PolyNetwork Hack: Everything You Should Know About $610M Largest Defi Hack

The Defi cross-chain protocol Poly Network fell prey to the biggest crypto heist in history. August 10, Tuesday, hackers stole approximately $610 million worth of cryptocurrencies from Poly Network operating across the Binance Smart Chain (BSC), Ethereum (ETH), and Polygon. The fortune was then transferred into three different wallet addresses on the respective blockchains.

O3 infiltration: the first step to the $610M hack

The panic began when hackers infiltrated O3, the largest cross-chain protocol. The hack was spotted when 03 announced it was struggling in processing $150 million worth of transactions. Following the initial fold of this legendary hack, Poly Network and O3 protocol suspended cross-chain functions.

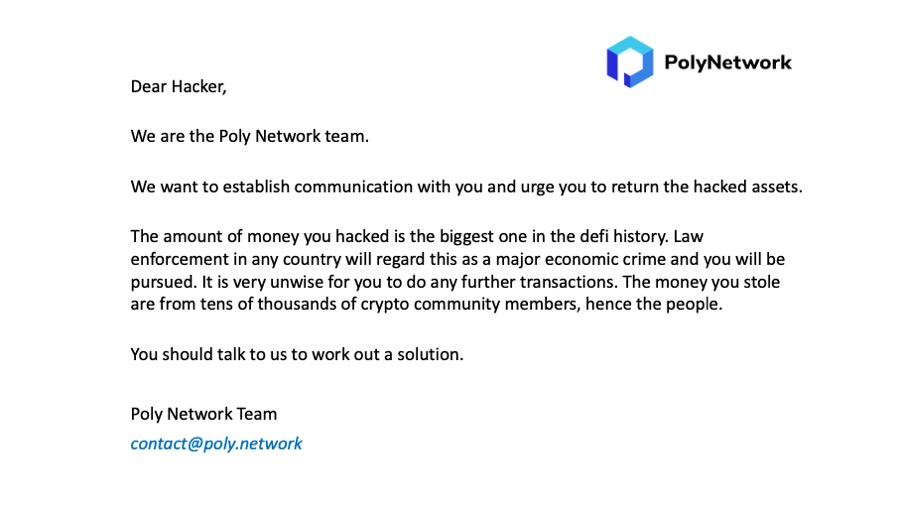

Poly Network warned exchange services to block any transactions originating from hacked accounts. Poly Network also requested the hackers to return the stolen assets, while simultaneously threatening them with legal action.

$610M hack amount distributed into three wallet addresses

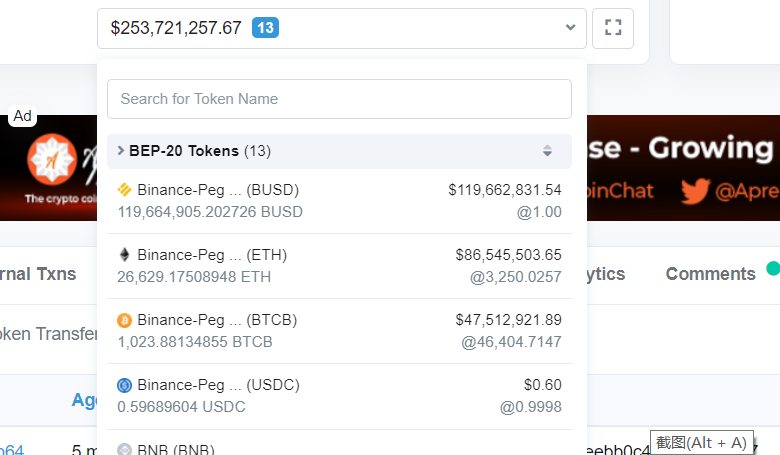

The hack summed up to be an enormous $610 million, with the amount being unevenly distributed into three blockchain addresses.

“A total of $610 million were stolen out of which $266,5 million were sent to an ETH address, $252 million were sent to a BSC address, and $85 million to Polygon address.”

A third of the $610M hack amount returned

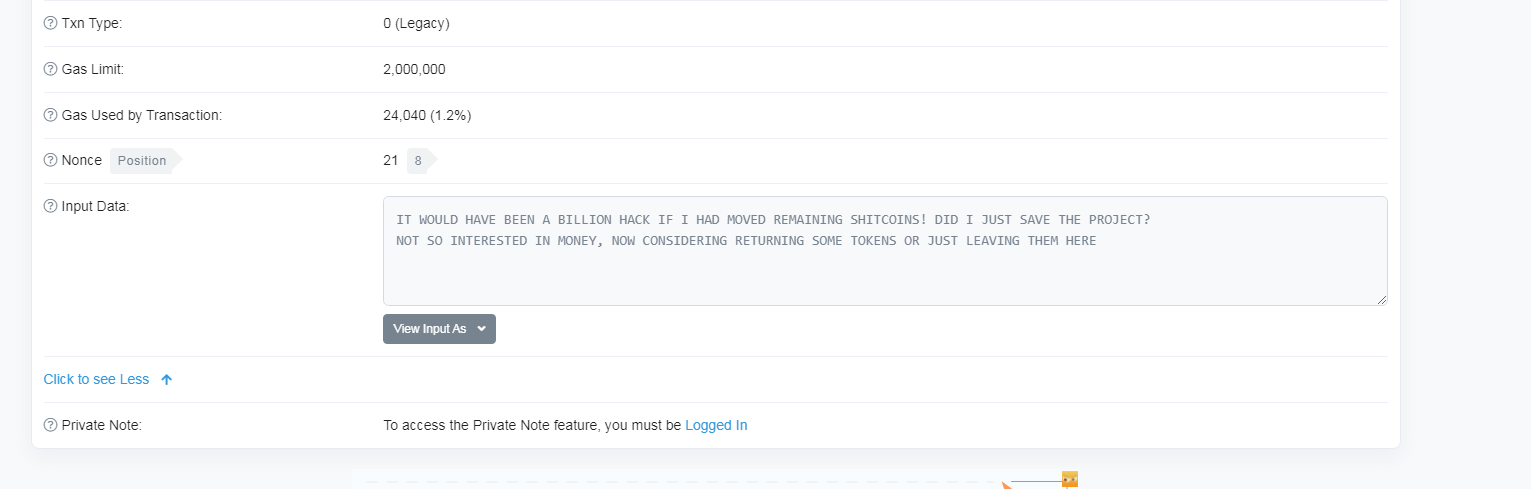

However, soon after the attack, the hacker agreed to return the fund and publicly demanded a secure multi-sig wallet from the Poly Network. Additionally, the hacker reportedly asserted that the attack would have been in billions if the hacker decided to include “Shitcoins” in the stolen assets. Along with the slight threat to the authorities, portraying his potential, the hacker also questioned the capabilities of Poly Network’s protocol developers.

In the latest update, hackers returned over a third, i.e., $260 million of $610 million in stolen digital assets. Experts claim that the return came in lieu of convenience, as laundering stolen crypto on such a scale, is a bigger task than stealing it.

“Even if you can steal cryptoassets, laundering them and cashing out is extremely difficult, due to the transparency of the blockchain and the broad use of blockchain analytics by financial institutions,” Tom Robinson, co-founder of Elliptic, told Reuters.

Amid the chaos of this hack, Tether decided to freeze $33 million worth of USDT and warn the exchanges and miners to beware of the mentioned hacked accounts. However, Binance and Circle decided against freezing the transactions and were thoroughly criticized for the same.

PolyNetwork hackers exchanged stablecoins for DAI as soon as possible, indicating that he is not a white hat (subsequently, he may be pressured to repay). It also shows that the Ethereum chain is not as resistant to censorship as UTXOs such as BTC.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs