MicroStrategy Bitcoin (BTC) Losses At $1 Billion, MSTR Stock Plummets 25%

Business Intelligence firm MicroStrategy (NASDAQ: MSTR) which has built a huge Bitcoin position on its balance sheet has seen the valuation of its holdings eroding by 25%. As of its latest filing with the U.S. SEC, MicroStrategy has amassed 130,000 Bitcoins for an aggregated investment of $3.97 billion.

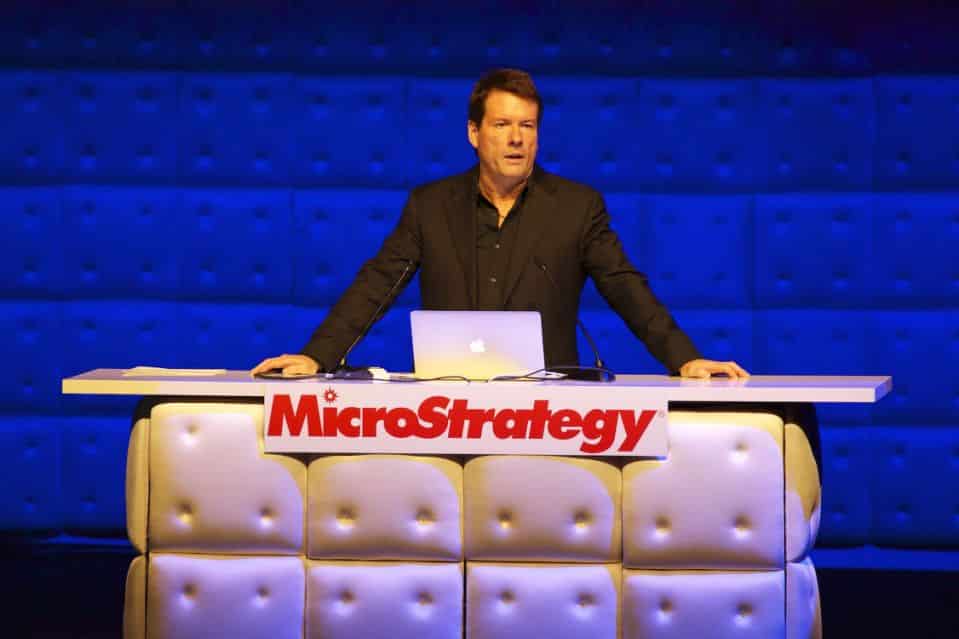

The firm led by CEO Michael Saylor has been aggregating BTC since August 2020 with its current average price at $30,700 as of March 31. Amid a brutal market correction over the last four days, the BTC price has crashed to $22,000.

Thus, the aggregate value of its Bitcoin holdings is currently at $3 billion with losses surmounting $1 billion. However, despite all the market turmoil, company CRO Michael Saylor is absolutely unfazed.

During his recent interview, said that his company would never sell Bitcoins and would even continue to buy at the top. Furthermore, he also has a very strong conviction that the Bitcoin price is going to a million over the next decade.

MicroStrategy Leads Deadly Sell-off In Crypto-Related Stocks

Crypto-based companies faced a severe beating on Monday’s trading session on Wall Street. Leading the entire crypto stocks rout was MicroStrategy as the MSTR stock collapsed by a staggering 25% ending Monday’s trading session at $152.

The MSTR stock has tanked more than 72% year-to-date. Other public-listed blockchain and crypto firms saw their stock prices plummet by 15% each. Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown told Bloomberg:

“Crypto fans have become used to volatile rides, but these rollercoaster descents are increasingly hard to stomach. With the era of cheap money coming rapidly to an end, traders are becoming much more risk averse and turning their backs on crypto assets.”

Recent Posts

- Crypto News

Shiba Inu Team Unveils ‘Shib Owes You’ Plan To Repay Plasma Bridge Hack Victims

Shiba Inu announced a formal repayment structure on Monday to address unresolved user losses linked…

- Crypto News

Fed Chair Race Tightens as Hassett’s Odds Slip Below 50% Ahead of Trump’s Decision

Prediction markets shows that the odds of Kevin Hassett becoming the next Fed Chair is…

- Crypto News

Fed Injects $26 Billion: Will the Crypto Market Record a Year-End Rally?

The New York Federal Reserve has continued to inject liquidity into the U.S. economy through…

- Crypto News

XRP Sell Pressure Intensifies amid Rising Inflows to Binance, South Korean Exchanges

XRP witnessed extreme volatility on Monday, with prices rising to $1.91 and falling back to…

- Crypto News

Crypto ETFs in 2026: What to Expect for Bitcoin, Ethereum, XRP, and Solana

Bitwise and Bitfinex analysts have predicted that the crypto ETFs could see increased adoption next…

- Crypto News

BlackRock Moves $200M BTC and ETH as Crypto ETPs See $3.2B Outflows Since October 10 Crash

BlackRock deposited a large amount of Bitcoin and Ethereum to a U.S. crypto exchange while…