Polygon Based Defi Protocol Becomes Latest Victim of Exploit, Price Crashes to Zero

Polygon-based defi project Safedollar became the latest victim of an exploit earlier today as hackers managed to exploit a security vulnerability in the algorithmic stablecoin’s liquidity pool. The security breach crashed the price of the defi protocol to zero.

Hackers managed to initiate an infinite mint and drained $250,000 worth of stablecoins from the liquidity pools to dump on the open market. The market Cap of $SDO at the time of exploit was $248 million but had only $250K in its liquidity pools. The developers behind the project claimed they had no part in the exploit and promised to investigate the exploit along with a detailed report.

SafeDollar was exploited today and dumped on the open market for ~$250k. It was an infinite mint exploit. The market cap of $SDO was ~$248mm but there was just $250k in exit liquidity,. The attack happened because SafeDollar incentivized a token that has a fee on transfer. 🧵👇 pic.twitter.com/7oW020zEQ4

— Mudit Gupta (@Mudit__Gupta) June 28, 2021

The official Telegram group acknowledged the hack and said,

“SafeDollar has been under attack. We have paused activities on SafeDollar and investigating the matter.”

The developers have promised to compensate the liquidity providers who lost money during the recent exploit

The project was launched just a couple of weeks ago and has faced two security vulnerabilities. The first one occurred on June 20 when one of its IDO vaults was compromised for $95,000.

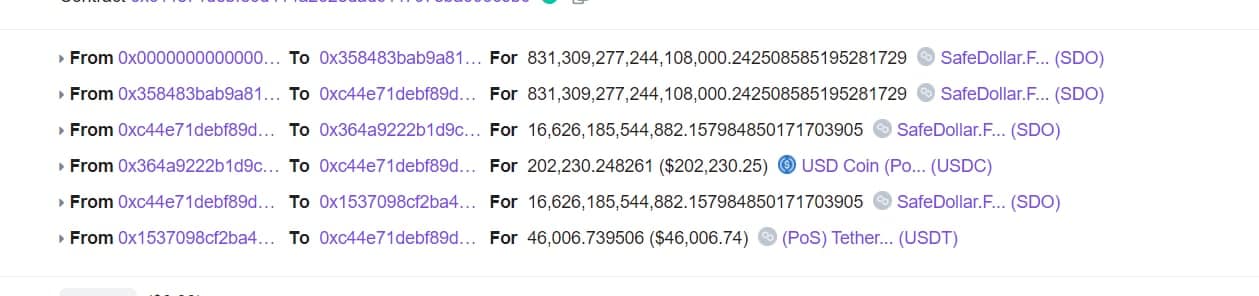

Hackers Minted 831 Quadrillion Stablecoin

The $SDO protocol’s liquidity vulnerability allowed hackers to mint 831 quadrillion stablecoins which were later sold to the liquidity pools which in turn led to a price collapse.

The Safedollar price crash comes just weeks after another Polygon-based defi protocol Iron Finance whose price crashed after its governance token TITAN was exploited. The project had Mark Cuban as one of the leading investors.

Defi has become one of the most popular use cases to emerge out of the crypto ecosystem with its market cap reaching over $100 billion within a year. However, the growing ecosystem has been plagued by various exploits and hacks from time to time.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Bitget Rolls Out Group-Based Maker Rates to Boost Liquidity Across Spot and Futures

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs