MSTR Stock Rebounds After Market Crash As MicroStrategy Failed To Purchase Bitcoin Last Week

Highlights

- MicroStrategy didn't buy any Bitcoin or sell any shares between February 24 and March 2.

- The company still holds 499,096 BTC.

- The MSTR stock price has recovered from last week's crash.

In a significant development, MicroStrategy’s MSTR stock price has rebounded following the last week’s market crash. This follows the platform’s failure to make new Bitcoin purchases over the past week. In addition, MicroStrategy, now rebranded as Strategy, has not sold any shares, a typical precursor to its BTC buys. As a result, the software company still holds 499,096 BTC, with the 500k BTC milestone yet to be hit.

MicroStrategy Did Not Make Any Bitcoin Purchase Last Week

In an SEC filing, MicroStrategy revealed that it made no Bitcoin purchases between February 24 and March 2 last week. The company also revealed that it did not sell any shares of class A common stock under its at-the-market equity offering program.

It is worth mentioning that Strategy acquired 20,356 BTC for $1.99B at $97,514 per BTC two weeks ago. This came following a $2B zero-coupon convertible notes offering, in which it was able to raise the funds for this BTC purchase.

Meanwhile, following its failure to buy any Bitcoin last week, MicroStrategy still holds 499,096 BTC, which it acquired for $33.1 billion at an average price of $66,357 per BTC. Strategy remains the public company with the largest Bitcoin holdings, well ahead of MARA holdings, which is second on the list.

The company’s failure to buy any BTC last week is also notable considering that the Bitcoin price dropped below $80,000 last week following a major crypto crash. As such, the company didn’t take advantage of a major dip which could have lowered its average cost price.

MSTR Stock Recovers

MicroStrategy’s stock has crashed last week following the Bitcoin price decline, as both assets share a positive correlation. The MSTR stock price has now recovered following BTC’s rebound above $90,000 over the weekend.

Nasdaq data shows that the stock price is up over 3.72% in premarket, trading at around $285. MSTR closed last week at around $255 following the Bitcoin price crash. However, following last week’s crash, MSTR now boasts a year-to-date (YTD) loss of over 11%.

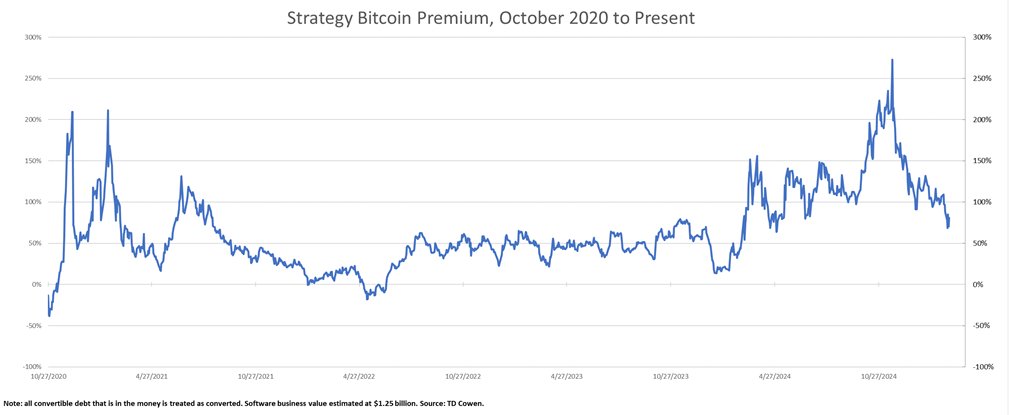

VanECK’s chief also revealed that MicroStrategy’s Bitcoin premium has dropped back to April 2024, which may be something for market participants to keep an eye on.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs