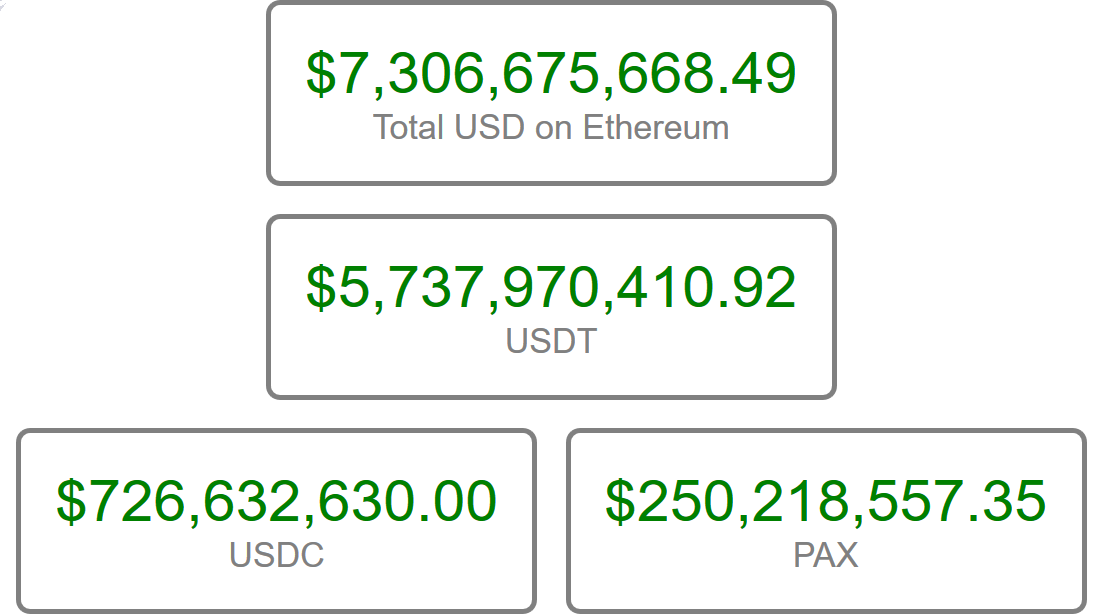

Over $7.3 Billion Worth of Stablecoins Being Secured by Ethereum (ETH), True Adoption?

Two months to the launch of ETH 2.0, statistics reveal that the Ethereum network, slow as it is, now secures over $7 billion worth of stablecoins.

Stablecoins are digital currencies tailored to minimize the effect of price volatility since digital assets are well known for their fluctuations. Technically, stablecoins act as a unit of account and most importantly, a reliable refuge as a store of value.

#Ethereum is currently securing ~$7.3 billion worth of stablecoins ?https://t.co/QHfpfS3XnO

— Anthony Sassano | sassal.eth (@sassal0x) May 17, 2020

List of Stablecoins

The most common stablecoins include Tether (USDT), Gemini Dollar (GUSD), Paxos Standard (PAX), USD Coin (USDC), Binance USD (BUSD), DAI which is issued by the MakerDAO protocol, and Huobi USD (HUSD).

Most of these tokens are issued from the Ethereum blockchain. There are some which are based on the Tron blockchain, and the Omni Network.

Ethereum is Dominant

The smart contracting capability enabled by Ethereum has made it possible for several stablecoins including Tether, the world’s most capitalized, to proliferate. And backing this up has been a stellar 2019 where the benefits of DeFi were highlighted.

By Q1 2020, the total value of Ethereum (ETH) measured in USD terms held at DeFi dapps had exceeded $1 billion in February.

Because the Ethereum ecosystem is free from fiat influence as loans and interests are paid out in digital currencies and specifically the issuance of loans is in DAI, a stablecoin, the success of DeFi therefore means the wide adoption of stablecoins.

Tether (USDT) Flips Bitcoin Cash, USDT Market Cap to Pump

Stablecoins continue to be a key feature.

To measure its role, the world’s most valuable stablecoin, USDT recently flipped Bitcoin Cash (BCH). At the time of press, USDT had a market cap of $4.4 billion, exceeding BCH’s by $200 million.

Despite crypto asset prices stabilizing in the last few days, it is highly likely that USDT market cap and therefore liquidity will likely edge higher in days ahead.

The more BTC and ETH pump, the higher net-worth individuals shielding their privacy through Tether Limited will continue to pour into cryptocurrency through their preferred coin, USDT.

The rise of $USDT and stablecoins on Ethereum:

?️ January 2019

ETH stablecoins: $835 million

USDT on Ethereum: $60 million?️ April 2020

ETH stablecoins: $5.9 billion

USDT on Ethereum: $4.4 billion pic.twitter.com/1WhTaBSwUX— Messari (@MessariCrypto) April 22, 2020

This means not only will USDT market cap rise but the issuer will remain dominant even as other stablecoins which are regularly audited and available on different ramps threaten to clip market share.

? ? ? ? ? ? ? ? ? ? 200,000,000 #USDT (200,382,814 USD) minted at Tether Treasury

— Whale Alert (@whale_alert) May 14, 2020

USDT has a market share exceeding 77 percent while year-to-date growth has been impressive at over 110 percent.

- Breaking: Bank of America (BofA) Reveals Holdings in This XRP ETF

- BlackRock Signal Further Downside for Bitcoin And Ethereum As It Moves $170M to Coinbase

- Just-In: Binance Buys Additional 1,315 BTC for SAFU Fund

- Big Short Michael Burry Issues Dire Warning on Bitcoin Price Crash Risks

- Kevin Warsh Nomination Hits Roadblock as Democrats Demand Answers on Powell, Cook

- Bitcoin Price Prediction As US House Passes Government Funding Bill to End Shutdown

- Ondo Price Prediction as MetaMask Integrates 200+ Tokenized U.S. Stocks

- XRP Price Risks Slide to $1 Amid Slumping XRPL Metrics and Burn Rate

- Gold and Silver Prices Turn Parabolic in One Day: Will Bitcoin Mirror the Move?

- Cardano Price Prediction as the Planned CME’s ADA Futures Launch Nears

- HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Sparks Prediction-Style Trading Boom