Top 4 Reasons Ethereum Price May Blast to $5,000 Soon

Highlights

- Ethereum price may be on the verge of a strong bullish breakout to $5,000 soon.

- The coin is benefiting from strong fundamentals and whale buying.

- Technical analysis show that the coin is yet to get to the ultimate resistance of the Murrey Math Lines tool.

Ethereum price continues to consolidate today, September 4, as sentiment in the crypto market remains neutral and as ETH ETF inflows rise. ETH was trading at $4,400, and four key catalysts point to an eventual rebound, potentially to $5,000.

Top Catalysts that Will Boost Ethereum Price to $5k

Ethereum price could be on the verge of more gains to $5,000, helped by numerous catalysts. The first major catalyst is that there is still interest in Ethereum assets.

In a statement, Grayscale, a top asset manager in the crypto space, filed for the Ethereum Covered Call Fund, which will enable users to generate regular income from their investments.

Covered call ETFs generate high dividends by investing in an asset and then selling their call options. They then receive a premium, which they then distribute to investors.

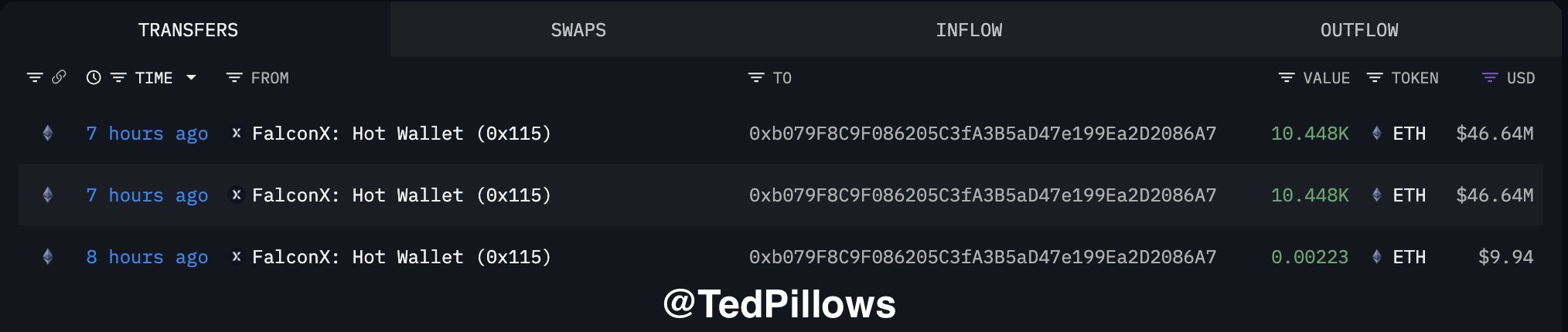

Ethereum price may also jump as whales have continued to buy the tokens. One whale bought tokens worth $100 million on Thursday, a sign that he expects the upward trajectory to continue.

Whale buying is usually a bullish sign because these investors are seen as being more experienced and sophisticated than retail ones. They also have more skin in the game.

Further, the value of ETH will continue doing well as it outperforms other related blockchains like Solana, Tron, and BNB Smart Chain. A good example of this is in the decentralized finance (DeFi) industry, where Ethereum has a market dominance of over 70%.

DeFi applications on the network, like Aave, Uniswap, and Lido have the biggest market share in their respective industries. For example, all DEX platforms on Ethereum handled tokens worth over $3.6 billion in the last 24 hours. The network’s stablecoin supply has also soared to a record high of $150 billion.

ETH Price Technical Analysis

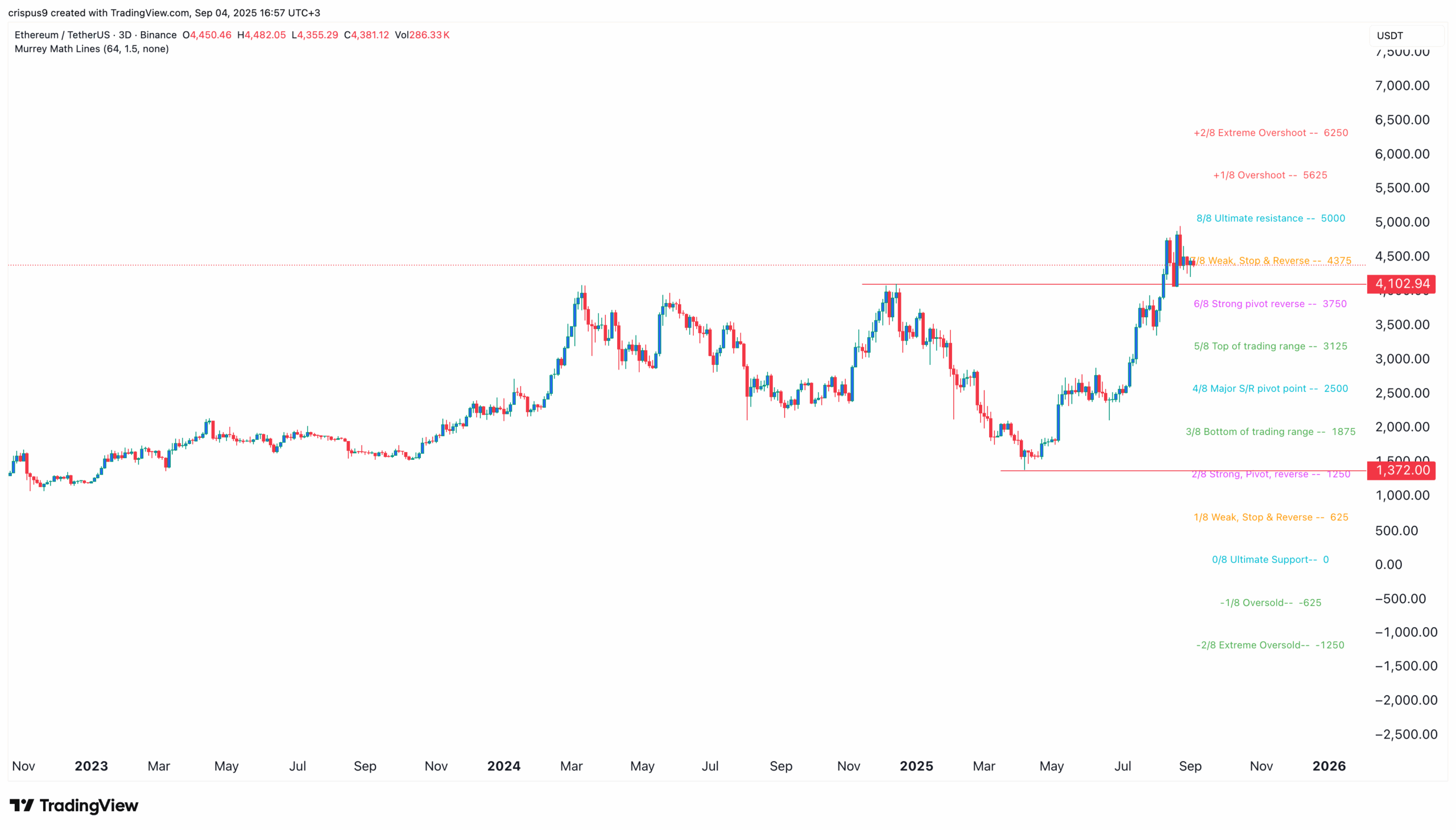

The fourth main catalyst why Ethereum price may surge to $5,000 and beyond is that it has strong technicals. The three-day timeframe shows that the coin sits at the weak, stop, & reverse point of the Murrey Math Lines indicator.

This means it has a long way to go before it reaches the extreme overshoot point at $6,250. Most importantly, the ultimate resistance is at $5,000, raising the possibility that it will get to that level soon.

ETH price has also retested the support at $4,100, the highest level in December. A break-and-retest pattern normally confirms a bullish breakout.

On the flip side, a drop below the support at $4,100 will invalidate the bullish ETH price forecast for 2025, and point to more downside, to the major S/R pivot point at $2,500.

Frequently Asked Questions (FAQs)

1. Will Ethereum price jump to $5,000 soon?

2. What are the main catalysts for ETH price?

3. How high can Ethereum coin price get this year?

- Shark Tank Kevin O’Leary Warns Bitcoin Crash as Quantum Computing Threats Turns Institutions Cautious

- Japan’s SBI Clears XRP Rumors, Says $4B Stake Is in Ripple Labs Not Tokens

- 63% of Tokenized U.S. Treasuries Now Issued on XRP Ledger: Report

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Crypto Ties Revealed in Epstein Files: 2018 Emails Point to Gary Gensler Discussions

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?