Michael Saylor Flips on MSTR Stock Issuance Rules As Strategy Loses Bitcoin Premium

Highlights

- MSTR stock is losing its premium to Bitcoin amid recent underperformance.

- The company’s mNAV premium has dropped from 3.4x in November to 1.6x, prompting management to ease restrictions on issuance.

- MSTR has traded flat around $360 for months, with analysts warning of a potential drop to $300 amid technical weakness.

In a month, Strategy executive chairman Michael Saylor has relaxed the company’s financing rule for MSTR stock issuance, for purchasing more Bitcoin. This comes amid the stock underperformance over the past few months, thereby losing the premium over Bitcoin it once enjoyed. As per the latest revision, the company will issue stock under the mNAV of 2.5 to fund its latest BTC purchases.

Michael Saylor Eases Strategy Stock Issuance

Within three weeks, Michael Saylor is easing the funding limits for MSTR stock issuance to fund his new Bitcoin purchases. In late July, Strategy assured investors it would avoid issuing new shares at a price below 2.5 times the value of its Bitcoin holdings. Saylor dubs it as the “mNAV premium,” which has crashed from 3.4x since November 24, to now at 1.6x.

Strategy (NASDAQ: MSTR) shareholders have long argued against the share dilution. However, the management has justified the recent flip by calling it “management flexibility,” as per the Bloomberg report. The change provides Saylor greater flexibility to raise cash and cover expenses as the company’s formerly large premium over its Bitcoin holdings narrows.

The recent flip in the stand comes after MicroStrategy purchased Bitcoins, worth $51 million, on Monday, August 18. Over the past few weeks, the pace of BTC purchases has dropped from billions to a few million dollars as MicroStrategy’s market value-to-Bitcoin holdings ratio (mNAV) fell below 2.5x, a bearish signal for the MSTR stock.

Acknowledging this shift, Saylor revised his strategy to allow issuing additional MSTR shares even when mNAV is below the 2.5x threshold. This marks a reversal from his earlier stand, of not opting for share dilution. Brian Dobson, managing director for Disruptive Technology Equity Research at Clear Street said:

“I think the additional language in the guidance gives them more leeway with issuing common stock. That should allow the company to be more opportunistic in its Bitcoin purchases.”

Strategy Shares Under Pressure As BTC Declines

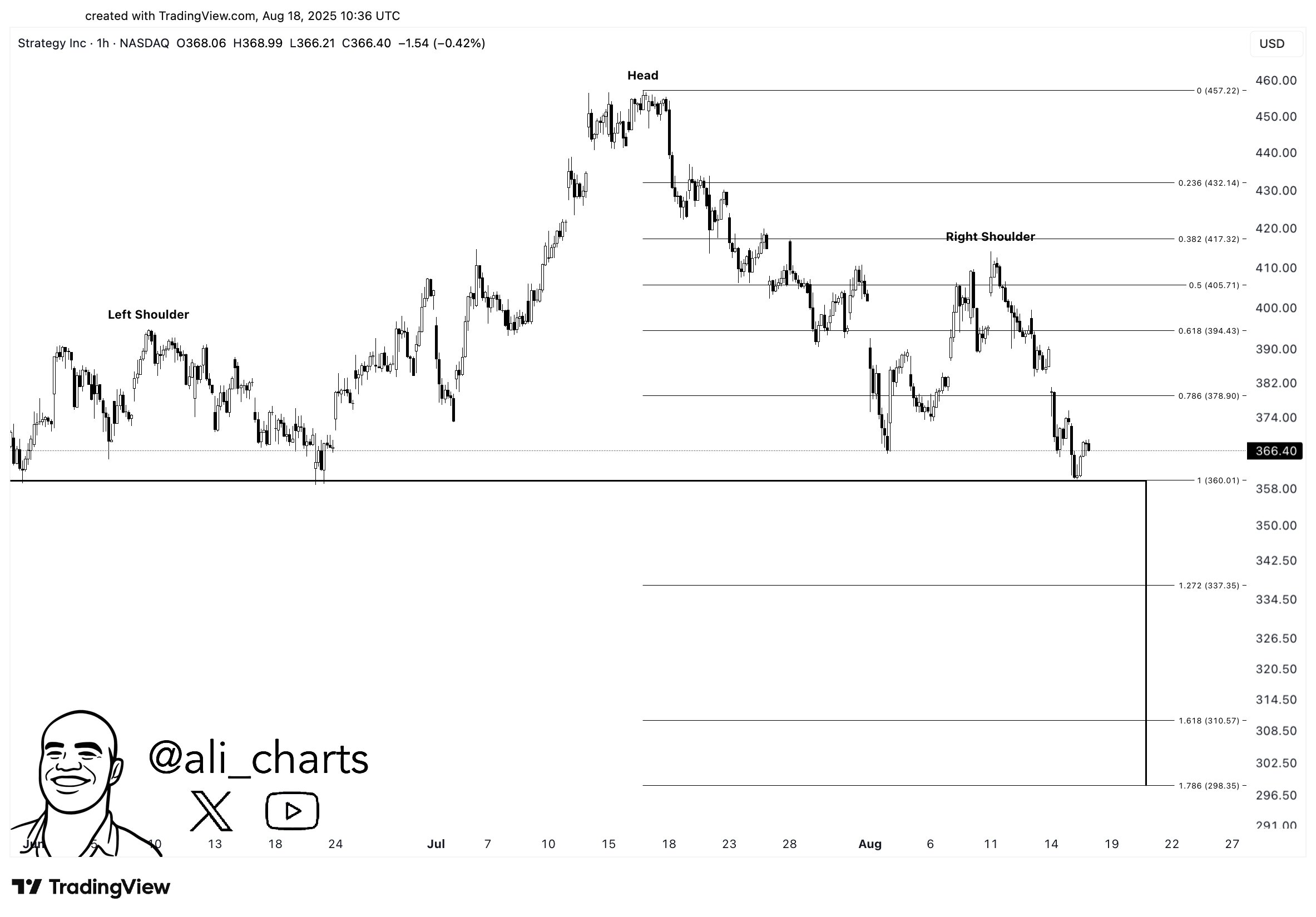

Over the past four months, MSTR stock has been trading at the same level at around $360, and has failed to get enough traction. On the other hand, with BTC price hitting fresh all-time highs, it has led to a drop in the premium gap. As per popular crypto analyst Ali Martinez, MSTR share price is forming a classic head-and-shoulder pattern. Thus, falling under $360, could lead to a further drop to $300.

Furthermore, Vanguard has also offloaded its MSTR shareholding by 10% during Q2. With the volatility in the stock price curbing fast, retail participation has also dropped as a result.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Kraken Gains Access To The Federal Reserve’s Payment System as Ripple Awaits Approval

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

Buy $GGs

Buy $GGs