Metaplanet Buys More Bitcoin, Can It Overtake MicroStrategy?

Highlights

- Japanese investment firm Metaplanet increased its Bitcoin holdings by 57 BTC.

- It follows the company announcement of a loan to purchase bitcoins worth 1 billion Yen.

- MicroStrategy raising $2 billion to buy more BTC.

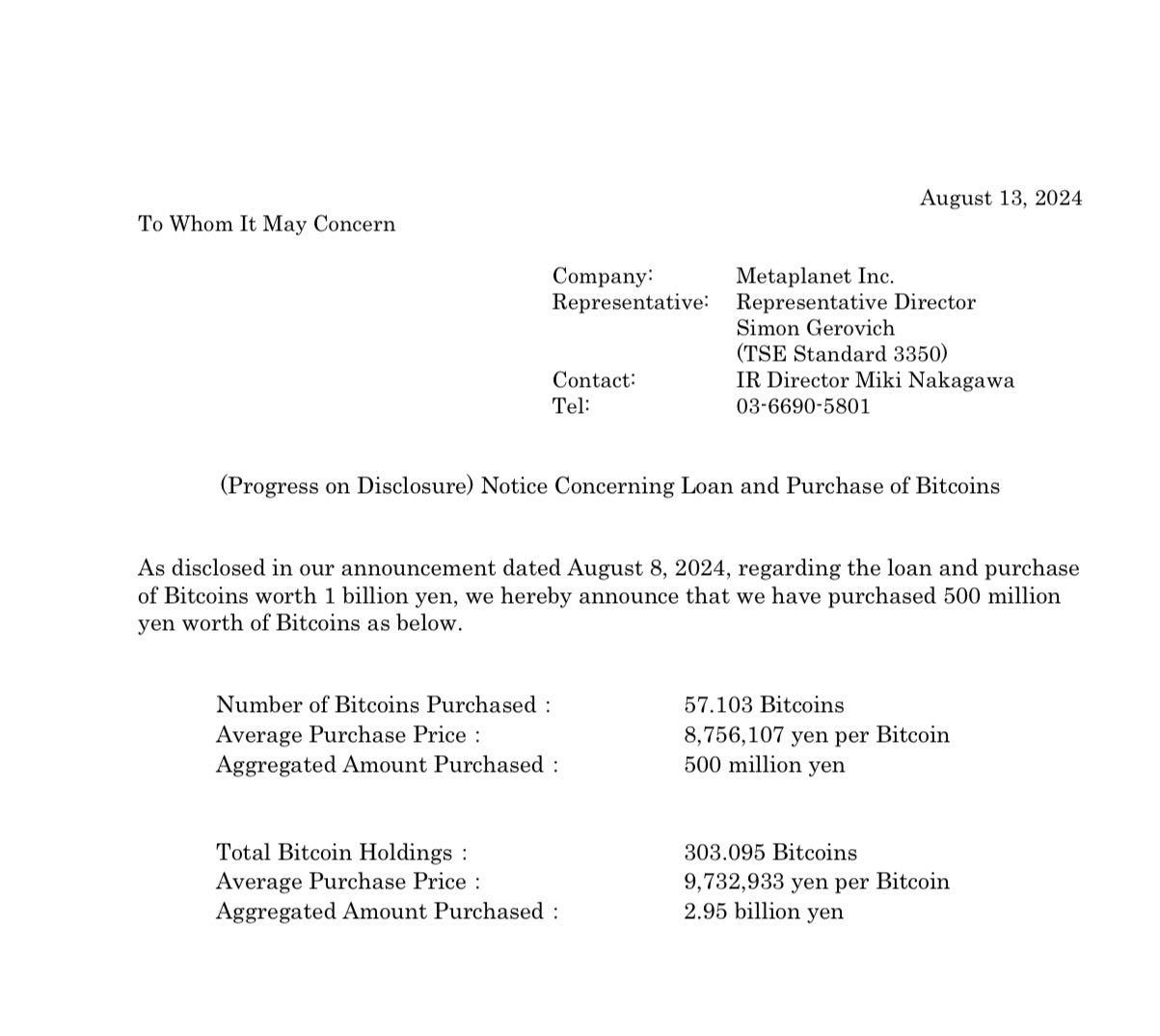

Metaplanet, a public listed Japanese investment firm, on Tuesday said it has increased its Bitcoin holdings by 57 BTC after the recent purchase. The move comes days after the company announced a 1 billion Yen loan to purchase bitcoins.

As per an official announcement on August 13, the company known as “Asia’s MicroStrategy” has purchased 57.103 BTC worth 500 million Yen ($3.3 million). The company purchased it at an average price of 8,756,107 yen per BTC.

The firm is on an aggressive Bitcoin buying spree as it recently raised 1 billion Japanese yen at just 0.1% APR. After the recent purchase, the firm still has 500 million Yen to buy more BTC. The total bitcoin holding of the firm has increased to 303.095 bitcoins worth 2.95 billion Yen.

Metaplanet is taking the full benefit of low interest rates in Japan to buy bitcoins after taking loans. It seems to be the best use of the Japanese Yen carry trades, which involves buying the Yen at a cheaper rate and purchasing other assets in the global market.

Metaplanet Buying Bitcoin Aggressively Than MicroStrategy

Meanwhile, other companies such Marathon Digital and Selmer Scientific have also followed the US-based largest Bitcoin holder’s strategy to add bitcoins to their balance sheet. Also, it is obvious that Metaplanet is adopting MicroStrategy’s playbook for its BTC acquisition. Some even see huge competition between the two companies in the coming years.

Recently, MicroStrategy announced a plan to raise as much as $2 billion to buy more bitcoins. The company to raise these funds by selling MSTR class A shares. It currently holds 226,500 Bitcoin worth nearly $14 billion, depending on market fluctuations.

MSTR price closed 2.89% lower at $131.46 on Monday. The price has dropped over 18% in a month amid Bitcoin volatility and uncertainty recently. Meanwhie, the Tokyo Stock Exchange-listed Metaplanet stock price fell 5.80% to 1,121 JPY on Tuesday. The stock price has rallied over 600% after the company added BTC to its balance sheet.

BTC price is currently trading above $59,500, up 1% in the last 24 hours. The 24-hour low and high are $58,477 and $60,680, respectively. Furthermore, the trading volume has decreased by 3% in the last 24 hours, indicating declining interest among traders.

However, an analysis by CoinGape indicated concerns among traders after the formation of a Bitcoin death cross on the chart, which risks a crash in the price.

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- U.S. Jobs Report: January Nonfarm Payrolls Rise To 130k, Bitcoin Falls

- Arkham Exchange Shut Down Rumors Denied as Bear Market Jitters Deepen

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates