Peter Schiff Warns Bitcoin Is No Hedge Against Inflation Despite Recent Price Surge

Highlights

- Peter Schiff says Bitcoin still tracks tech stocks, not gold, questioning its role as an inflation hedge.

- Bitcoin rose 14% in April, but Schiff argues it's driven by speculation, not store-of-value fundamentals.

- Despite Schiff's criticism, long-term holders added 254K+ BTC, showing continued investor confidence.

Peter Schiff has questioned Bitcoin’s role as a hedge against inflation, stating that its recent trading patterns do not support the claim. Schiff, known for his strong stance on gold, argued that Bitcoin continues to behave more like a tech stock than a store of value.

Peter Schiff Criticizes Bitcoin’s Inflation Hedge Narrative

Amid ongoing economic uncertainty in the US, Peter Schiff has renewed his skepticism toward Bitcoin’s utility as a hedge against inflation. According to Schiff, recent price action shows that Bitcoin still mirrors the behavior of tech stocks rather than that of gold.

“Bitcoin has not decoupled from the NASDAQ,” Schiff said in a recent post, adding that investors concerned about inflation should focus on gold instead. He argued that Bitcoin lacks the stability needed to serve as a reliable store of value and remains susceptible to broader market swings.

Peter Schiff also noted that the rise in Bitcoin’s price appears more related to investor speculation and macroeconomic developments than to intrinsic monetary properties. He continued to warn that Bitcoin may not offer the same long-term protection for wealth as traditional safe-haven assets.

Senator Lummis Links Bitcoin to National Debt Relief

Senator Cynthia Lummis has also entered the discussion by connecting Bitcoin adoption to broader economic policy. In a public statement, she endorsed the BITCOIN Act as a possible solution to address the United States’ $36 trillion national debt.

According to Lummis, the current administration has shown willingness to consider digital assets, and thus passing the BITCOIN Act is “the only solution to our nation’s $36T debt.” Even with limited details, the proposal marks growing interest by policymakers in exploring alternative financial systems.

Lummis, known for her pro-Bitcoin stance, has consistently supported legislative efforts that encourage adoption and regulatory clarity. However, while MicroStrategy (MSTR) announced a first quarter 2025 loss of $16.49 per share stemming from a $5.9 billion writedown from the drop in price in Bitcoin earlier this year.

However, MicroStrategy remains one of the largest corporate holders of Bitcoin and says it is willing to grow its holdings. To point to long term value in the asset, Saylor said he intended to raise up to $84 billion to acquire additional Bitcoin.

Market Conditions Boost Bitcoin’s Momentum

Bitcoin price rose over 14% in April, benefiting from easing inflation data and growing expectations of interest rate cuts. The PCE inflation rate came in at 2.3% year over year, reinforcing the view that the Federal Reserve may consider lowering interest rates in upcoming meetings.

Moreover, US President Donald Trump recently urged Federal Reserve Chair Jerome Powell to cut interest rates ahead of the next Federal Open Market Committee (FOMC) meeting. Trump claimed that there is “no inflation” and that current economic conditions warrant a looser monetary stance.

Analysts noted that Bitcoin’s performance continues to outpace traditional equity markets. While the S&P 500 has remained mostly flat, Bitcoin’s rise has been supported by easing trade tensions, favorable macro data, and renewed institutional interest.

Different Views from Peter Schiff’s on Bitcoin Role

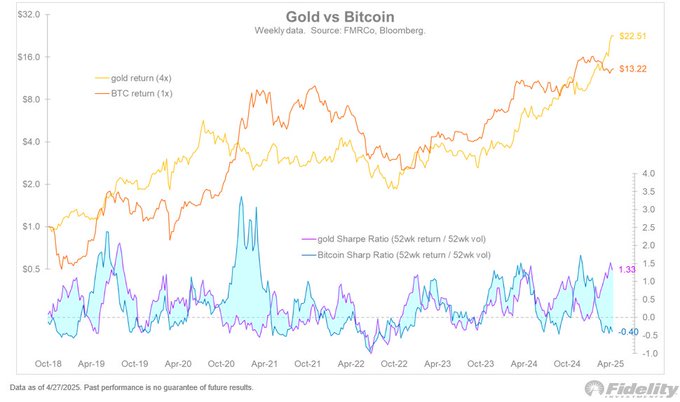

Jurrien Timmer, Director of Global Macro at Fidelity, commented on Bitcoin’s dual characteristics, comparing it to both gold and speculative technology assets. Unlike Peter Schiff, he noted that Bitcoin can behave differently depending on broader financial conditions.

“Bitcoin has a Dr. Jekyll and Mr. Hyde personality,” Timmer said, explaining that it sometimes acts as hard money but also trades like a risk asset. He added that Bitcoin’s performance has historically been tied to growth in the global money supply and equity markets.

Timmer also shared data showing a recent divergence between gold and Bitcoin based on their Sharpe ratios. He pointed out that gold currently holds a higher Sharpe ratio, indicating more consistent risk-adjusted returns, but suggested that Bitcoin could outperform again if liquidity conditions become more favorable.

According to Glassnode long-term holders continued adding over 254,000 BTC in recent months, demonstrating confidence. However, as BTC prices approach $99,900, the risk of increased sell-side pressure may rise.

- India’s Crypto Taxation Unchanged as the Existing 30% Tax Retains

- Crypto News: Strategy Bitcoin Underwater After 30% BTC Crash

- Expert Predicts Ethereum Crash Below $2K as Tom Lee’s BitMine ETH Unrealized Loss Hits $6B

- Bitcoin Falls Below $80K as Crypto Market Sees $2.5 Billion In Liquidations

- Top Reasons Why XRP Price Is Dropping Today

- Here’s Why MSTR Stock Price Could Explode in February 2026

- Bitcoin and XRP Price Prediction After U.S. Government Shuts Down

- Ethereum Price Prediction As Vitalik Withdraws ETH Worth $44M- Is a Crash to $2k ahead?

- Bitcoin Price Prediction as Trump Names Kevin Warsh as new Fed Reserve Chair

- XRP Price Outlook Ahead of Possible Government Shutdown

- Ethereum and XRP Price Prediction as Odds of Trump Attack on Iran Rise