XRP Price Hit New Highs Last 2 Times This Indicator Flashed Buy Signal, Will History Rhyme?

Highlights

- MVRV ratio buy signal preceded past XRP price surges twice before.

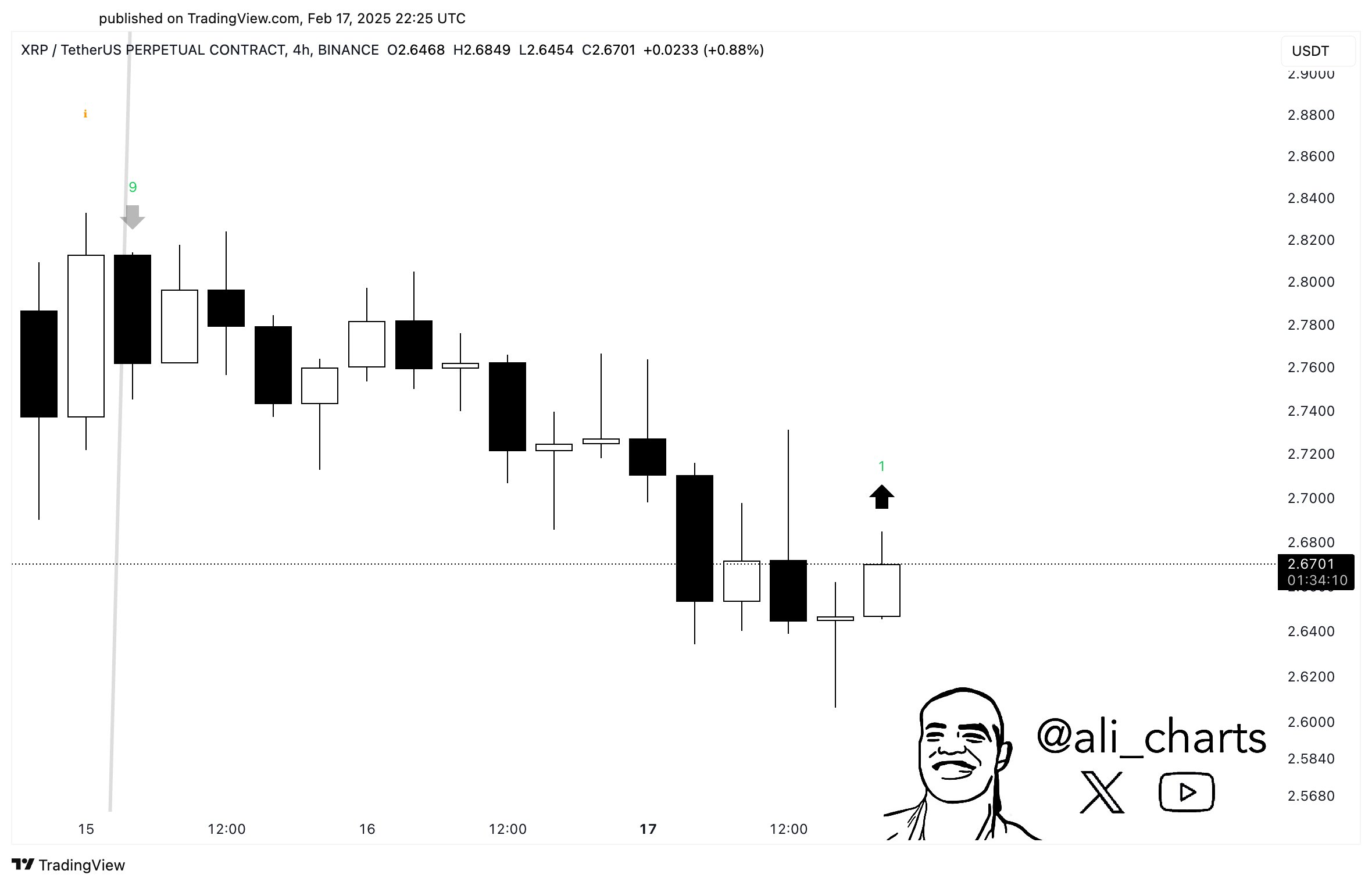

- TD Sequential suggests potential trend reversal, hinting at a rebound.

- Ripple holding $2.50 support; a breakout above $3.00 signals a bullish move.

Ripple (XRP) price has seen signs of consolidation over the past week. Recent fluctuations suggest concern in the market direction. The Ripple is hovering above the $2.50 support level, maintaining stability. Historically, XRP has surged when a key technical indicator flashed a buy signal. Will history repeat itself this time? Let’s uncover.

This Buy Signal Led to XRP Price Peaks Twice; Will It Repeat for a Third Time?

XRP price has reached new highs whenever a particular market indicator signals a strong buy opportunity. Historical data shows this pattern has repeated twice, leading to significant price rallies. The MVRV ratio analysis shows two essential points in time when it indicated to buy, resulting in strong price increases.

A 49.1% rally took place between November 3 and December 3, 2024, while a later spike of 68.94% occurred between December 31, 2024, and January 16, 2025. This trend raises speculation about whether history will repeat itself once more.

The recent movement of XRP suggests that a similar buy signal has appeared again, aligning with past trends. Analysts note that previous occurrences of this indicator have corresponded with sharp price increases. The latest MVRV ratio trend, combined with network realized profit and loss data, suggests that the market may be positioning itself for another breakout.

If the pattern holds, XRP could see another upward surge, reinforcing that price history may follow a familiar cycle.

Ripple Price Eyes Rebound After Buy Signal

Analyst Ali suggests that XRP may be positioning for a potential rebound, citing the TD Sequential indicator flashing a buy signal. This signal, often used to predict trend reversals, appears after an extended downward movement, hinting at a possible shift in market sentiment.

The recent price action shows XRP struggling to hold support amid broader market fluctuations. However, if buyers step in following TD Sequential’s bullish signal, the asset could see an upward push.

XRP price surged as Grayscale’s spot XRP ETF filing fueled optimism over regulatory clarity and institutional adoption. The move signals potential SEC policy shifts, strengthening Ripple’s legal stance and market prospects.

XRP Price Analysis

The price of XRP remains at $2.58 after displaying a 4% reduction over the past day. The price maintains a position above $2.50 support which represents a critical point to decide future market movements.

A break below $2.50 may push the Ripple price toward $2.00, where buyers could look for opportunities. On the upside, resistance stands at $3.00, followed by a stronger hurdle at $3.50.

A push past $3.00 could fuel a bullish continuation. The Relative Strength Index (RSI) is currently at 40.31, signaling weakening momentum.

The crypto market is still trading is the sideways trend, with bulls struggling to regain momentum. The global crypto market cap is $3.15T, with 1.45% dip in the past day as BTC hovers below the $96k support level.

To conclude, If history repeats, the XRP price could see another surge following the recent buy signal. Market trends and technical indicators suggest potential bullish momentum ahead.

Frequently Asked Questions (FAQs)

1. How does the MVRV ratio affect XRP price predictions?

2. What role does Grayscale's XRP ETF filing play in market sentiment?

3. Could XRP fall below the $2.50 support level?

- Breaking: Bitcoin Bounces as U.S. House Passes Bill To End Government Shutdown

- Why Is The BTC Price Down Today?

- XRP’s DeFi Utility Expands as Flare Introduces Modular Lending for XRP

- Why Michael Saylor Still Says Buy Bitcoin and Hold?

- Crypto ETF News: BNB Gets Institutional Boost as Binance Coin Replaces Cardano In Grayscale’s GDLC Fund

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks

- XRP Price Risks Slide to $1 Amid Slumping XRPL Metrics and Burn Rate

- Gold and Silver Prices Turn Parabolic in One Day: Will Bitcoin Mirror the Move?

- Cardano Price Prediction as the Planned CME’s ADA Futures Launch Nears

- HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Sparks Prediction-Style Trading Boom

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery