Will Ethereum Price Break $3,000 As BlackRock Buys Nearly $100M ETH

Highlights

- BlackRock’s $98M ETH buy aligns with ETF inflow surge.

- A $2,738 breakout could trigger a run to $3,000.

- 76% spike in Network Growth hints at rising retail interest.

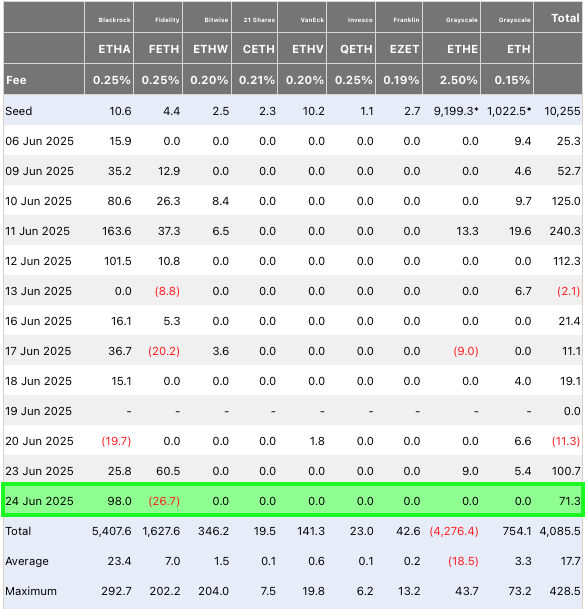

On June 24, BlackRock bought $98 million worth of spot Ethereum ETF, bringing their total holdings $5.40 billion. This inflow aligns with the recent weekend crash that pushed Ethereum price to a low of $2,111, indicating that investors were buying the dips. This outlook indicates that investors are bullish on ETH’s future. But can Ethereum price break above $3,000?

BlackRock Buys $98 million worth of ETH

As noted above, the total spot Ethereum inflow on June 24 came down to $71.3 million amid BlackRock’s $98 million buy and Fidelity’s $26.7 million sale. The recent purchase from BlackRock, the world’s largest asset manager, brings their total holdings to $5.40 billion. But is this enough to push the Ethereum price beyond $3,000?

Can Ethereum Price Clear $3,000?

A closer look at the one-day chart shows that Ethereum price is repeating a “fakeout” that led to the recent crash. The sideways consolidation for nearly a month ended with a bullish fakeout above $2,738, leading to a 27% correction. However, the breakdown also seems to be exuding signs of a fakeout. A recovery above $2,312, the lower limit of the consolidation, indicates that a further uptrend is possible.

- The next target based on this technical analysis of Ethereum is $2,738, which is the upper limit of the range-bound movement.

- Beyond this, investors can expect Ethereum price to tag the $3,000 psychological level.

The supply zone formed in late January is a key hurdle, and the bulls could face stiff resistance here. However, due to the recent spot ETF inflows and Bitcoin’s recovery adds credence to the potential recovery rally beyond $3,000.

The Relative Strength Index (RSI) came close to revisiting the oversold level, but the recent recovery has pushed it close to the 50 mean level. A recovery above 50 will signal that there was premature buying, and this demand could further propel the ETH price toward $3,000.

The lagging Awesome Oscillator (AO) is also flashing green histogram bars below the zero mean level, signalling the decline in bearish momentum.

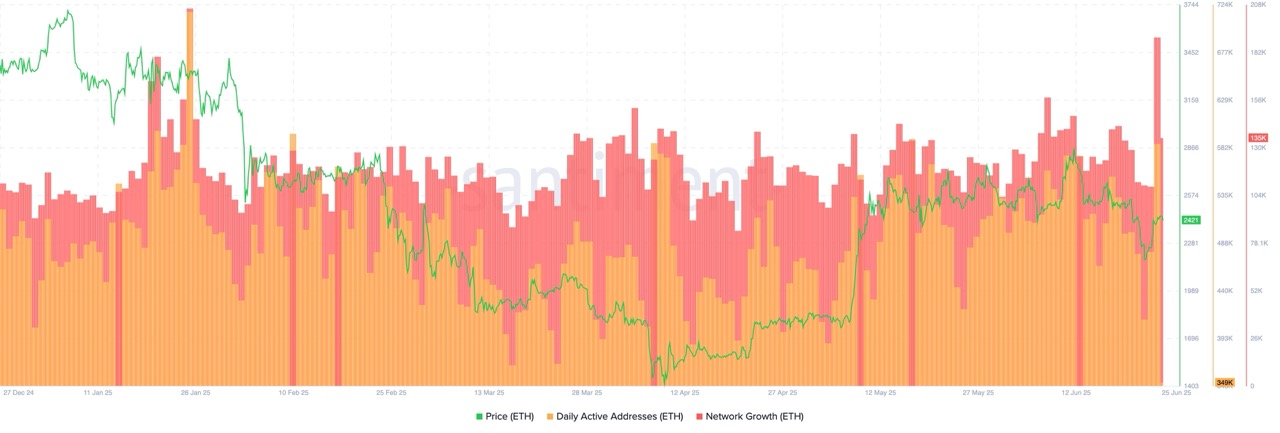

Overall, the outlook for Ethereum looks positive, with a short-term future target of $3,000. A look at the blockchain data shows that there was a massive spike in the Network Growth metric. Santiment’s data shows that the indicator has grown from 108K to 190K in the past 24 hours, denoting a 76% spike. This indicator tracks the new addresses joining the Ethereum blockchain and is a proxy of growing investor interest at the current price levels.

Additionally, this uptick in network growth aligns with the recent surge in BlackRock’s acquisition activity and positive ETF inflows. To conclude, the chances of Ethereum retesting and potentially breaking the $3,000 level are high. With a bullish short-term outlook driven by ETF inflows, consider the Ethereum price prediction for 2025.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Why did BlackRock buy $98M ETH?

2. What’s Ethereum’s key resistance level?

3. Is ETH’s rally sustainable?

- $2T Barclays Explores Blockchain to Tap Into Stablecoin and Tokenization Boom

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs