MSTR Bottom In? Santiment Flags Hidden Indicator as Crypto Traders Bet on Strategy’s MSCI Delisting

Highlights

- Santiment data shows MSTR social activity at multi-month lows amid heavy price decline.

- MSTR stock fell about 65% since July as sentiment weakened faster than price action.

- Polymarket shows 74% odds of MSCI removal as Strategy pauses Bitcoin buying.

MSTR stock is showing signs of a short-term bottom as investor attention across social platforms continues to fade. Social metrics covering the period from September 23 to December 23, 2025 show weakening engagement even as the stock faced a deep price correction.

According to Santiment report, social volume and social dominance indicators for MSTR have dropped to multi-month lows. Social dominance declined to 0.099%. The platform has previously observed similar levels near the end of selloffs or during early consolidation phases.

MSTR Stock Shows Sentiment Shift as Crowd Interest Fades

According to the firm’s research, a declining crowd is frequently evident when speculative pressure is off. As focus wanes, momentum selling often craters. This has also coincided with local lows in previous cycles.

During the same time, Bitcoin price traded in a tight range between $87,000 and $90,000. Social MSTR metrics are weakened more than prices as prices remain static for Bitcoin. The divergence indicates that the bearish sentiment is potentially priced into the stock already.

Since its local high on July 16, MSTR stock has seen a heavy pullback. Almost 65 percent from a high of around $456 to about $158.71. The selloff followed increasing hostility and meme-motivated narratives on social media.

Bitcoin Strategy and Polymarket MSCI Outlook

Most of the criticism centered on Strategy’s Bitcoin acquisition policy. Over time, the company has raised convertible debt and other borrowings to boost its supply of BTC.

During an up market, that strategy has performed exceptionally well. It has come under more pressure in times of price weakness. In online chatter the risk is frequently framed as leverage risk linked to the balance sheet.

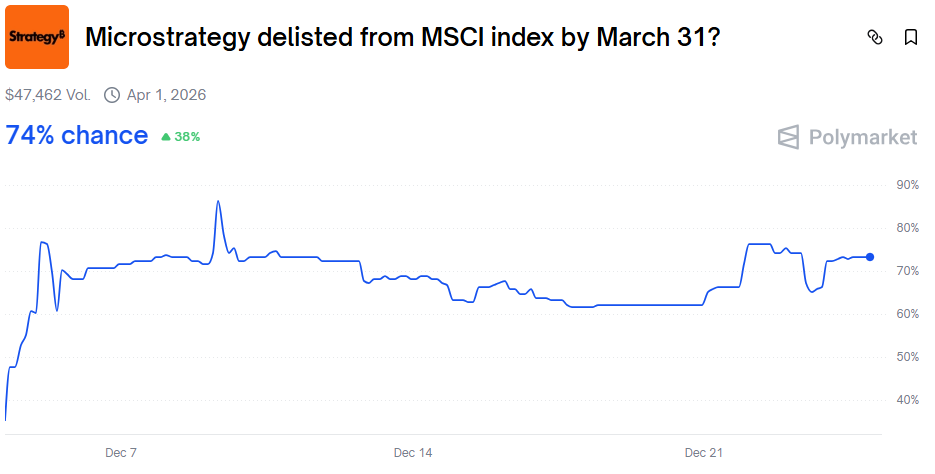

According to data from Polymarket, 74% of traders predicted that MicroStrategy would be delisted from the MSCI index by March 31. The data suggests increased uncertainty around the stock’s short-term trajectory.

Attention also shifted to Michael Saylor’s Strategy paused Bitcoin buying. The SEC filing confirmed the company made no BTC acquisitions between December 15 and 21. Strategy continues to hold 671,268 Bitcoin, acquired for $50.33 billion at an average price of $74,972.

- Bitcoin Reclaims $70K as Experts Signal a BTC Bottom

- 3 Reasons Why the XRP Price Is Up 20% Today

- China Tightens Stablecoin Rules as Bessent Urges Congress to Pass CLARITY Act to Keep Crypto Lead

- Bitget Launches ‘Fan Club’ Initiative In Bid To Strengthen Community Amid Crypto Crash

- BlackRock Signals More Selling as $291M in BTC, ETH Hit Coinbase Amid $2.5B Crypto Options Expiry

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch

- XRP Price Outlook As Peter Brandt Predicts BTC Price Might Crash to $42k

- Will Cardano Price Rise After CME ADA Futures Launch on Feb 9?