Mt Gox Risks To Bitcoin Crash Plunges 75%: Arkham

Highlights

- Mt Gox wallets now have less than 25% BTC.

- Bitcoin crash risks due to Mt Gox repayment now dropped to nearly 75%.

- Multiple factors suggest upcoming BTC price rally.

Bitcoin crash risks due to Mt Gox repayment have now dropped to almost 75%, on-chain analytics platform Arkham Intelligence stated on Saturday. Institutional and retail investors offloaded Bitcoin holdings on fears of a huge market crash as Mt Gox Trustee started BTC repayment in July this year.

Mt Gox Wallet Down To 25% Bitcoin Holdings

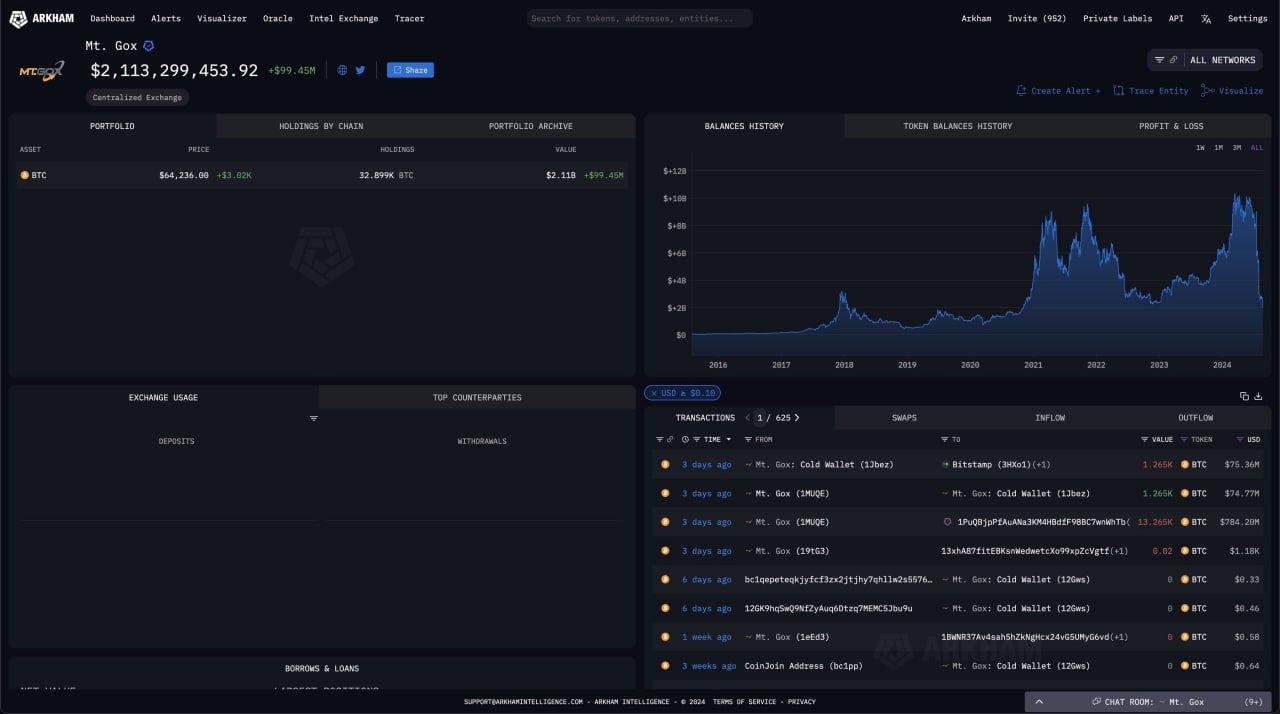

Arkham Intelligence confirmed on August 24 that beleaguered crypto exchange Mt Gox wallets now have less than 25% BTC. This means the risks of any more Bitcoin liquidation or crash due to the repayment have dropped significantly, contributing extremely toward bullish sentiment.

Mt Gox wallets have held 141.69K BTC since 21, with a peak value of $10.12 billion as of March 2024, as per Arkham data. The wallet now holds 32.9k BTC worth $2.11 billion. Moreover, creditors have so far not sold their BTC holdings and are likely to not sell them due to the ongoing bull run.

With Bitcoin selloff by the US government the only remaining major crash risk, experts believe the path to $100k is even more clear. The crypto market bulls showed resilience amid selloffs by the German government, the US govt, and repayment by the exchange.

More Factors Suggesting BTC Price Rally

Mt Gox has distributed nearly 109K BTC worth $6.6 billion to creditors since July, which is considered impressive as BTC price recovered above $60,000 after falling below the level many times in the last few months.

Institutional and retail investors are more bullish now after strong signals of Fed rate cuts from the FOMC Minutes and Fed Chair Jerome Powell speech. US Fed officials are also more upbeat on rate cuts, indicating that the Federal Open Market Committee is likely to vote for a monetary policy pivot in the September meeting.

Traders also expect the ‘Golden Cross’ pattern formation in the coming days as 50-DMA is likely to crossover above 200-DMA, which indicates the possibility of a long-term bull market.

Moreover, US spot Bitcoin ETF saw $252 million in net inflows on Friday, bringing the weekly total to $506.4 million. The 11 Bitcoin ETFs saw consecutive inflows for seven days, which supports speculation of a massive BTC rally this year.

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Will Bitcoin Crash To $58k or Rally to $75k After Hot PCE Inflation Data?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral