Terra Price Analysis: LUNA Price Soars Amid Multiple Hurdles Ahead; Is It Safe To Buy?

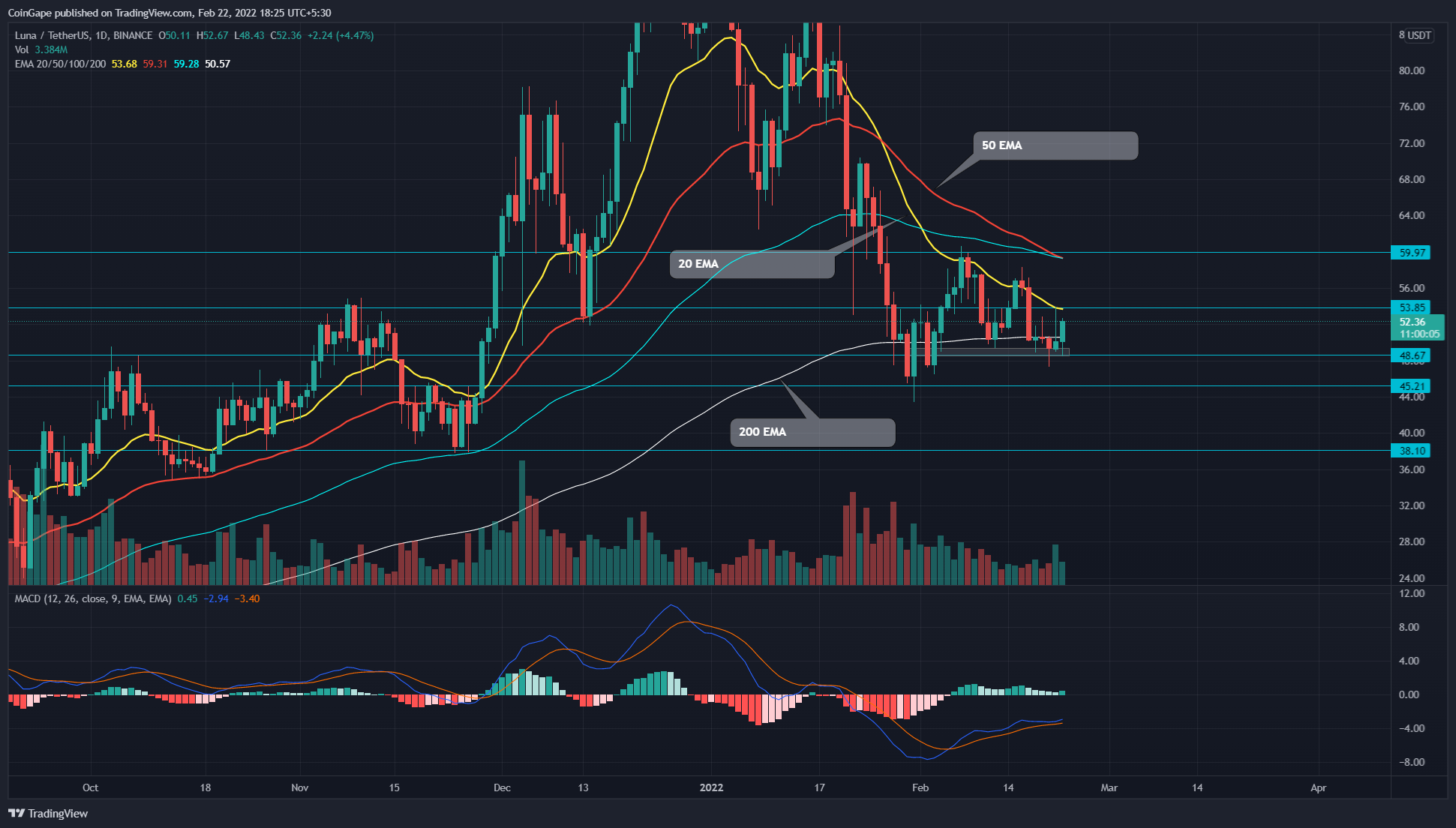

In the last two weeks, the Terra (LUNA) buyers provided a second bounce from the $48.6 support, indicating the traders are buying this dip. However, the 20-day EMA dynamic mounts a stiff resistance on the upside, narrowing up the price range. Will sellers continue to dominate or buyers make a major move?

Key technical points:

- LUNA buyers attempt to te regain 200-day EMA

- The LUNA price spats 8.11% from $48.6 support

- The intraday trading volume in the LUNA is $2.4 Billion, indicating a 123.6% hike.

Read More: Terra LUNA Project Review and LUNA Price Predictions 2021

Source- Tradingview

Source- Tradingview

On February 17th, the LUNA price turned down from the 20-day EMA with an evening star pattern. The bearish candle plummeted to the immediate support of $48.6, threatening further price correction. However, the long tail candle on February 20th indicates the buyers are defending this support.

Today, the LUNA price rebounded from the $48.6 support, with its intraday of 4.63.%. The bullish candle would soon challenge a confluence of major technical levels, i.e., $54 horizontal level, 20-day EMA, and 0.5 Fibonacci retracement level.

The MACD indicator shows steady growth in the fast and slow line. A breakout above the neutral zone(0.00) would provide additional confirmation for long traders.

Will 50 and 100-day EMA Negative Crossover Bolster The Selling Pressure

If buyers breach the overhead resistance(48.6), the coin price would surge to the next shared resistance of $60 and the 50-day EMA, which stands as the key resistance for possible trend reversal.

On a contrary note, if LUNA price again reverts from the 20-day EMA, the selling pressure would escalate and threaten a bearish breakdown from $48.6 support. If they succeed, the altcoin would plunge another 7%, bringing it to the $45 mark.

The descending 20, 50, and 100-day EMA indicates the sellers have an upper hand. Moreover, the 50 and 100-day EMA bearish crossover could attract more sellers in the market

- Resistance levels: $48.6 and $60

- Support levels: $45.6 and $45

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter