BREAKING: Nasdaq Files with US SEC to List BlackRock Bitcoin Premium Income ETF

Highlights

- BlackRock iShares Bitcoin Premium Income ETF advances with Nasdaq filing.

- US SEC acknowledges the filing meet the eligibility criteria in the General Listing Standards.

- The ETF will provide income by selling BTC call options to generate yield.

Nasdaq has officially filed to list and trade BlackRock iShares Bitcoin Premium Income ETF with the U.S. Securities and Exchange Commission (SEC). This premium income ETF by the world’s largest asset manager BlackRock aims to provide a yield to investors from Bitcoin-linked strategies.

BlackRock Bitcoin Premium Income ETF to List on Nasdaq

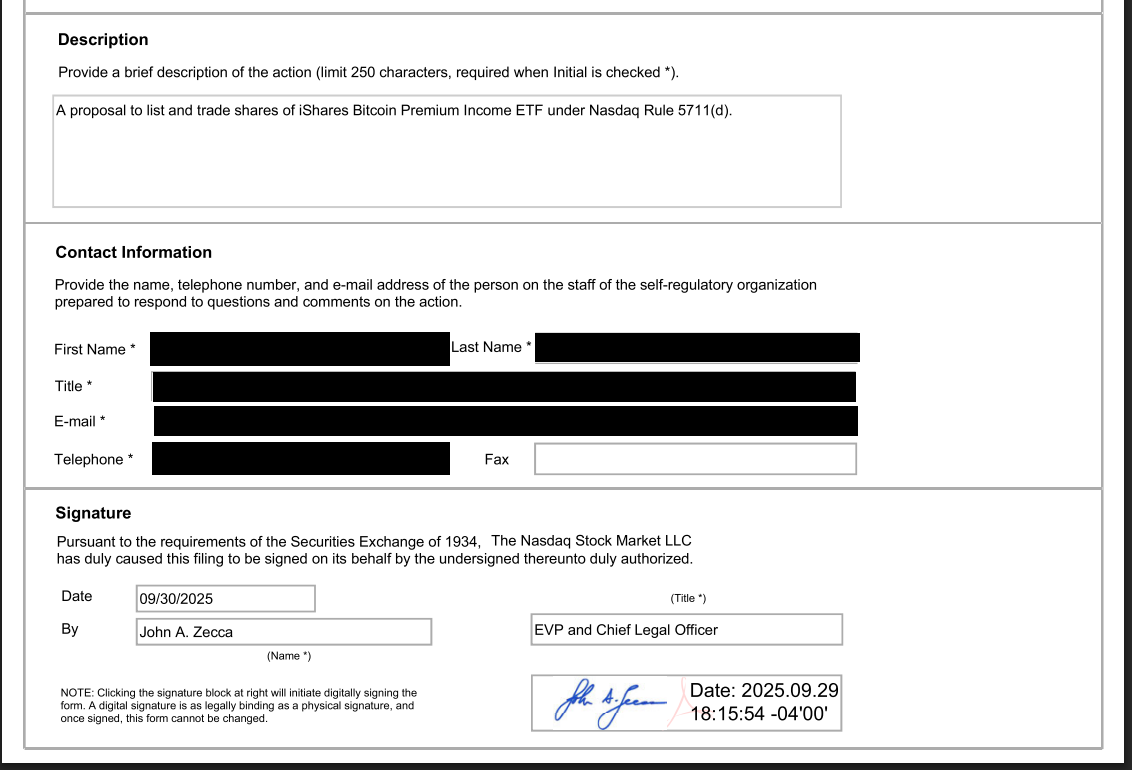

Nasdaq proposes to list and trade BlackRock iShares Bitcoin Premium Income ETF under the commodity-based trust rule, according to a US SEC filing dated September 30.

It follows a registration of the iShares Bitcoin Premium Income ETF by the asset manager in Delaware last week. Bloomberg analyst Eric Balchunas described it as a “sequel” to IBIT, suggesting intent to expand its suite rather than diversify into a broad mix of altcoins. The company also framed the product as a way for investors to generate income from BTC while reducing volatility.

The SEC has acknowledged the submission by Nasdaq, noting that the BlackRock iShares Bitcoin Premium Income ETF meets the eligibility criteria in the General Listing Standards. The commission now seeks comments on the proposed rule change to list and trade the income ETF under the commodity-based trust rule.

How Is It Different from Bitcoin ETF (IBIT)?

As ETF expert Eric Balchunas explained, the fund is designed to generate income from its exposure through covered call Bitcoin strategies. Unlike BlackRock’s IBIT, which simply tracks the spot BTC price, the new product aims to provide a steady yield for income-focused investors.

The firm disclosed in the filing that the BlackRock iShares Bitcoin Premium Income ETF will provide income by writing (selling) call options primarily on IBIT or indices that track spot Bitcoin ETPs.

In terms of holdings, it will invest primarily in spot Bitcoin and IBIT, cash, while also writing options on IBIT or indices tracking spot Bitcoin ETPs. The trust asserted that it may also invest in exchange-listed FLEX options.

As CoinGape reported earlier, BlackRock filed to amend its iShares Bitcoin ETF (IBIT) and iShares Ethereum ETF (ETHA). The IBIT and ETHA will operate in compliance with the generic listing standards from Q1 2026.

At press time, BTC price is holding above $114K, while altcoins face selling pressure. The 24-hour low and high are $112,740 and $114,746, respectively.

- BlackRock Bitcoin ETF (IBIT) Options Data Signals Rising Interest in BTC Over Gold Now

- XRP and RLUSD Holders to Access Treasury Yields as Institutional-Grade Products Expand on XRPL

- Prediction Market News: Polymarket to Offer Attention Markets Amid Regulatory Crackdown

- How “Quiet Builders” Are Winning the Web3 Race

- XRP News: Ripple Taps Zand Bank to Boost RLUSD Stablecoin Use in UAE

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?