Multi-Billion Dollar Investment Management Firm cashes out from Stocks to invest in Defi

Dawn Fitzpatrick, CEO, and CIO of the $27 billion Soros Fund Management announced that the investment management giant has been liquidating the $5 billion it had invested in March 2020 during the Covid-19 triggered market instability. Furthermore, Fitzpatrick noted that the company will be redirecting its investment into Decentralized Finance.

Defi Dominance over the “mainstream” Bitcoin

Soros CEO and CIO confirmed that the company owns a small portion of crypto in their portfolio. However, Fitzpatrick claimed Defi’s dominance over “mainstream” crypto, stating that coins have become less interesting as compared to the use cases of Defi.

“We own some coins — not a lot — but the coins themselves are less interesting than the use cases of Defi and things like that,” she told Bloomberg, noting that “cryptocurrencies have gone mainstream.”

Chainalysis report confirms Defi growth

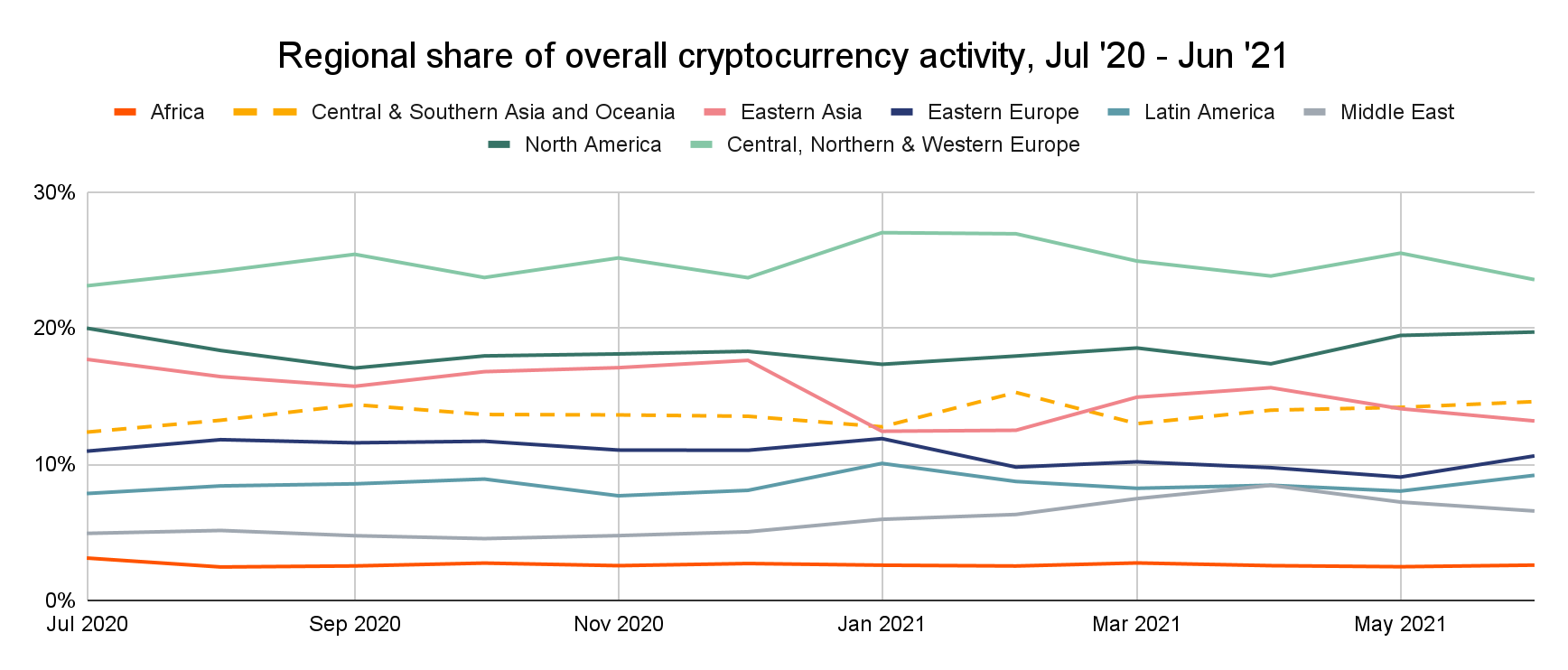

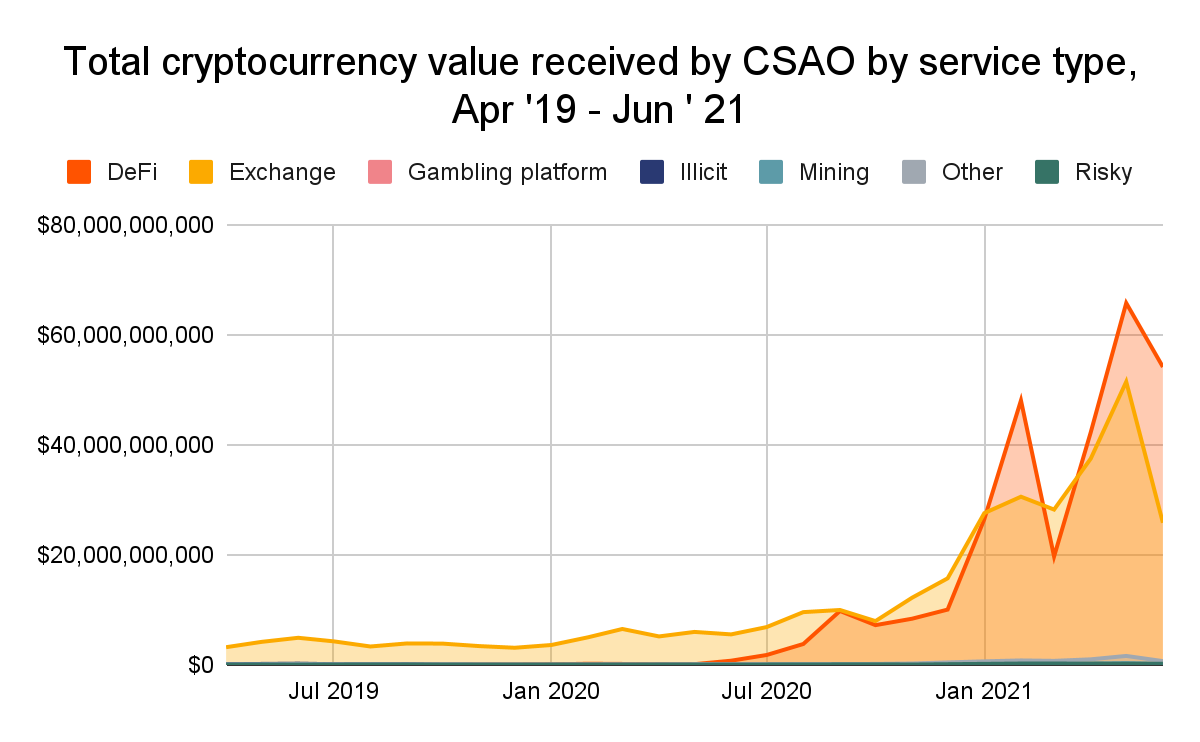

The latest virtual currency adoption report by blockchain-based analysis firm, Chainalysis also noted exceptional Defi growth in the span of merely one year. The report stated that the Central and Southern Asia and Oceania (CSAO) region has seen the most cryptocurrency usage with Vietnam, India, and Pakistan topping the charts, according to the Global Crypto Adoption Index.

However, among several crypto activities, Defi took charge with skyrocketed Defi’s activity as a share of all transaction volume beginning from May 2020, and further-reaching above 50% by February. This activity has primarily been driven by Uniswap, Instadapp, and dydx, with significant activity on Compound, Curve, AAVE, and 1inch as well.

Defi Hacks

The rise of the Defi sphere comes with the unwelcoming Defi hacks trend. The Defi hack trend has taken the better of the blockchain system with protocols like CREAM Finance, PolyNetwork, Neko Network, the DEX protocol – NowSwap, pNetwork, and the latest hack of StakeSteak suffering exploits with attackers finding loopholes in the system. While Defi enables accountability through advanced smart contract technology for blockchain and further makes regulatory approval more approachable, but Defi hacks are currently the biggest threat to its potential growth.

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- CLARITY Act: Crypto Group Challenges Banks Proposal With Its Own Bill Suggestions

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?