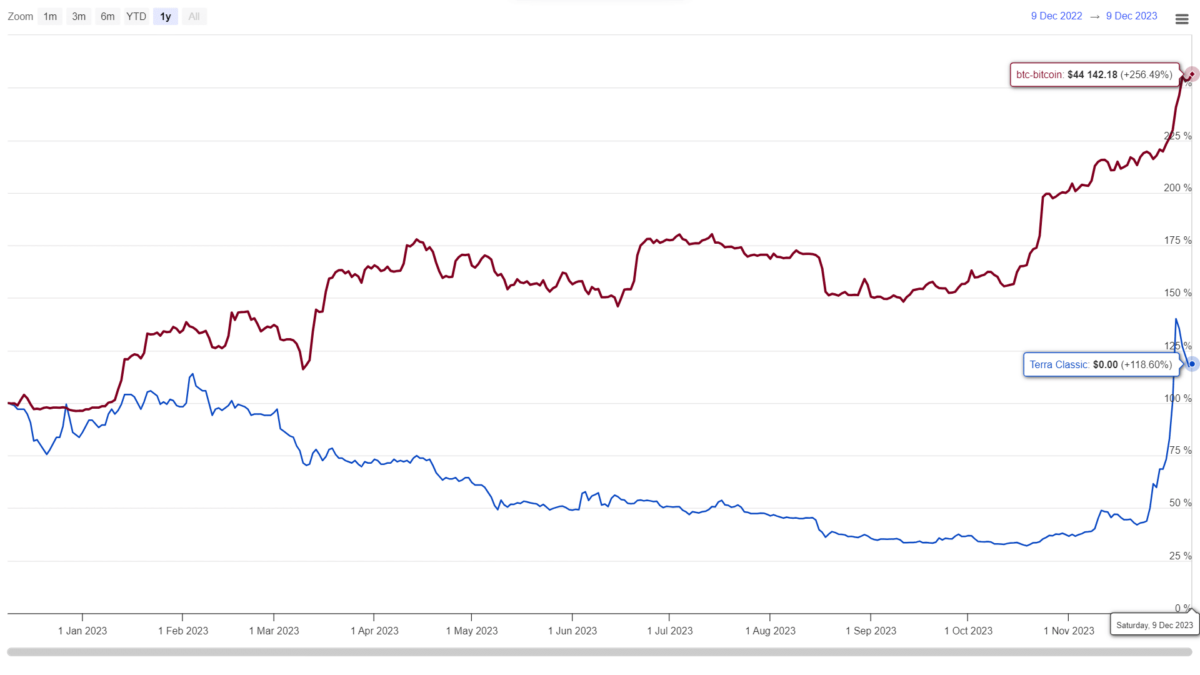

LUNC vs BTC Performance

Comparing the Terra Classic with Bitcoin over the last two months, the LUNC price has exhibited a more volatile pattern, characterized by aggressive surges, while the Bitcoin price movement has been relatively stable and gradual, aligning more with the preferences of risk-averse traders. The LUNC price dynamic behavior offers opportunities for traders to capitalize on dips amidst its strong recovery trend.

- Average Directional Index: The daily ADX slope at a high of 55%, accentuates the exhausted position and need for a minor pullback.

- Exponential Moving Average: the 20-day EMA is providing solid support to the LUNC price during the market pullback.

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?