Pepe Coin Whale Dumps 366B PEPE, Price To Dip Ahead?

Highlights

- Pepe Coin price slipped more than 6% today as whales continue to take profit-booking strategy.

- A PEPE whale dumped 366 billion coins into Binance exchange.

- The massive dump by the whales after a prolonged rally in the PEPE price has sparked speculations over a potential dip ahead.

The leading player in the meme coin space, Pepe Coin price has experienced a notable dip today. Notably, the slip in the PEPE price comes as investors are seizing profit-booking opportunities, leading to a 6% drop in the coin’s value. Meanwhile, this decline comes after a significant dump by a whale, sparking market speculations about further price movements.

Pepe Coin Price Slips Amid Whale Dump

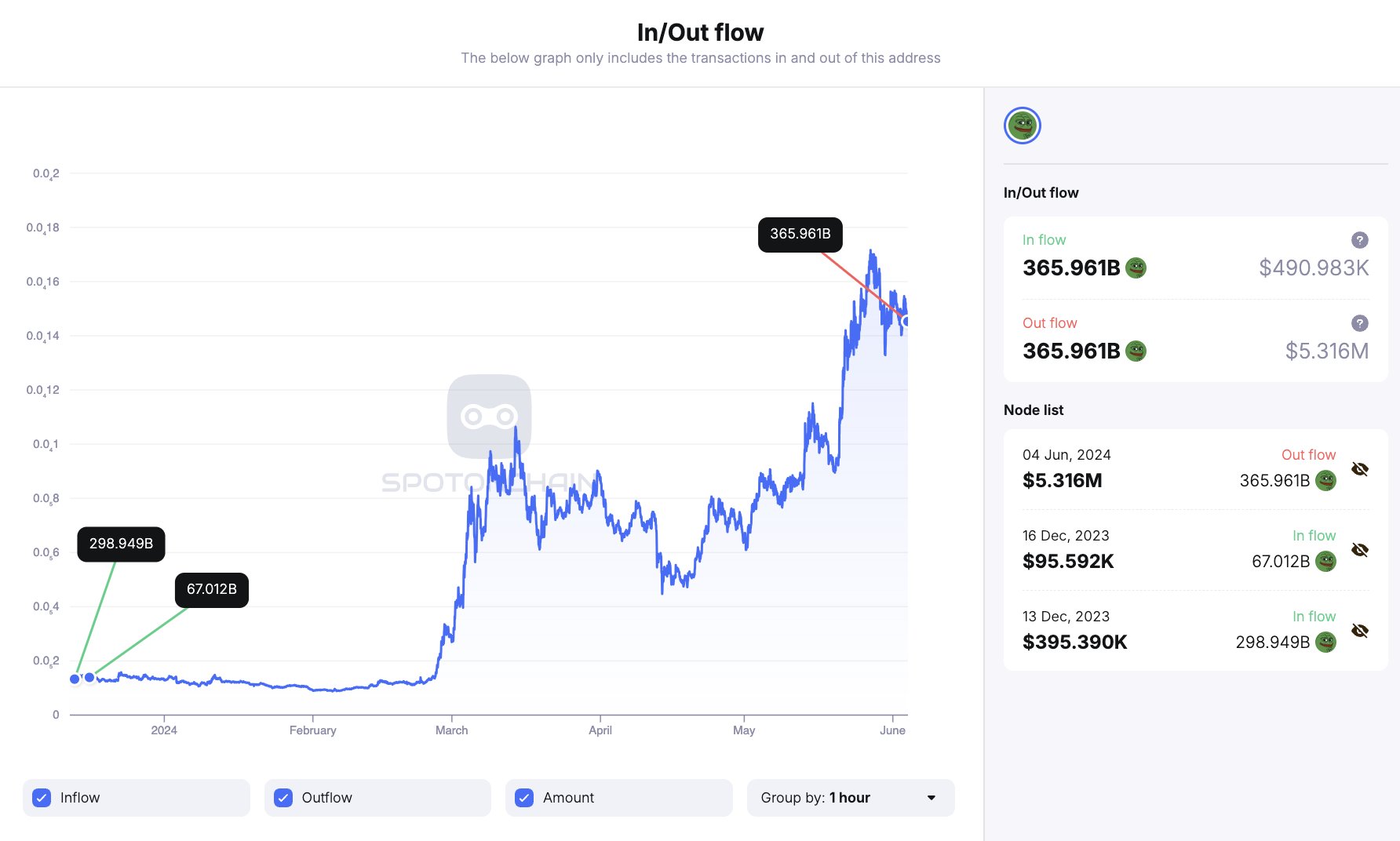

According to a recent report by the on-chain transaction tracking platform SpotOnChain, a Pepe Coin whale has deposited a staggering 366 billion PEPE, worth $5.31 million, into Binance. Notably, the report suggests that this move could be a sell-off by the large holder, especially as the Pepe Coin has noted significant gains over the past few days.

Meanwhile, this transaction allowed the whale to realize an estimated profit of $4.84 million, a remarkable gain of 985%. In addition, the report highlights that this whale used the same deposit address as two other smart traders who recently profited from PEPE.

In other words, the recent surge in the meme coin’s price created an opportune moment for several PEPE investors to book profits. However, this influx of large transactions has resulted in a price dip.

The SpotOnChain report notes that another smart trader deposited 660.71 billion PEPE, valued at $9.01 million, into Binance after the price dropped by 14% on May end. This trader withdrew the PEPE from Binance and MEXC at an estimated cost of $4.57 million in early May, achieving a profit of $4.44 million, or 49.3%.

Also Read: This Firm Cuts Down Bitcoin & Ether ETP Fees To Zero

What’s Next?

The market’s reaction to these substantial dumps has been mixed, with some investors expressing concern about the potential for further declines. The significant profits realized by these whales indicate a pattern of strategic trading that could influence the coin’s market dynamics.

However, investors are closely monitoring the situation, trying to anticipate the next moves of these large holders. In addition, Pepe Coin’s recent price surge was driven by a combination of factors, including increased market interest in meme coins and speculative trading.

However, the influx of large sell orders from whales seems to have tempered this enthusiasm. The market is now in a state of flux, with many traders waiting to see if the price will stabilize or continue to dip.

As of writing, the Pepe Coin price was down 6.02% and exchanged hands at $0.00001434, while its trading volume fell 18% to $1.28 billion. However, over the last 30 days, the PEPE price rose about 70%, reflecting the growing confidence of the traders towards the frog-themed meme coin. Meanwhile, the Pepe Coin Open Interest fell 6.83% to $159.02 million, CoinGlass data showed.

Also Read: Citron Research Is Shorting GameStop Again, Will It Win This Time?

- BlackRock Signals $257M Bitcoin and Ethereum Sell-Off Ahead of Partial U.S. Government Shutdown

- XRP News: Jane Street Emerges Among Key Institutions Driving XRP ETF Inflows

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Digital Assets Are Fixed In The Future Of Traditional Finance

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15