New Investment Inflow Helps Ethereum (ETH) Surge Past $1400 Despite Rising Gas Fee

The world’s second-largest cryptocurrency Ethereum (ETH) has made a bold move once again surging past $1400 levels earlier today. Earlier today, Ethereum (ETH) surged past $1400 but failed to hold the momentum to hit an all-time high. At press time, ETH has cooled down a bit but is still trading 4.3% higher at $1375.

For a while, Ethereum has been consolidating just like Bitcoin did before breaking past its previous ATH of $20,000. Well, technically, the charts show that ETH is poised for a Bitcoin-like breakout in the near time. On-chain data provider Santiment notes that there’s a flood of new investors recently coming to Ethereum that is allowing the momentum to continue.

???? #Ethereum ticked back up to a high of $1,411 today & is currently +5.2% in the past 24 hours. Though there are concerns like the rising average gas fees, a positive sign is the fact that invested fiat in $ETH is at its youngest age since December, 2018. https://t.co/sZpCM794hq pic.twitter.com/Lj4k7pTuhi

— Santiment (@santimentfeed) February 2, 2021

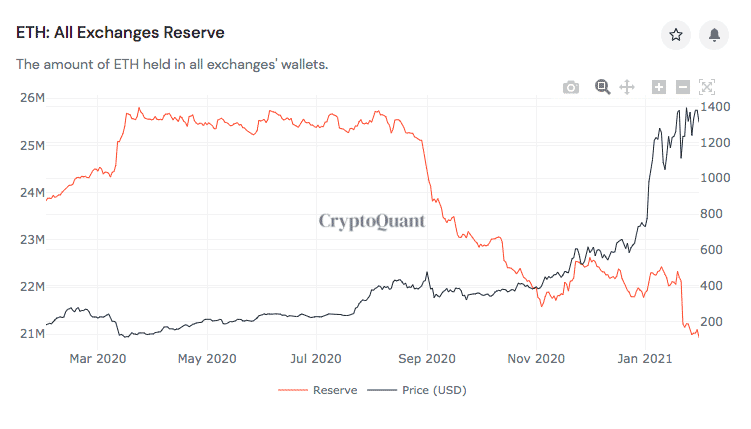

On the other hand data from CryptoQuant suggests that a large number of ETH has been moved off the exchanges in recent times. the total number of ETH held on exchanges has recently hit a historic low. In the last 30 days, 3.75M ETH worth $4.97 billion has moved off the exchanges. Possibly, these ETH coins have gone to Ethereum 2.0 staking, cold storage or DEXs.

Another report from Glassnode shows that the total value held in Ethereum 2.0 deposit contracts hit a massive $4.0 billion.

???? #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just went above $4,000,000,000.

Current value: $4,019,518,393

View metric:https://t.co/1ezmu1GKcj pic.twitter.com/Rd5hEcEaBW

— glassnode alerts (@glassnodealerts) February 2, 2021

A Small ‘Yellow Flag’ for Ethereum

On-chain data provider Santiment notes that the ETH gas fee has been rising and has hit a 3-week high of $11.46. This suggests a possible cooldown period in usage until the fee returns to normal.

???? A mild caution flag for #Ethereum is its rising fees. With average fees now at $11.46 (3-week high levels), this can correlate to a cooling off period in usage until fees return to normal. A top is far from a guarantee, but something to be cautious of. https://t.co/PrzRZvai5u pic.twitter.com/C4Kf7qa8jE

— Santiment (@santimentfeed) February 1, 2021

The rise in ETH gas fee would not only from ETH investors buying more but also the surge in the DeFi activity in recent times. The Ethereum price has already moved 90% up year-to-date but analysts think that we might be just getting started at this point. This is because the launch of CME Ether Futures in just a week’s time can bring a flood of institutional investments to the cryptocurrency.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k