PCE Inflation: Wall Street & Economists Predict Fed Rate Cuts Timeline

Highlights

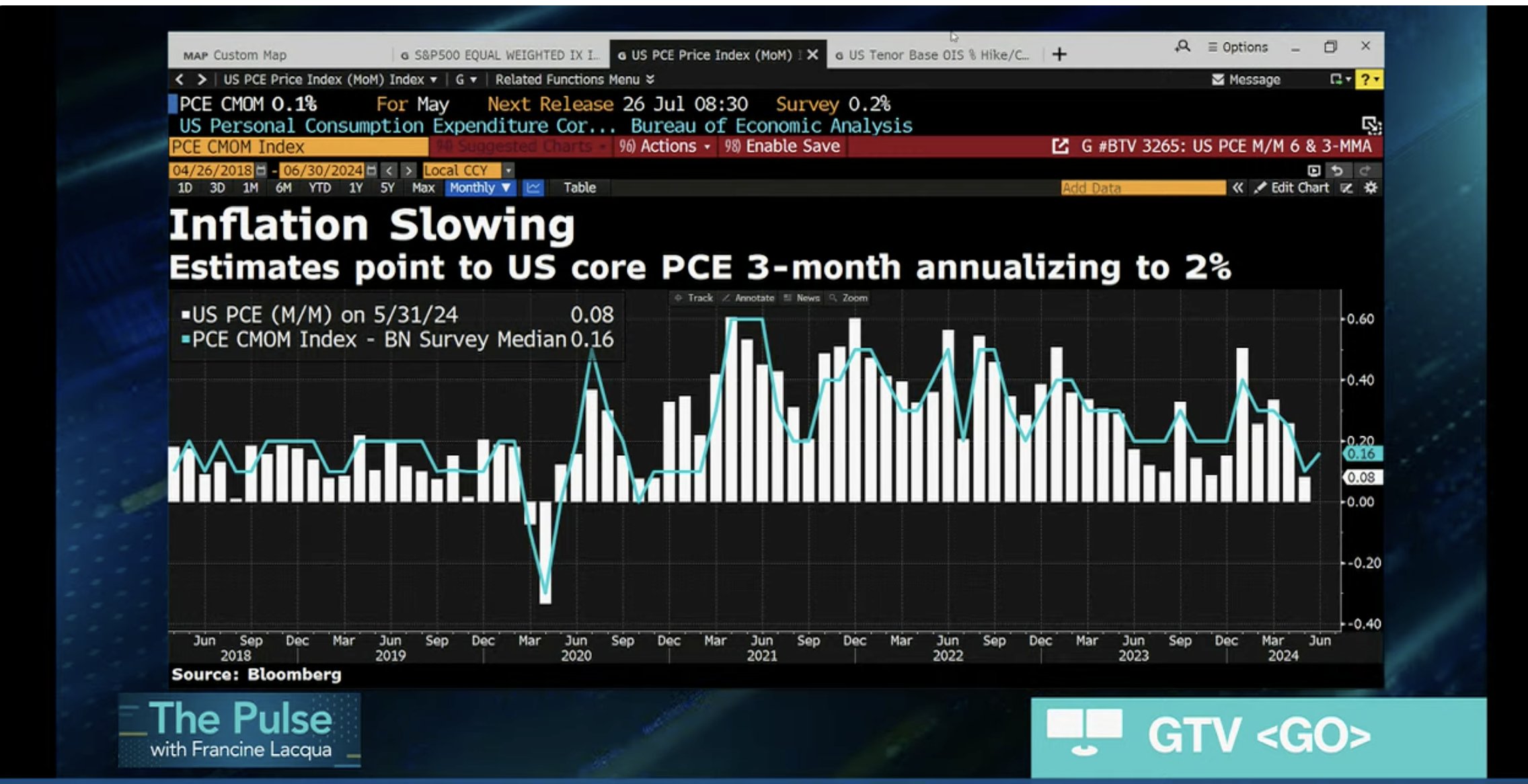

- Wall Street and economists see PCE inflation slowing for a second consecutive month to 2.5%.

- Morgan Stanley joined Goldman Sachs to predict three cuts this year starting in September.

- Bitcoin price jumps 5% as the Bitcoin Conference fueled bullish sentiment.

PCE Inflation: Stock and crypto market traders saw a rise in bullish sentiment after the release of the US Federal Reserve’s preferred inflation gauge PCE for further bullish cues. The U.S. Bureau of Economic Analysis released the personal consumption expenditure (PCE) price index today and economists see PCE inflation slowing for a second consecutive month to 2.5% from 2.6%, making the FOMC to put interest rate cuts on the table.

Federal Reserve officials have recently shared their dovish outlook on monetary policy, hinting at a pivot to rate cuts. The market expects a first rate cut by the U.S. Fed in September, with two following in November and December.

Wall Street Estimates On PCE Inflation Data

The PCE data showed inflation cooled further as per the latest analysis by economists. The annual PCE fell to 2.5%, down from 2.6% last month. However, the annual core PCE inflation came in at 2.6%, in line with last month but higher than expected.

In addition, the monthly PCE inflation was 0.1% while the monthly core PCE came in at 0.2%. Notably, the Federal Reserve’s latest economic projections estimated annual PCE inflation at 2.6% and the core rate at 2.8% for the current year.

Wall Street giants including JPMorgan, Morgan Stanley, Bank of America, Goldman Sachs, Nomura, and UBS have estimated a median forecast of 2.5% y/y and 0.1% m/m. Meanwhile, the banks estimate core PCE inflation to come in at 2.5%, in line with the market forecast. Also, the estimates point to US core PCE 3-month annualizing to 2%, reaching the target rate of the Federal Reserve.

Also Read: LUNC Delisting – Terra Classic Seeks Clarification From TFL CEO And eToro

Bitcoin and Crypto Market Prepares for Rally

According to Morgan Stanley, “Considerable progress on inflation allows the Fed to inch closer to rate cuts. Chair Powell should emphasize increased confidence.”

Morgan Stanley joined Goldman Sachs to predict three cuts this year starting in September. They expect Fed Chair Jerome Powell to continue indicating that the Fed is nearing a decision to lower rates, without committing to a specific timeline.

BTC price jumped 5% in the last 24 hours as the Bitcoin Conference fueled bullish sentiment. The price is currently trading over $67,300, with the 24-hour low and high of $63,473 and $67,466, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating a rise in interest among traders.

Meanwhile, the US dollar index (DXY) is moving near 104.38, with a further drop expected due to anticipation of Donald Trump’s win in the presidential election. Moreover, the US 10-year Treasury yield dropped to 4.244% today. As Bitcoin moves opposite to DXY and Treasury yields, the pressure is reducing.

Also Read: Bitcoin Conference – Donald Trump Refuses To Debate With Kamala Harris

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Breaking: Grayscale Sui Staking ETF to Start Trading on NYSE Arca Today

- Prediction Market Lawsuit: Nevada Targets Kalshi in Court After Action Against Polymarket

- Robinhood to Raise $1B IPO to Open Private Markets to Retail Investors

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k