Veteran Trader Peter Brandt Warns of Bitcoin Crash Amid Bullish Forecasts

Highlights

- Peter Brandt warns that strong fundamentals often appear at Bitcoin market tops, mirroring 2021 patterns.

- Bitcoin’s current range between $60K–$105K echoes the 2021 top; a 77% drop could send it to $23K.

- Despite a Golden Cross, repeated rejections near $106K raise risks of a fall to $97K or lower.

Bitcoin is showing a price structure that resembles the market conditions leading up to the 2021 crash. Prominent trader Peter Brandt has pointed out that fundamentals often appear strongest at market tops. His comments come as analysts debate whether a Bitcoin crash is repeating a similar pattern from the past. This all happens while there is growing demand for bitcoin by institutions and governments.

Bitcoin Price Structure Mirrors 2021 Distribution Zone

Bitcoin has been trading between $60,000 and $105,000, a range that has persisted for about seven months. This consolidation period mirrors the 2020–2021 distribution phase, where Bitcoin moved sideways between $30,000 and $65,000 before falling sharply in early 2022.

Throughout the period, as per Peter’s X post, unsuccessful breakouts of Bitcoin price acted as an indication of distribution. In November 2021 it reached around $69,000 before falling to around $15,500 in November 2022. That was a price reduction of approximately 77.5%. According to Peter Brandt, incase the current arrangement causes a comparable fall in the $105,000 band, Bitcoin might collapse to nearly $23,600.

Although there has been a bullish mood concerning spot ETFs and institutional participation, the price has failed to surpass the barrier at the price level of $105,000. The incomplete ability to escalate higher is making some technical analysts concerned.

Bitcoin Technical Resistance and Market Behavior

Bitcoin has recently failed to hold above the $106,000 resistance zone. According to Michaël van de Poppe, this level is key for maintaining upward momentum. His chart shows that Bitcoin’s latest rally was rejected quickly after testing the resistance, causing long-side liquidations. The price dropped to the $104,000–$105,000 region after the failed breakout.

Ali Martinez noted on X that $104,124 is now an important support level. If it fails, Bitcoin could drop to around $97,405. This aligns with past market behavior, where failed resistance tests triggered sudden corrections.

Earlier in June, a similar pattern occurred when Bitcoin was rejected at the same resistance level. It fell back toward $100,000, signaling strong overhead supply and weak follow-through from bulls.

Peter Brandt Reasons for BTC Crash Scenarios

Peter Brandt’s caution comes as the current consolidation resembles the 2021 topping structure. He said, “Fundamentals are always the brightest at tops and darkest at bottoms.” This historical trend suggests that strong fundamentals do not always prevent corrections.

In the previous significant cycle, before the crash in 2021, the fundamentals of Bitcoin were good. Institutional flows, ETF approvals, and low supply in exchanges have equally helped market participants to be optimistic today. Nevertheless, failing to hold gains close to highs repeatedly increases the probability of a reversal in market.

AetherX Capital, responding to Peter Brandt, reasoned that the fundamentals are quite bullish, and high-timeframe charts are also bullish, which makes being bearish difficult. Nevertheless, they also admitted that a bearish result is not excluded. Their discussion indicates that the price formation is similar to the 2021 market in terms of extended lateral volatility and unsuccessful breakouts.

BTC Golden Cross Hints at Bullish Breakout in the long term

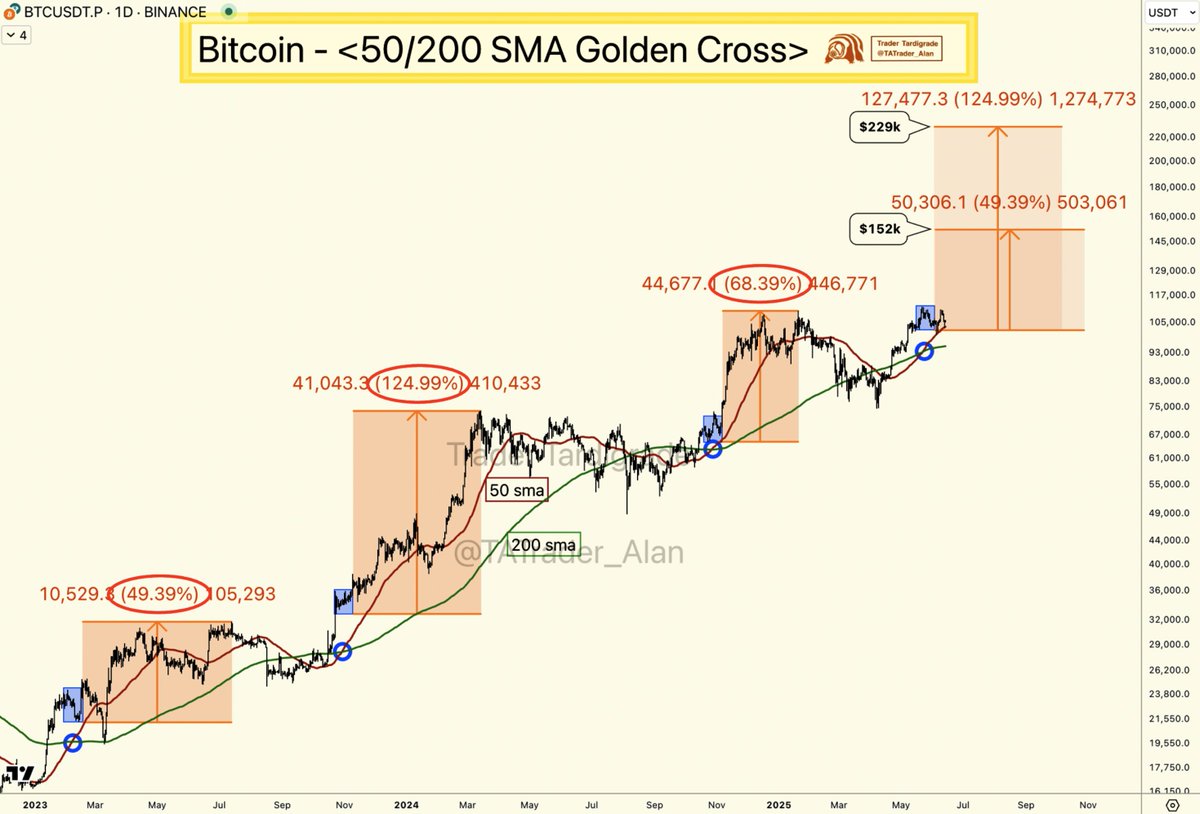

Some traders remain optimistic due to technical signals, unlike Peter Brandt. Trader Tardigrade pointed out that Bitcoin’s 50-day and 200-day simple moving averages recently formed a Golden Cross. This pattern previously led to gains of 49%, 125%, and 68% in recent years.

Based on those patterns, the next BTC price targets could be between $152,000 and $229,000. However, these gains depend on the market holding support levels and not repeating past breakdowns. If Bitcoin loses the $105,000 support again, another move toward the $100,000 region is likely by the end of June.

Meanwhile, as reported by Coingape, more than 60 companies have announced Bitcoin treasury in less than a week. Peter’s BTC Crash warning is very contradictory to ongoing bullish hype driven by US president Trump and institutions.

- Cardano Founder Slams President Trump, Says His Memecoins Stalled U.S. Crypto Bills

- Monero (XMR) Hits Record High After 44% Rally Just Hours After UAE Privacy Token Ban

- Just-In: After Trump and Melania, NY Mayor Announces New Meme Coin

- US Crypto Regulation: Senators Target Gray Area in Developer Liability

- Crypto Market Bill Faces Yet Another Delay as U.S. Senate Postpones Markup to Late January

- Pi Coin Price Prediction: How Mainnet Migration and New Tokens Supply Could Affect Pi Network?

- Crypto Stocks To Watch: MSTR, Metaplanet, and S&P 500 price

- Solana Price Targets $200 as WisdomTree Declares Its Dominance Structural

- Bitcoin Price Prediction Amid DOJ Probe as Powell Indictment Fears Cool

- Why is Monero (XMR) Price Up Today?

- Binance Coin Price Target $1,000 as CZ Signals Incoming Crypto Super Cycle