XRP Price Prediction as Whales Dump 2.23B Tokens — Is $2 the Next Stop?

Highlights

- XRP price slips below $2.72 support, confirming a bearish continuation pattern.

- Whales dump over 2.23B XRP, reinforcing broad market fear and sell pressure.

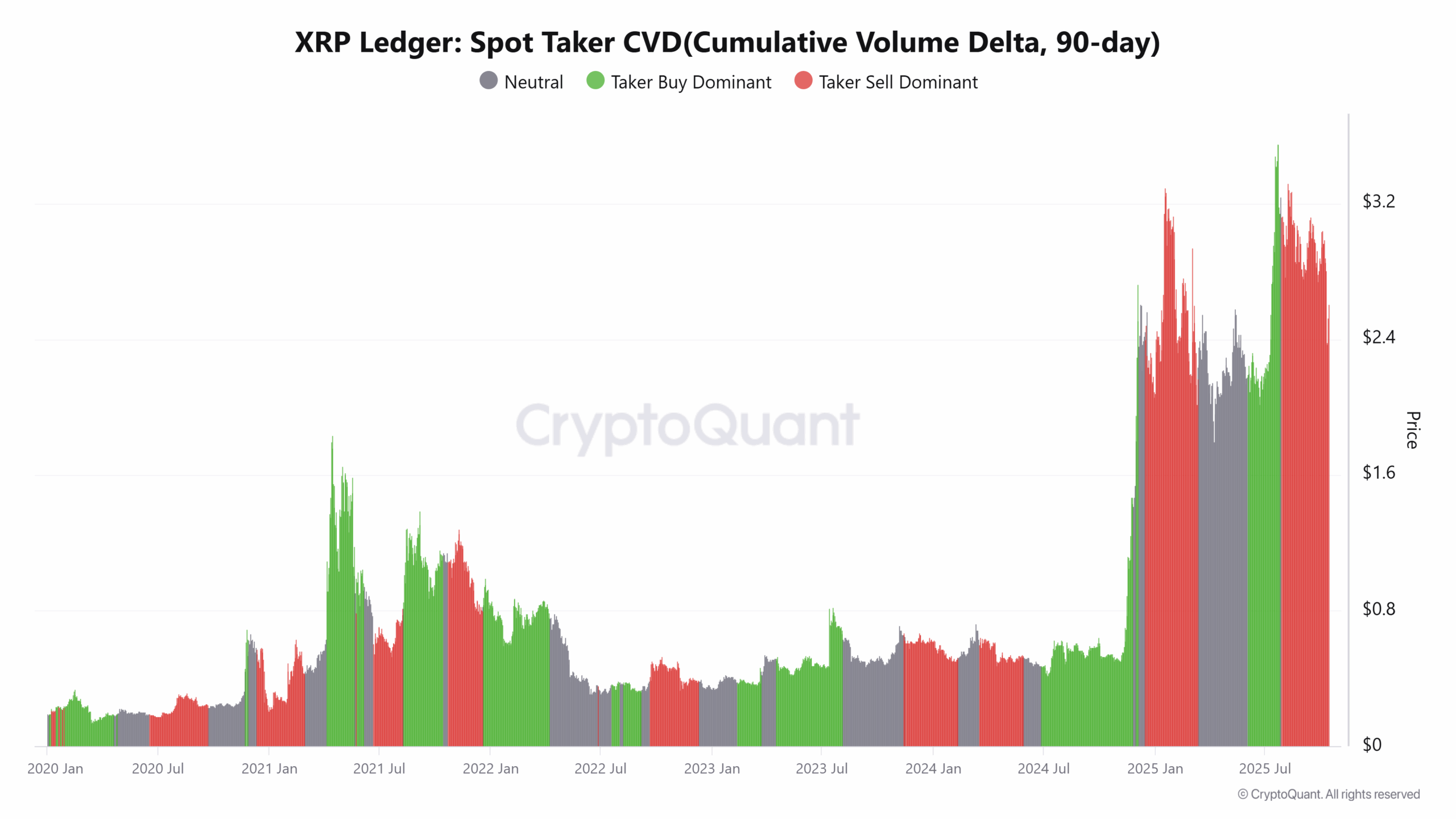

- Spot Taker CVD data shows strong sell dominance as traders remain cautious.

The XRP price has faced renewed downward pressure as the broader crypto market endures heightened volatility. Over the past week, most large-cap tokens have struggled to hold critical support zones, with Ripple’s native asset suffering sharper declines. Uncertainty surrounding investor confidence and whale movements has compounded the situation, keeping the token in a fragile state.

XRP Price Action Suggests Deeper Retest Before Recovery

As earlier warned by a market analyst, the XRP price has been moving within a descending triangle formation since late July, marked by lower highs converging toward a stable horizontal base near $2.72. The current XRP market value trades at $2.47 after falling by over 5% in the past 24 hours, confirming continued bearish momentum.

This formation typically signals an impending breakdown, especially when paired with declining trading volume and repeated rejections at the descending trendline. The October 10 crash intensified this structure’s bearish bias, pushing XRP below its prior accumulation zone and validating the analyst’s caution.

Moreover, the Parabolic SAR indicator reinforces the negative outlook, with dotted markers appearing above the recent candles. Therefore, attention now shifts to the $2.00–$2.39 support region, which has historically triggered strong rebounds.

Overall, the pattern aligns with a cautious long-term XRP price prediction, suggesting the token could test $2 before mounting a recovery.

Whales Offload 2.23B Tokens, Heightening Market Fear

Whale activity has emerged as a primary catalyst behind the recent downtrend, with on-chain data revealing that over 2.23 billion XRP have been sold since Friday. This large-scale distribution, highlighted by analyst Ali Martinez, reflects deepening bearish sentiment among major holders following XRP’s failure to defend the $2.72 support.

The heavy selling pressure has reduced liquidity, restricting short-term recovery potential as smaller investors remain cautious.

Besides,

Spot Taker CVD data confirms a Taker Sell dominance, reinforcing the bearish bias across spot markets. This shows market sellers remain aggressive while buyers reduce exposure. The imbalance keeps the XRP price exposed to extended downside risk. However, a potential rebound could emerge once the token retests the $2.00 demand level.

Historically, this zone triggered renewed accumulation after steep drops. For now, sellers still hold control as the XRP price struggles to regain stability amid fading optimism.

To sum up, The XRP price remains weak after whales unloaded billions of tokens and technical supports collapsed. The $2 zone now acts as the decisive test for a possible rebound. If this level holds, buyers may drive a short-term recovery toward $2.72. However, failure could deepen the decline before a reaction forms. For now, all eyes remain on whether XRP can stabilize near $2 before reversing higher.

Frequently Asked Questions (FAQs)

1. What does the descending wedge formation indicate for XRP?

2. What is the role of Spot Taker CVD in market analysis?

3. Why is whale activity important in crypto markets?

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise