Will Nasdaq’s Next Move Affect Bitcoin’s (BTC) Price In The Short Term?

In recent times, the price of Bitcoin (BTC) has maintained a close association with the performance of the stock market in the United States. During periods in which the price of the stock was aggressively rising, the price of bitcoin also rose, however, in a range that was relatively lower. Given this scenario, significant changes in the NASDAQ stock market could create an impact on the prices of cryptocurrencies in the short term.

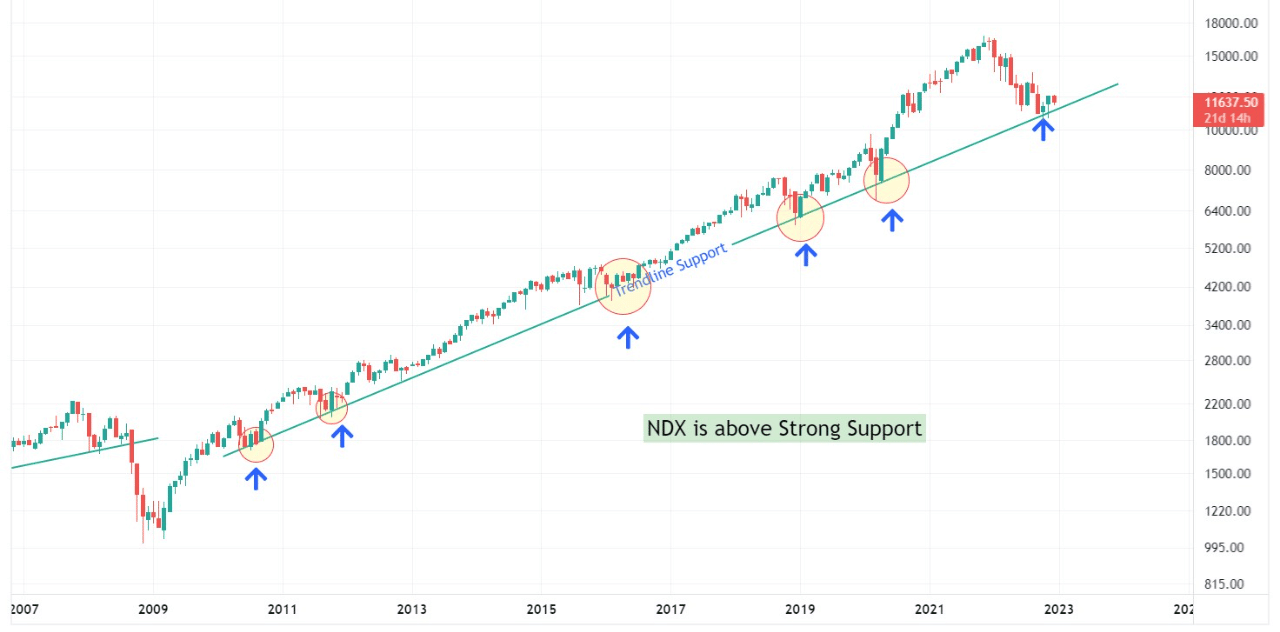

NASDAQ On The Brink

According to data, the NASDAQ has been above the trend risk support as can be seen from the image below. This trend line has prevented the prices from further declines and has supported it since 2010. However, in the coming weeks, the market would be deciding on the reaction to this trend line.

There have been five instances in the past where this trend line has acted as support for the market.

Read More: Will Bitcoin’s (BTC) Price Hit $100K In 2024? Data Suggests So

In spite of the fact that this trend line has the potential to put an end to the current downward trend and serve as the starting point for a market recovery; the trend line’s support, if in case broken, will indicate that the current downtrend is extremely strong and that the market still has more room to fall.

Bitcoin Mimicking NASDAQ?

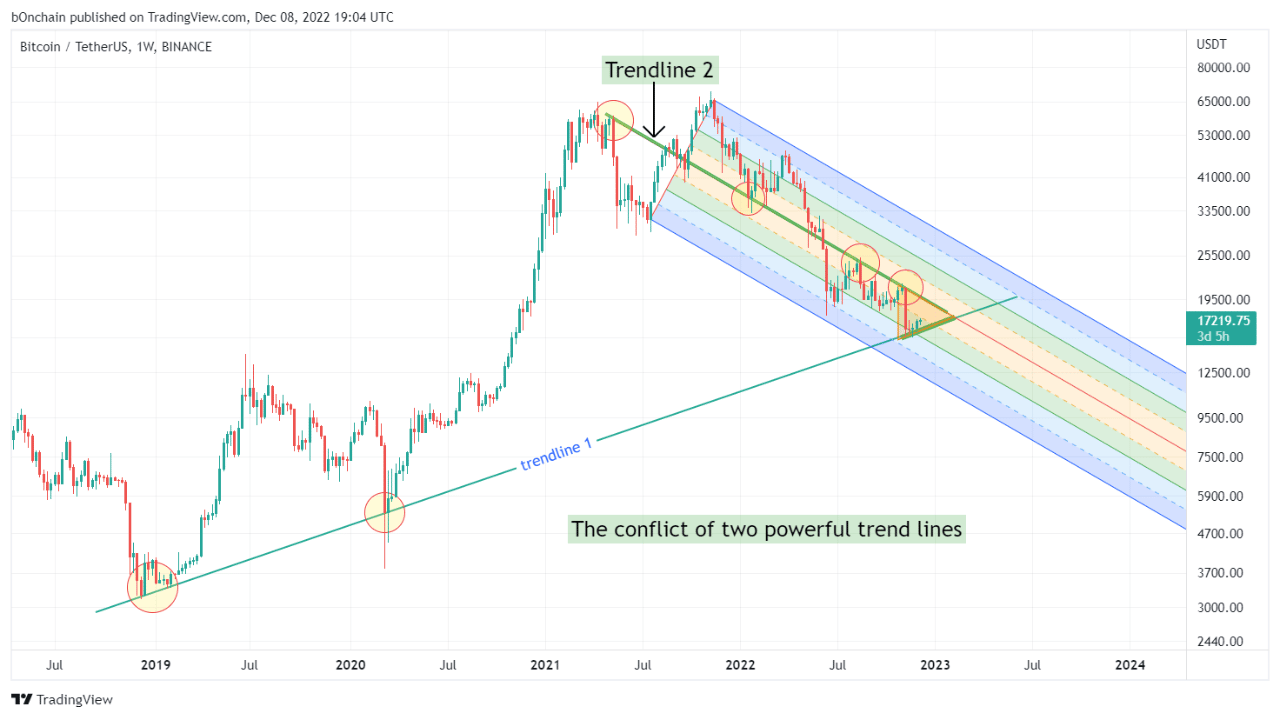

Bitcoin, on the other hand, is also currently resting on support at a trend line as can be seen from the figure below.

Given the association between the stock market and Bitcoin, there is possible anticipation of a reversal in the cryptocurrency market if the stock market is supported here. If the stock market is not supported, then analysts expect a continuation of the downward trend.

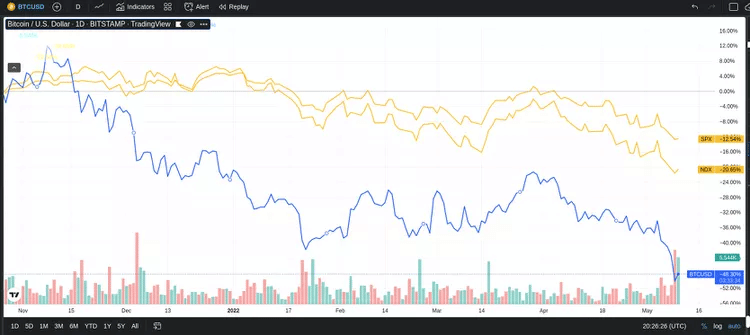

After the end of 2021 and continuing into the middle of 2022, the price of cryptocurrencies climbed and dropped in a manner comparable to equity prices.

A comparison of the price of Bitcoin (BTC) to that of the S&P 500 (SPX) and the Nasdaq 100 is presented in the following chart (NDX).

BTC Mining Woes

Apart from the stock market correlation, which can pull the price of Bitcoin down, the number one cryptocurrency by marketcap also faces the brunt of a severe bitcoin mining crisis due to the ongoing bear market.

Bitcoin’s hashrate, mining difficulty & possible bankruptcies of mining firms may lead to a dump in BTC price for the short term.

Read More: Will The Slow Down In BTC Mining Hamper Bitcoin’s Short-Term Price?

- BlackRock Signals $257M Bitcoin and Ethereum Sell-Off Ahead of Partial U.S. Government Shutdown

- XRP News: Jane Street Emerges Among Key Institutions Driving XRP ETF Inflows

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15