Fed Rate Cuts: Raphael Bostic Aligns with Fed Officials on No Further Cuts, BTC Slips

Highlights

- Bostic said he isn't support of further rate cut this year.

- The Atlanta Fed president isn't a voting member on the FOMC this year.

- Fed's Alberto Musalem also suggested that he might not support further rate cuts.

Atlanta Fed President Raphael Bostic expressed his thoughts on further Fed rate cuts this year, following the first cut at the FOMC meeting last week. This comes as BTC and the broader crypto market shed gains from the aftermath of the rate cut decision.

Raphael Bostic Comments On Further Fed Rate Cuts This Year

During a WSJ interview, the Atlanta Fed president said that he sees little reason to make further cuts this year. This came as Bostic revealed that he had projected only one rate cut this year, indicating that he doesn’t expect the Fed to lower interest rates at the October and December FOMC meetings.

As CoinGape reported, the FOMC made the first Fed rate cut at last week’s FOMC meeting, lowering interest rates by 25 basis points (bps). Bostic remains wary about further rate cuts for now due to his concerns over rising inflation, which is currently above their 2% goal.

He remarked during the interview that he has been concerned about the inflation that has been too high for a long time, and so, he would not be moving in favor of a rate cut. The next FOMC meeting holds between October 28 and 29. However, it is worth mentioning that Bostic is not a member of the FOMC this year and so can’t directly influence the rate cut decision.

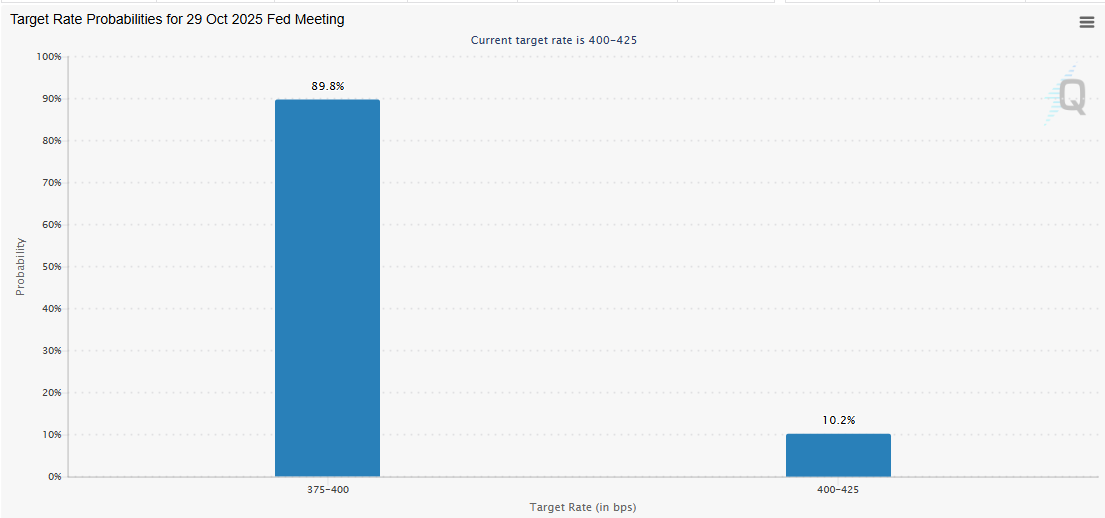

CME FedWatch data shows that there is currently a 89.8% chance that the committee will make another 25 bps Fed rate cut at the October FOMC meeting. Meanwhile, Bostic revealed that he was only comfortable with a rate cut at this last meeting because of the balance in the risks between weaker employment and rising inflation, compared to three months ago, when inflation was the major priority.

The crypto market has shown a mixed reaction to the Fed rate cut from last week. Following the cut, the Bitcoin price rose above $117,000, sparking bullish sentiments. However, the market has since retraced, with BTC hovering around $113,000.

Fed Musalem Echoes Bostic’s Sentiments

St. Louis Fed President Alberto Musalem, who is a voting member this year, has echoed Raphael Bostic’s sentiments. According to a Bloomberg report, the Fed president said that he only supported last week’s rate cut as a way to take out insurance against a weakening labor market.

Notably, Fed Chair Jerome Powell, in his FOMC press conference, had described the Fed rate cut as a “risk management cut.” Now, Musalem sees limited room for more cuts amid rising inflation. He said that he would only support further cuts if the labor market worsens, but noted that it is also crucial for them to keep inflation stable.

The St. Louis Fed president also remarked that interest rates are now between modestly restrictive and neutral, which his why he believes that the committee needs to tread carefully. Meanwhile, he admitted that the Trump tariffs haven’t had as much impact on inflation, but that other factors seem to be contributing to inflation remaining above the Fed’s 2% target.

- Bitcoin vs Gold Feb 2026: Which Asset Could Spike Next?

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible