President Trump Allegedly Got Paid to Settle Crypto Cases: NYT Report

Highlights

- New York Times alleges financial gains for Trump from settled lawsuits.

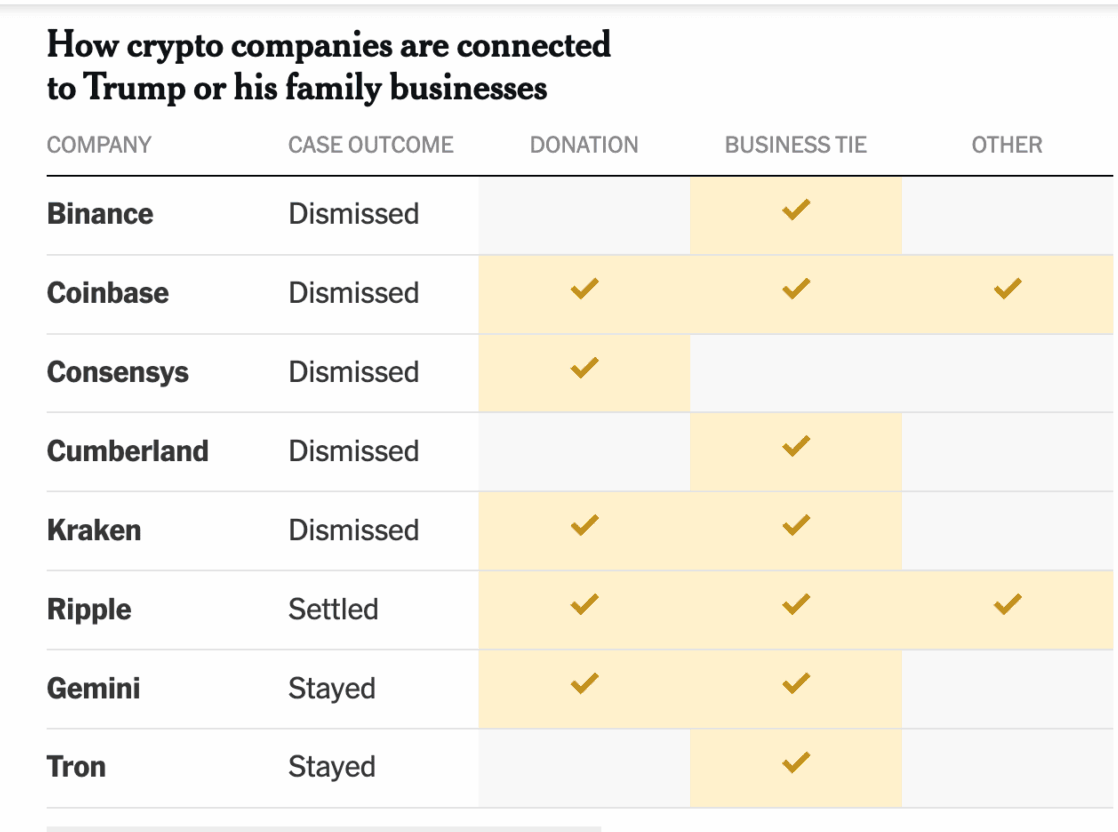

- Some legal setttlemet were linked to donations or business ties, involving firms that later formed connections to the Trump family.

- Crypto cases were dismissed at a higher rate than enforcement actions in other industries.

The New York Times has accused President Trump and his family of having financially benefited from the settled crypto cases since the beginning of his administration. They linked some of them to political donations or business links.

NYT Report Links Trump to Crypto Case Reversals

An investigation by the New York Times found numerous crypto enforcement actions were either dropped or scaled back after the President started his second term. They said some cases involved companies that later formed financial or political connections with his family.

The report says that several legal outcomes were linked to donations or business ties to the family’s growing crypto business.

One example is the crypto company started by the Winklevoss twins. This company faced a federal lawsuit, and once the administration changed, regulators tried to freeze the case. Around the same time, the SEC wholly abandoned its case against Binance.

In another high-profile reversal, the SEC looked to cut a court-ordered penalty against Ripple Labs after years of litigation.

The Times termed the pullback highly unusual. Traditionally, the SEC rarely beats a retreat in large clumps of lawsuits against the same sector. Still, investigators found the agency let up on more than 60% of crypto cases that were active when the President re-entered the White House.

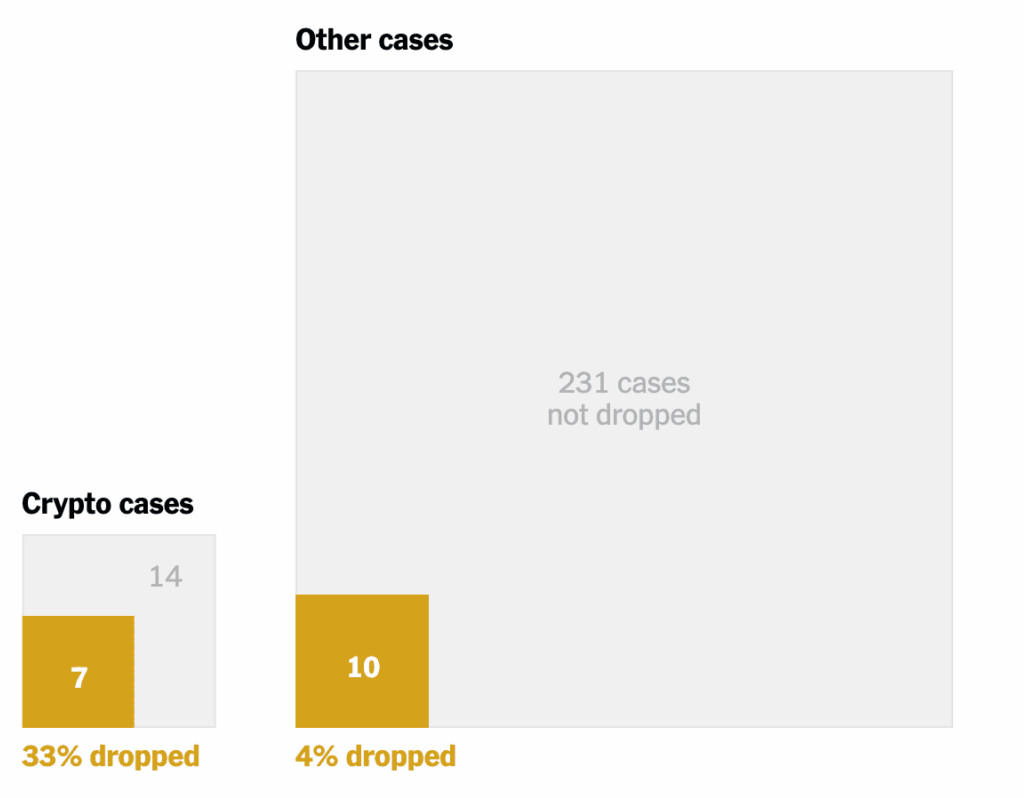

Dismissals stood out in crypto-related cases. These cases were dismissed at a higher rate compared to those in other industries under this administration. Meanwhile, the SEC kept filing enforcement actions unrelated to crypto during that time.

The report also mentioned that the SEC no longer actively pursues any crypto cases involving firms connected to Trump. Every such case was either paused or rolled back.

White House press secretary Karoline Leavitt dismissed the conflict of interest allegations.

“fulfilling the president’s promise to make the United States the crypto capital of the world by driving innovation and economic opportunity for all Americans,” she said.

To note, the SEC did not voluntarily dismiss a single crypto case during the Biden administration that it had inherited from Trump’s first term.

Legal Outcomes Tied to Donations and Business Connections

The Times found that the second administration dismissed roughly a third of the inherited Biden-era crypto cases, as compared with about 4% involving other industries.

Of the 23 crypto cases it inherited, the SEC pulled back from 14. Eight of those involved defendants who formed political or financial ties to the president or his family.

Examples include crypto founder Justin Sun, whose company Tron later became linked to digital assets tied to Trump. Lawyers for the President’s related businesses deny that there is any link between government decisions and private companies.

The Ripple case, for instance, moved just as fast. After the President’s comeback, the SEC tried to get the penalty reduced to $50 million. A judge had ordered the company to pay $125 million for securities violations. Then the judge refused to let them take it back on the grounds of the agency’s sudden reversal.

- UK Treasury Introduces Crypto Bill Following US Playbook- Is It Already Too Late?

- US SEC Advances Proceedings to Enable Nasdaq Launch Tokenized Securities Trading

- Metaplanet CEO Teases “Crucial” Bitcoin Buy Decision at Upcoming EGM, Stock Wavers

- Crypto Market Eyes Bounce as Traders Await U.S CPI Data, Jobless Claims and BOJ Rate Decision

- Bitcoin Faces Slide Towards $70K as Japan Rate Hike Odds Spike

- Bitwise SOL ETF Records 33 Days of Nonstop Inflows- Is A Recovery to $150 Possible?

- Will Bittensor Price Break Above $400 After First TAO Halving Tomorrow?

- Expert Predicts Bitcoin Price Crash to $75k as ETF Inflows Fall, Treasury Companies Plunge 83%

- HYPE Price Jumps 8% as Open Interest Hits $1.61B — Is $50 Next?

- Is Solana Price Poised for a +50% Bullish Rally? Here’s What to Expect

- Top 3 Price Predictions for Bitcoin, Ethereum, and XRP in DEC 2025