XRP Price Prediction: Sellers Dominate $XRP And Warns A Crash With This 5% Drop!

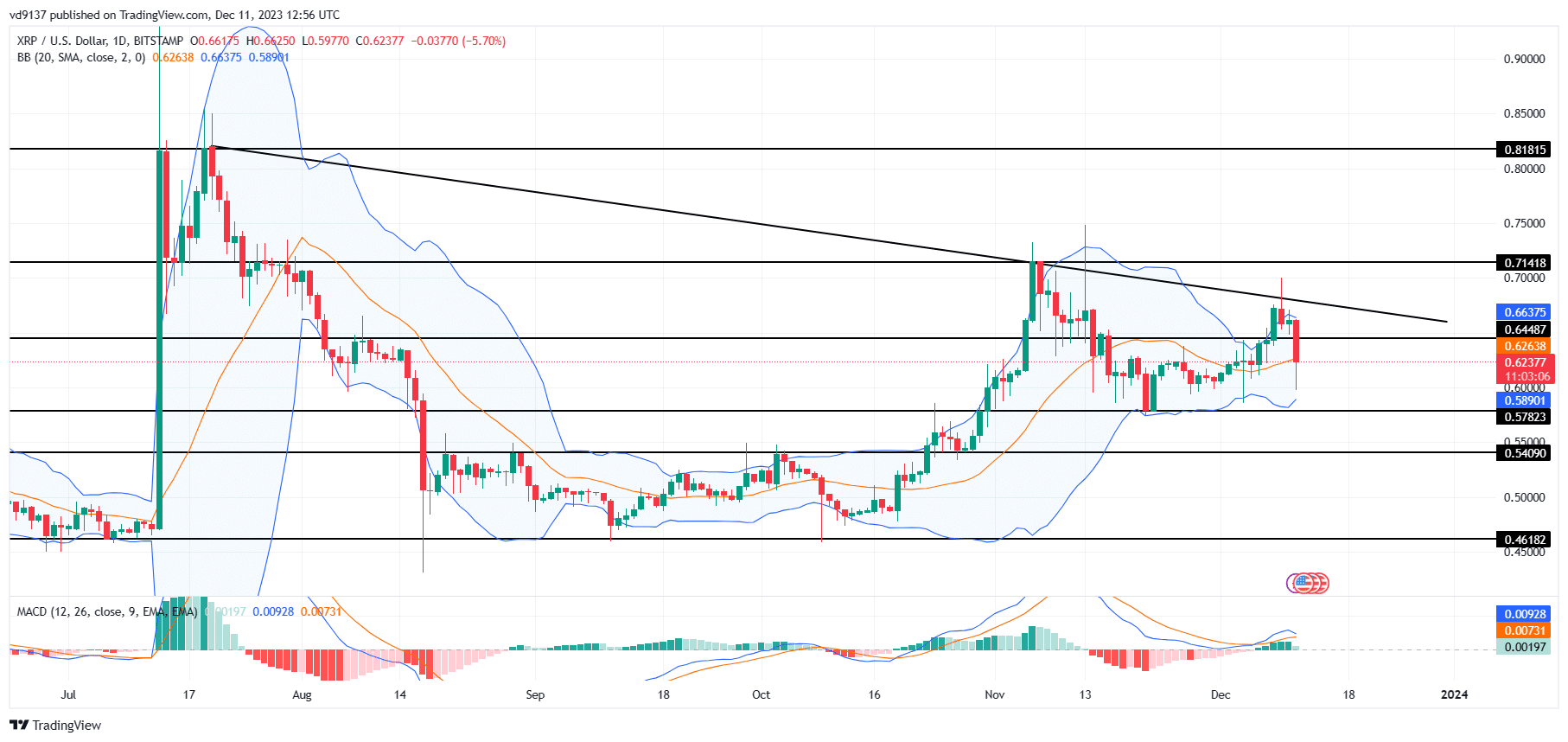

XRP Price Prediction: Driving a bounce-back rally with increasing momentum, the buyers test the overhead resistance trendline. However, the higher price rejection with the market-wide setback pulls back the XRP price under $0.65. This warns of a deeper correction. Will Ripple Labs manage to swim against the market-wide correction or is it falling under $0.60 this time?

Is XRP Crashing Below $0.60?

- The XRP price shows a sharp reversal from the resistance trendline as sellers delay a bullish break.

- The 5% drop with long tail formation teases a consolidation range.

- The intraday trading volume in Ripple is $1.843 Billion, indicating a 17% gain.

Hyping up the bullish hope for a breakout, the XRP price shoots from $0.57 and tests the overhead trendline. However, the hot bullish momentum chills down as the overhead supply leads a long wick candle, igniting a pullback phase.

Failing to unleash the uptrend with a slanted cup and handle pattern, the coin price reverts under $0.65 and approaches the bottom support of $0.60. Further, testing the patience of XRP holders, the ongoing correction may leave a big dent if it falls below the $0.57 mark.

Currently, the daily candle shows the XRP price trading at $0.62 and results in a bearish engulfing candle. However, the long wick keeps the bullish hope of reversal alive and may lead to a bounce back in the coming days or even hours.

Can XRP Sustain The Bullish Breakout Confidence?

The XRP price recovery fails to rechallenge the $0.70 mark and takes an early reversal, forming a lower high formation. Generating a downtrend under the influence of an overhead trendline, the altcoin walks on thin ice.

Considering the recovering market conditions help the coin price bounce back to give a break, the uptrend can reclaim $1 in 2023 with the Santa rally. However, a fall under $0.57 will make this even more difficult and might result in Ripple(XRP) ending the year at $0.50.

- Bollinger band: A reversal from the upper boundary of the Bollinger band indicator reflects the sellers are currently having an upper hand.

- MACD indicator. A bullish crossover between MACD and signal lines fails to sustain and teases a negative crossover.

- U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again?

- Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates