Over $4 Billion in Bitcoin and Ethereum Options Expiring After US CPI

Highlights

- BTC options with a notional value of $3.22 billion to expire on Deribit.

- Over 185,000 ETH options with a notional value of $0.82 billion expire after the August US CPI release.

- Spot and options traders diverge on BTC and ETH prices in the coming weeks.

Bitcoin and Ethereum saw a remarkable surge after weak US jobs data and cooling inflation eased fears and improved Fed rate cut hopes. The crypto market faces over $4 billion in BTC and ETH options expiry on Friday, after the key CPI inflation data.

Bitcoin and Ethereum Options Expiry

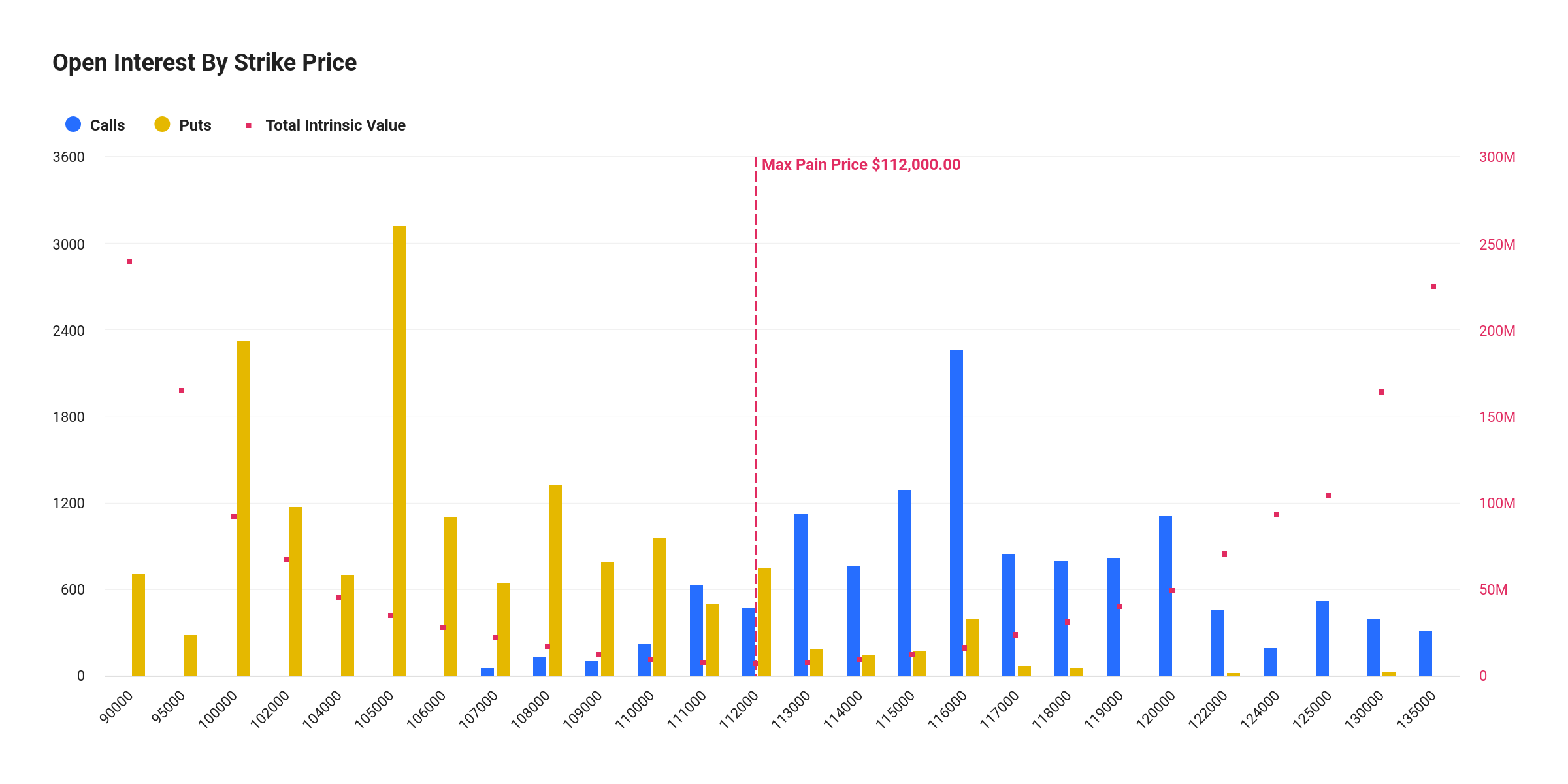

More than 28,000 BTC options with a notional value of $3.22 billion expire on September 12, according to Deribit data. The put-call ratio is 1.23, indicating bearish sentiment among traders as put bets surprisingly rise while the price of BTC jumped above $114,000 after almost 3 weeks.

At the time of writing, put volume was 14,972 as compared to call volume 14,040, with a put/call ratio of 1.06. This signals that options traders are pessimistic about a further rally in Bitcoin.

Moreover, the max pain price is at $112,000. Options traders may look to bring BTC down towards the max pain point, with puts clustered around $100,000-108,000 strike price.

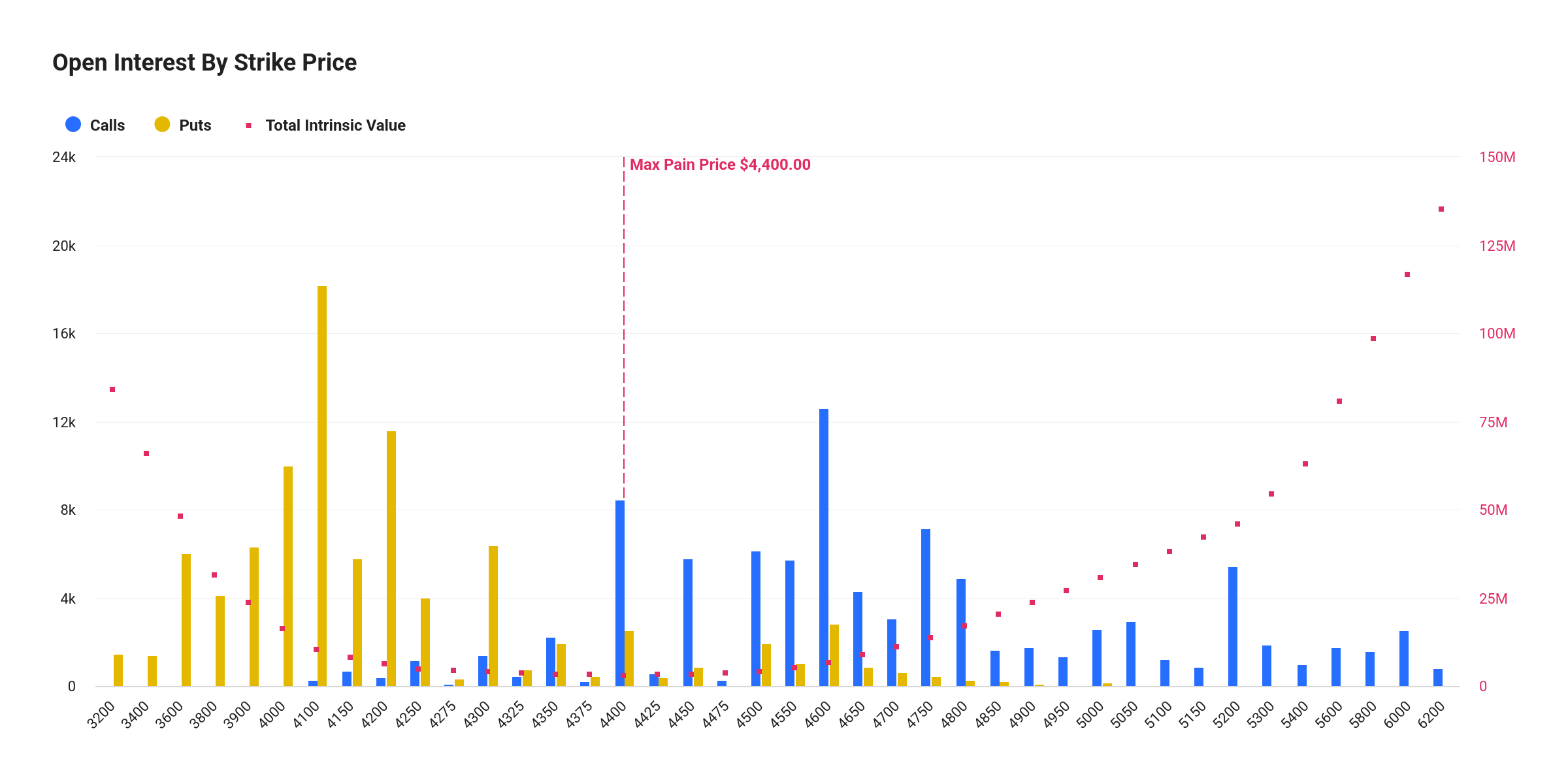

Meanwhile, over 185,000 ETH options with a notional value of $0.82 billion are set to expire on Deribit, with a put-call ratio of 0.97. A put-call ratio near 1 shows negative sentiment among traders.

In the last 24 hours, put/call ratio climbed to 1.50 as the put volume was significantly higher at 106,987 than the call volume of 71,691 at publishing time.

Moreover, the max pain price is at $4,400, still below the current ETH price of $4,435. Also, the $4,400 strike price has higher total call options bets of $37.51 million over $11.36 million in put options. This suggests a potential downward bias for ETH, as call buyers will likely aim to drive the price to the level that minimizes their losses.

BTC and ETH Price Action

Analysts anticipate BTC and ETH rallies in the coming weeks amid multiple catalysts, including ETF inflows, imminent Fed rate cuts next week, and bullish technical chart patterns. Traders expect a further Bitcoin price rally due to a triangle pattern breakout recently.

However, implied volatility in the options market shows a slight decline, according to options trading platform Greekslive. Moreover, options traders are considering relatively low volatility in the future. Deribit trade activity reveals trades concentrated for the current month, with active buying and selling occurring at similar rates.

BTC price trades near the $114,000 level after soft PPI data, with a 24-hour low and high of $112,181 and $114,471, respectively. Meanwhile, ETH price is up more than 2% amid higher trading volume, with the price currently trading at $4,430.

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?