MEXC Denies Insolvency Rumors, Faces Record Withdrawals as Users Seek Proof of Solvency

Highlights

- $5.5 billion Withdrawals from MEXC hints at rumors of insolvency, but the exchange has denied.

- Customers are transferring their money over transparency concerns, which compares to the collapse of FTX.

- Analysts are demanding a third-party audit to validate the assertion of MEXC having proof-of-reserves.

MEXC exchange has denied ongoing insolvency rumors after users reported withdrawal delays and increased fund outflows. The crypto exchange said it will update its Merkle tree data tonight to allow users to verify the reserves directly.

MEXC Outflows Surge to $5.5B Amid Liquidity Fears

The exchange issued a public statement reaffirming that all assets are “fully backed” and supported by Proof of Reserves (PoR) showing over 100% coverage. The clarification follows rising speculation on social media about MEXC’s liquidity, with some users claiming to have experienced slower transaction times.

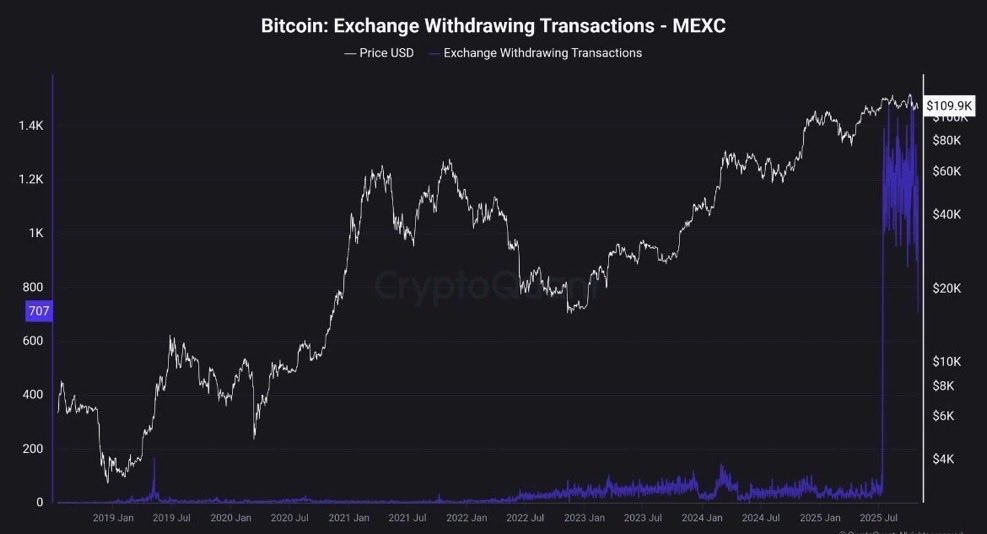

In response, the platform said such claims were “false and misleading” and emphasized its “strong financial health.” However, data from CryptoQuant shows Bitcoin withdrawals on MEXC have surged to record highs.

The massive outflows is a reflection of mounting apprehension among traders. The visual data indicates large BTC, SOL, and ETH movements over the past 24 hours. Exchange reserve data by Coinglass shows MEXC holds around $5.13 billion in assets.

The platform saw $5.50 billion in outflows over the past 24 hours, the largest among its peers. Net outflows were also registered in KuCoin and Bitget but their amounts were significantly smaller compared to MEXC.

Analysts Doubt MEXC’s Transparency, Request for Independent Audit

The main question that market analysts and community members still pose is whether the PoR statement alone by MEXC is enough to regain user confidence. A financial transparency analyst, Shanaka Anslem Perera replied, “Evidence of solvency is no press release”.

He added that the crypto exchange should be able to show verifiable on-chain balances, evident liabilities, and perform external verification. Perera also emphasized that “withdrawals are the audit.” This means liquidity strength is tested only when users can freely withdraw assets without disruption.

Withdrawals are the audit

If an exchange must announce it is fine during a bank run, the market already answered. Proof of reserves that needs a caption is theater. A press release cannot redeem a withdrawal. In final settlement systems, words price at zero and signatures price… https://t.co/Zv52hhxpi7

— Shanaka Anslem Perera ⚡ (@shanaka86) November 1, 2025

Another crypto commentator, CookieSlap compared the current situation to the lead-up to the FTX collapse. However, the exchange’s restructuring team recently claimed that FTX was never bankrupt. They added that creditors are now set to receive their full repayment.

Bearish, I’ve heard that during FTX collapse.

PoR needs to be done by an unbiased 3rd party with full access to all asset balance sheets.— CookieSlap (@CookieSlap) November 1, 2025

Still, crypto commentator argued that “PoR needs to be done by an unbiased third party with full access to all balance sheets.” StayCoti Node reminded holders to “review your positions” and maintain control over funds, warning, “They all say funds are safe, until they aren’t.”

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k