Tom Lee Predicts Ethereum Price to Hit $5,500 as Open Interest, Whale Buying Jumps

Highlights

- Tom Lee believes that Ethereum price has more upside and may jump to $5,500 soon.

- Ethereum ETF inflows are surging, a sign of increasing accumulation.

- Technical analysis points to more gains as demand jumps.

Ethereum price drifted upwards, erasing some of he losses made on earlier this week. It was trading at $4,645, up by 235% from the year-to-date low. This consolidation could be brief as Tom Lee believes that it can soar to $5,500 as open interest, whale purchasing, and ETF inflows jump.

Tom Lee Sees Ethereum Price Hitting $5,500

Tom Lee, the popular Wall Street analyst and crypto advocate, believes that Ethereum price rally has more room to go in the coming days. In an online interview, he argued that the current consolidation is happening as the recent rally takes a breather.

There are many reasons he believes that ETH price has more upside to go. One of the most important ones is that Wall Street analysts continued to accumulate ETH, as evidenced by the rising ETF Inflows.

All spot ETH ETFs added over $455 million in assets on Tuesday, higher than the previous day’s $443 million. They have added over $ 1.3 billion in assets in the last four days, bringing the cumulative total inflows to $13 billion.

Additionally, Ether price will benefit from ongoing corporate accumulation. Top companies, including Lee’s BitMine, The Ether Machine, and SharpLink have continued to buy ETH as they try to emulate MicroStrategy, which has become the biggest Bitcoin holder.

ButMine holds 1.53 million ETH coins currently worth over $7 billion, and is now raising over $20 billion for more purchases. Similarly, SharpLink has 740760 coin worth $3.2 billion. Altogether, these companies hold over 3.37 million ETH tokens.

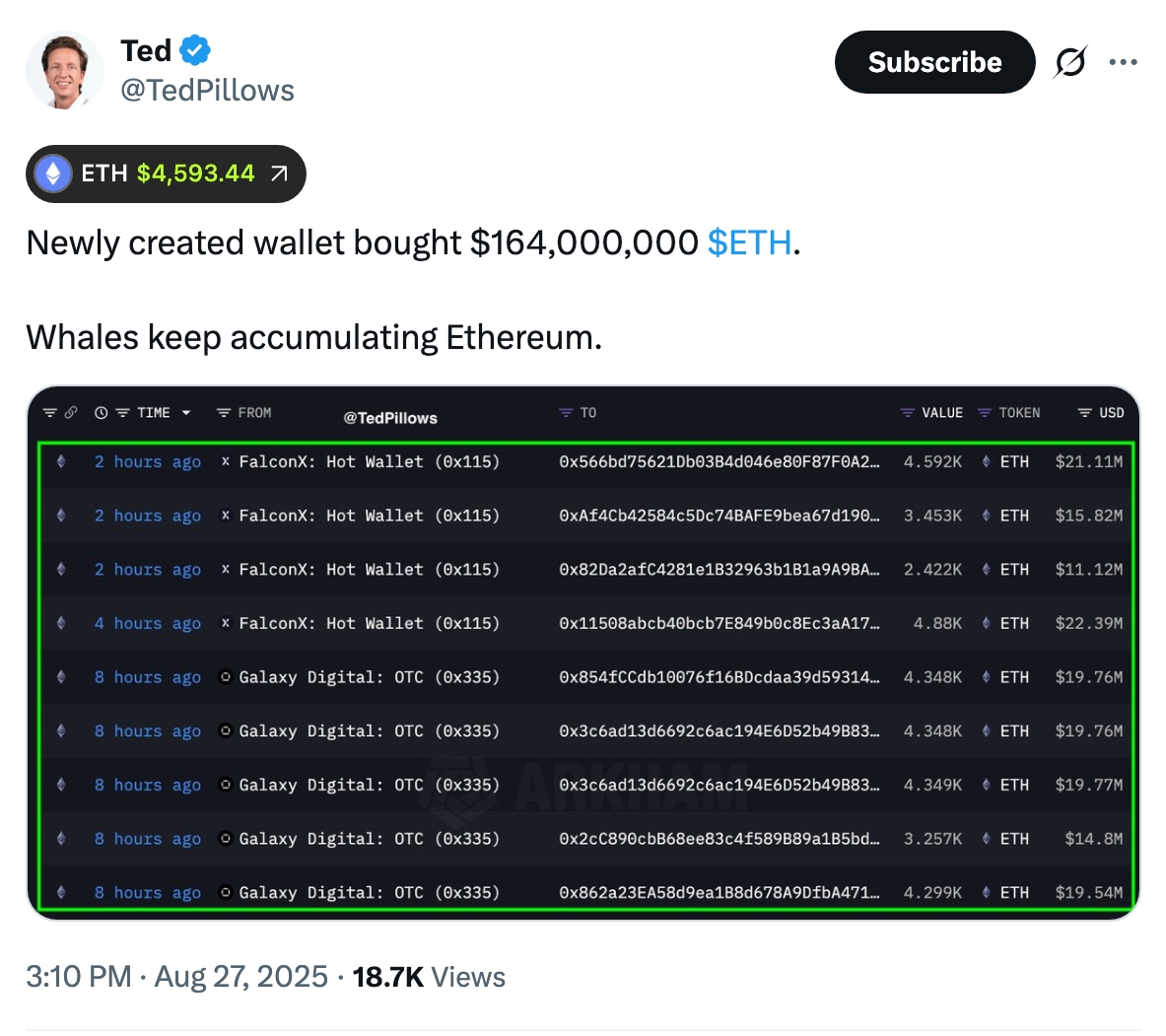

Whales are also aggressively buying Ethereum tokens. One of them bought tokens worth $164 million this week, a sign that he expects the bullish momentum to accelerate.

Derivative data also shows that the Ethereum price can pop to $5,500 within weeks. Per CoinGlass, the futures open interest rose to $63.7 billion on Wednesday, higher than $62 billion a day earlier and $62 billion on Monday.

Rising Ethereum open interest, coupled with lower liquidations and a positive funding rate is bullish as it shows more demand in the futures market.

ETH Price Chart Signs More Gains Ahead

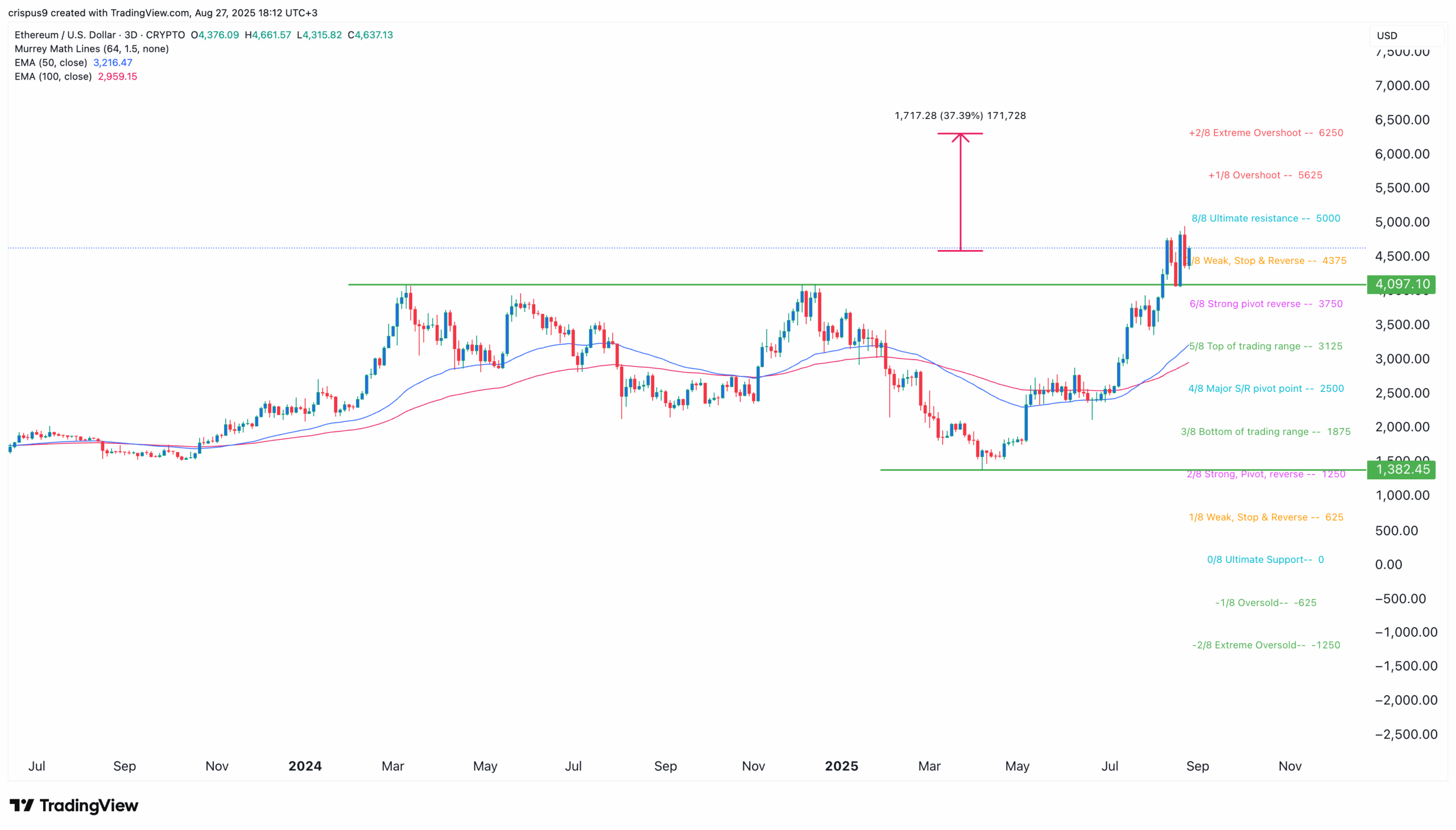

The daily timeframe chart shows that the Ether price has been in a relentless bull run after falling to $1,382 in April as most tokens slumped.

It recently jumped and crossed the important point at $4,097, where it formed a triple-top pattern last year. Moving above that price was a highly bullish catalyst for the coin because it signaled that there were bulls willing to take a risk.

Ethereum price then confirmed the breakout by retesting the price. It is now forming a bullish pennant pattern , which often leads to more gains over time.

Ether price remains above all moving averages and is slightly below the ultimate resistance of the Murrey Math Lines.

Therefore , the most likely ETH price forecast is bullish, with the key target price being at $6250, the extreme overshoot level of the Murrey Math Lines. A move to that level will be a 37% jump.

On the other hand, a drop below the important support level at $4,097, will invalidate the bullish forecast and point to more downside.

Frequently Asked Questions (FAQs)

1. What is the most likely Ethereum price forecast?

2. What are the main catalysts for the ETH price?

3. What is Tom Lee's Ethereum price prediction?

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Bitget Targets 40% of Tokenized Stock Trading by 2030, Boosts TradFi with One-Click Access

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown