Breaking: Michael Saylor’s Strategy Buys 1,286 BTC, Increases USD Reserve To $2.25B

Highlights

- Strategy bought 1,286 Bitcoin between December 29 and January 4.

- Michael Saylor had hinted about the purchase yesterday.

- The company has also increased its USD reserve to $2.25 billion.

- The MSTR stock is up over 4% in premarket trading.

Strategy has made another weekly Bitcoin purchase, continuing to double down on the flagship crypto. This latest purchase comes as Bitcoin broke above $90,000 and ahead of the key MSCI decision next week on whether digital asset treasury companies should remain in its global indices.

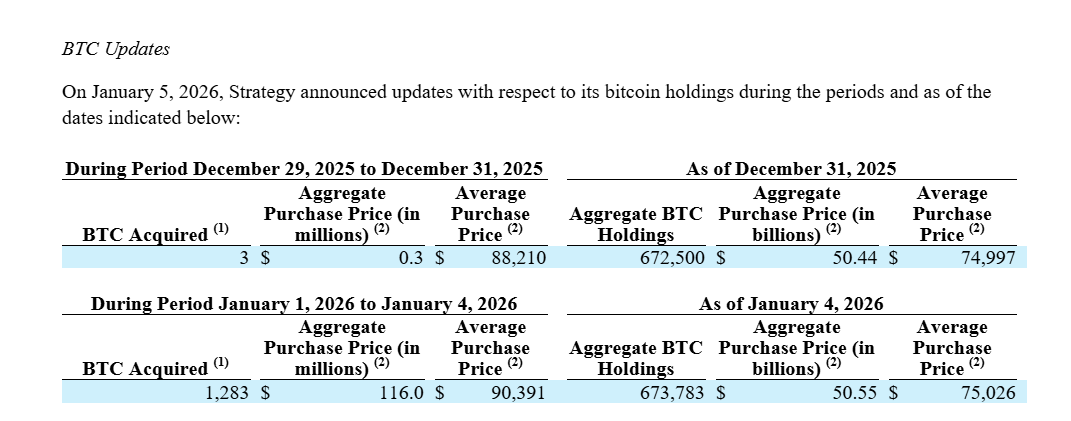

Strategy Acquires 1,286 BTC For $116 Million

An SEC filing showed that the company acquired 1,286 BTC for $116 million at an average price of $88,568 per Bitcoin. The company first acquired 3 BTC between December 29 and 31 to close out the year for an average price of $88,210. It then bought 1,283 BTC between January 1 and 4 for $116 million at an average price of $90,391.

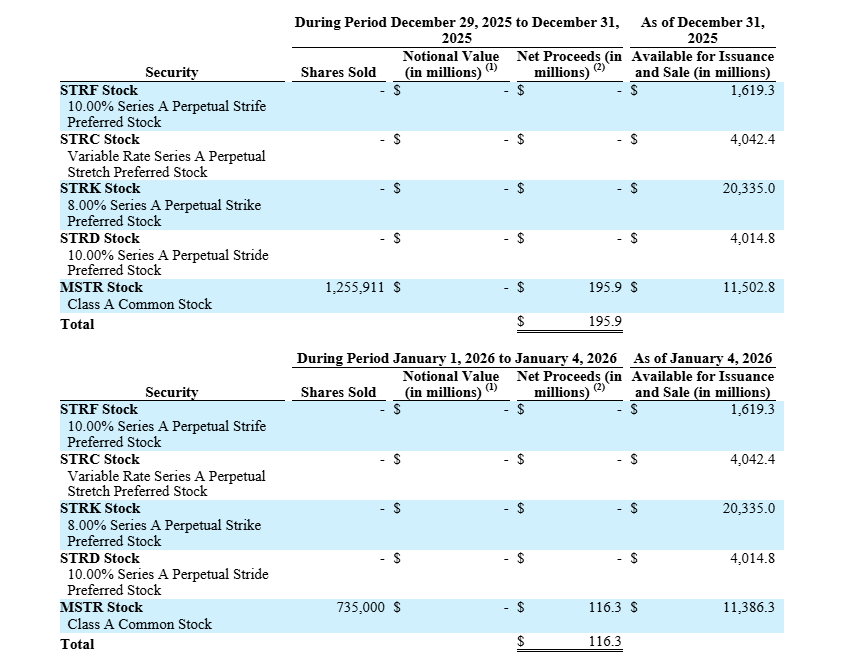

Strategy now holds 673,783 BTC, which it acquired for $50.55 billion at an average price of $75,026 per BTC. Meanwhile, it funded these purchases solely with proceeds from MSTR share sales. It sold almost 2 million MSTR shares, making net proceeds of $312.2 million.

The announcement comes after Strategy’s co-founder, Michael Saylor, had hinted about another weekly buy yesterday. He posted the company’s Bitcoin portfolio in his conventional Sunday X post, with the caption, “Orange or Green?”

Orange or Green? pic.twitter.com/55QX69NotP

— Michael Saylor (@saylor) January 4, 2026

The purchase also comes as Bitcoin rose above $90,000 amid the U.S. Venezuela conflict. The flagship crypto has surged to as high as $93,000 to start the year, currently boasting a year-to-date (YTD) gain of around 6%.

The Strategy stock has also surged amid this latest purchase. Yahoo Finance data shows that the stock is currently trading at around $164, up over 4% from last week’s close of $157.

Strategy is set to remain in the spotlight ahead of the MSCI decision next week, when the committee will decide whether digital asset treasury companies are classified as investment funds. If so, the company risks delisting from MSCI’s global indices, which JPMorgan has warned could lead to up to $2.8 billion in outflows.

An Increase In The USD Reserve

The SEC filing also showed that Strategy has increased its USD reserve by $62 million to $2.25 billion. The reserve is to support the payment of dividends on its preferred stock and interest on its debts.

It is worth mentioning that BTC and MSTR’s declines last year led to speculation that the company might sell some of its Bitcoin holdings. However, Saylor and Strategy established a USD reserve for dividend and interest payments, ensuring that they do not have to sell their BTC holdings anytime soon.

Meanwhile, CoinGape had earlier reported that Strategy was facing a Q4 loss due to declines in Bitcoin and MSTR. The company confirmed in the filing that it had an unrealized loss of $17.44 billion on digital assets for the fourth quarter. Furthermore, it recorded a $5.40 billion unrealized loss on digital assets in 2025.

- Wintermute Expands Into Tokenized Gold Trading, Forecasts $15B Market in 2026

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?