On-Chain Metrics: DeFi Token Compound (COMP) Registers 45% Rally In Three Days

With a severe correction over the last month, the DeFi market showed some recovery along with the overall cryptocurrency market. DeFi token Compound (COMP) has registered a solid rally gaining nearly 45% just over the last three days.

The COMP price surged all the way from $215 on Sunday, June 27, to $325 during the Tuesday market rally. The recent price rally in COMP comes along with some good improvements in its on-chain metrics. As per the report from Santiment, COMP has successfully managed to break from the “strong hold” of Bitcoin registering a solid move upside.

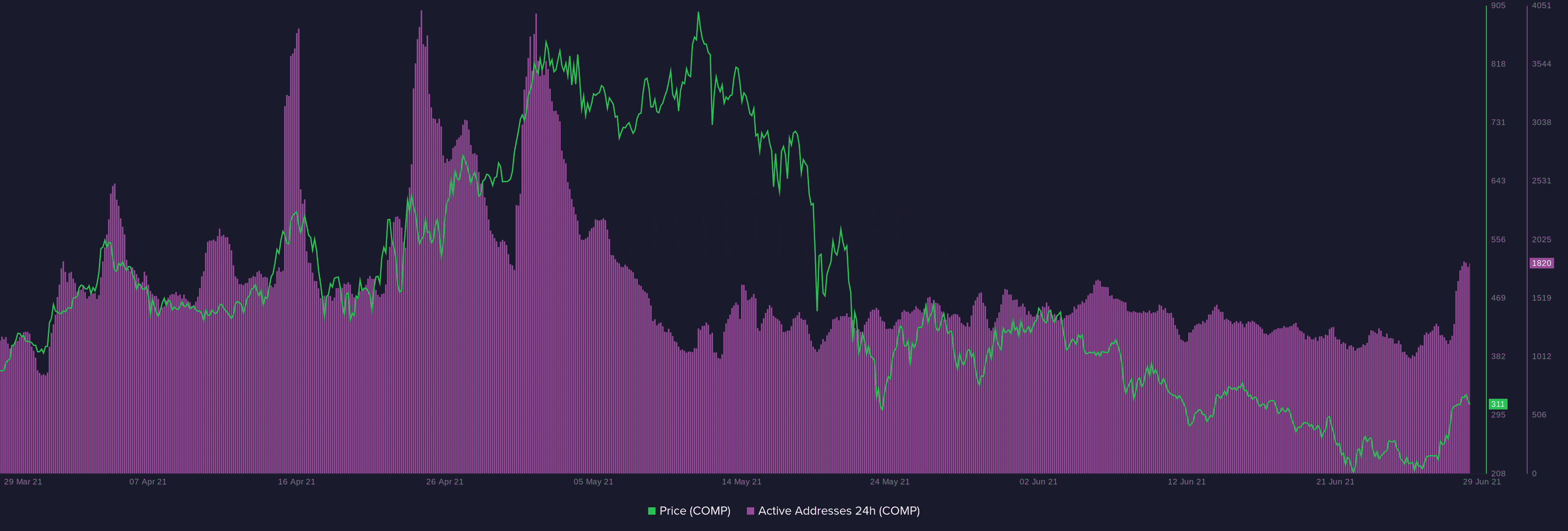

Over the last three days, there has been a strong uptick in the address activity of COMP. However, citing historical charts, Santiment notes:

“Looking at previous strong spikes we would not feel so confident. They were very short living and COMP dumped quite soon. During these upticks people may want to sell”.

Are We Approaching A Local Top for COMP?

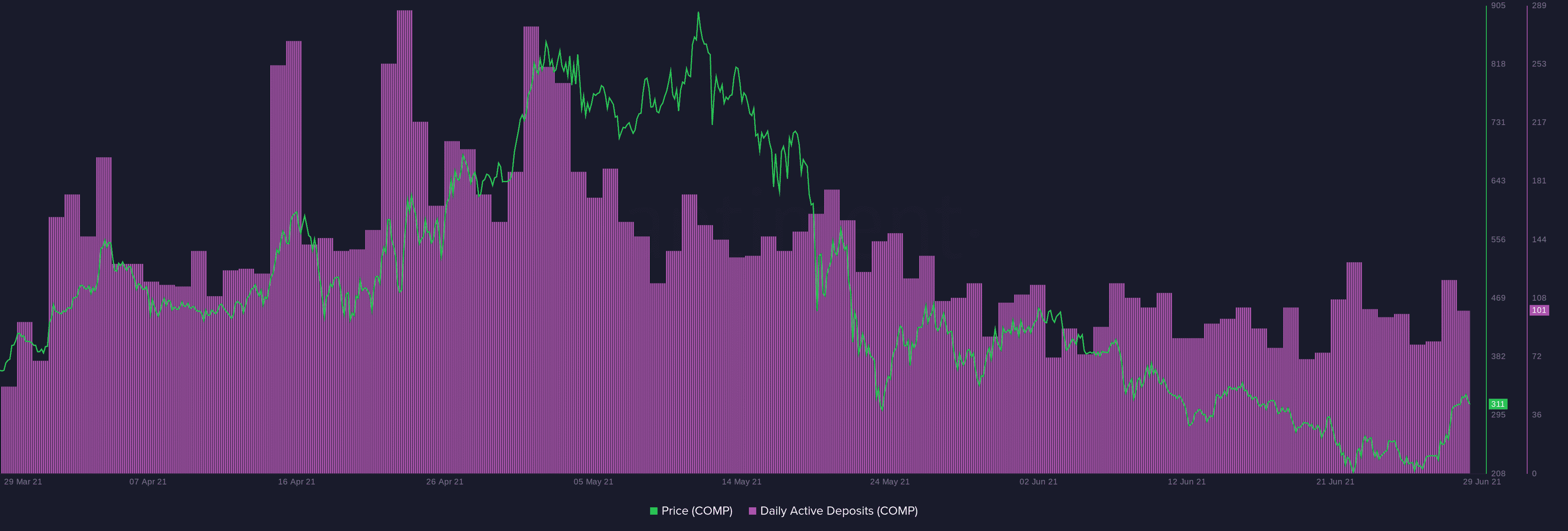

Apart from active addresses, the daily active deposits for COMP are on an uptrend. Looking at some previous deposit spikes, all point out at the local top in COMP price. Santiment notes that the surge in DAD is actually not a good sign for COMP. Meaning, we could be heading for some price correction going ahead. On the other hand, there’s also an uptik in the exchange inflows for COMP.

Further commenting upon the network profit-and-loss for the COMP token, Santiment writes:

“NPL just declining and declining. Even during upticks people just seem to be getting away from this coin. So yeah, the latest spike is relatively low but actually it’s a first time in a while that we see it moving to the positive. People are very quick to take even small profits”.

All these metrics suggest that COMP can come under pressure and witness price correction post this recent rally.

Compound Labs Launches ‘Treasury’

In a move to serve institutional DeFi players, the DeFi firm Compound Labs announced its new company Compound Treasury. the new entity Compound Treasury will work in partnership with Circle and Fireblocks and will allow fintech firms and neobanks to send that can be converted to USDC easily.

These USDC stablecoins will be deployed on the Compound network with a guaranteed interest rate of 4%. Speaking to CoinDesk, Compound founder Robert Leshner said:

“This is our path to sustainability as a company. … If the interest rates in Compound earn more than 4% over time, the business will make money. It’s the ability to offer a new financial product that fintechs have been clamoring for.”

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Breaking: Grayscale Sui Staking ETF to Start Trading on NYSE Arca Today

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- How Long Will Pi Network Price Rally Continue?

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k