Q3 Records 50% Decrease in Open Interest At CME- Skew Markets

A recent tweet by the market analysis platform, Skew markets suggests that open interest at the Chicago Mercantile Exchange has decreased by 50%, thus, implying a decrease in spot price and volumes.

Were A Large Number of Contracts Left to Expire in September?

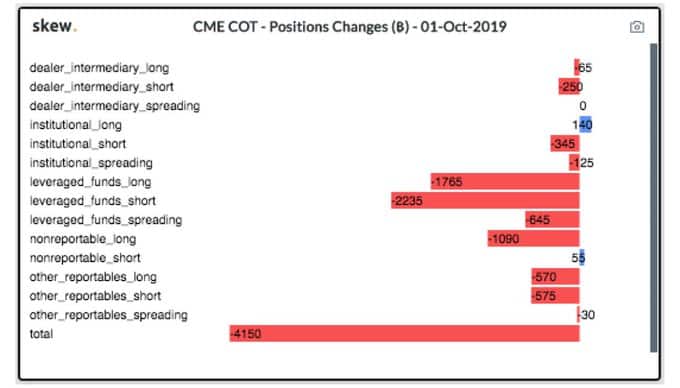

Spot trading volume has served as a lagging indicator of price. This implies that as the prices increase, more people start trading and thus the volume goes up. While this has been the case, the case of the Chicago Mercantile Exchange makes up for an interesting case scenario. Also, the recent report by Commitment of Traders(COT) reports that a significant amount of contracts were left to expire before September.

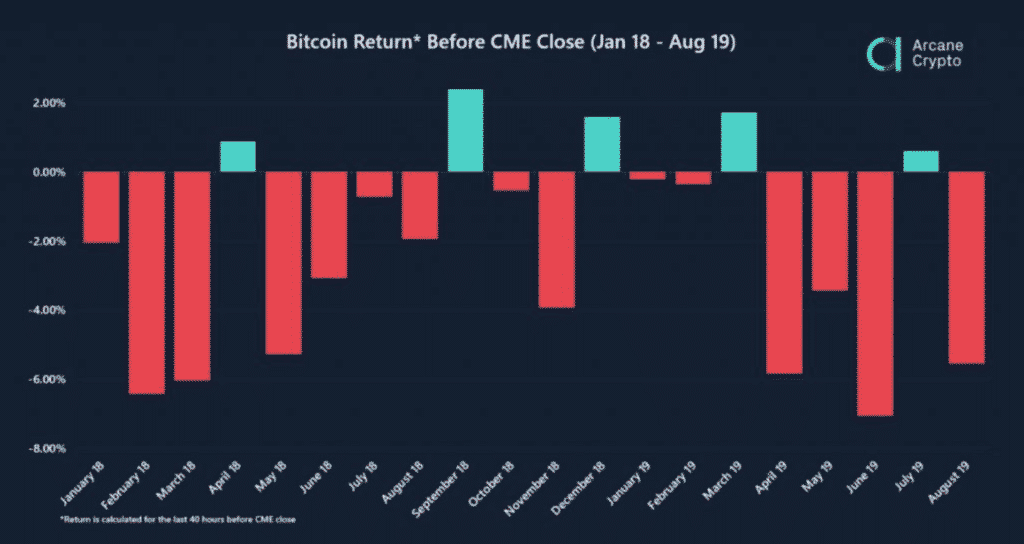

According to a research report from Arcane Crypto, there is a clear correlation between contract settlement and negative intraday Bitcoin returns. The report further suggests that since January 2018, on average, bitcoin falls 2.27% as it approaches the CME expiration date.

Bendeik Norheim Skei, an analyst said the previous week

“Traders that hold both a short position on CME and a long position somewhere else can sell their long position, and stay in the futures contract (that is a short position), and then get a profit from the drop they created when selling the bitcoin in the spot market. As there is a lot of algo trading in the market, traders might speculate that a dump of a relatively large long position might offset a ratchet effect, resulting in a larger price fall.”

While it is simply a hedging tactic or actual manipulation, an arbitrage opportunity comes forth as the settlement approaches. This thus allows traders to simultaneously long and shorts in varying markets.

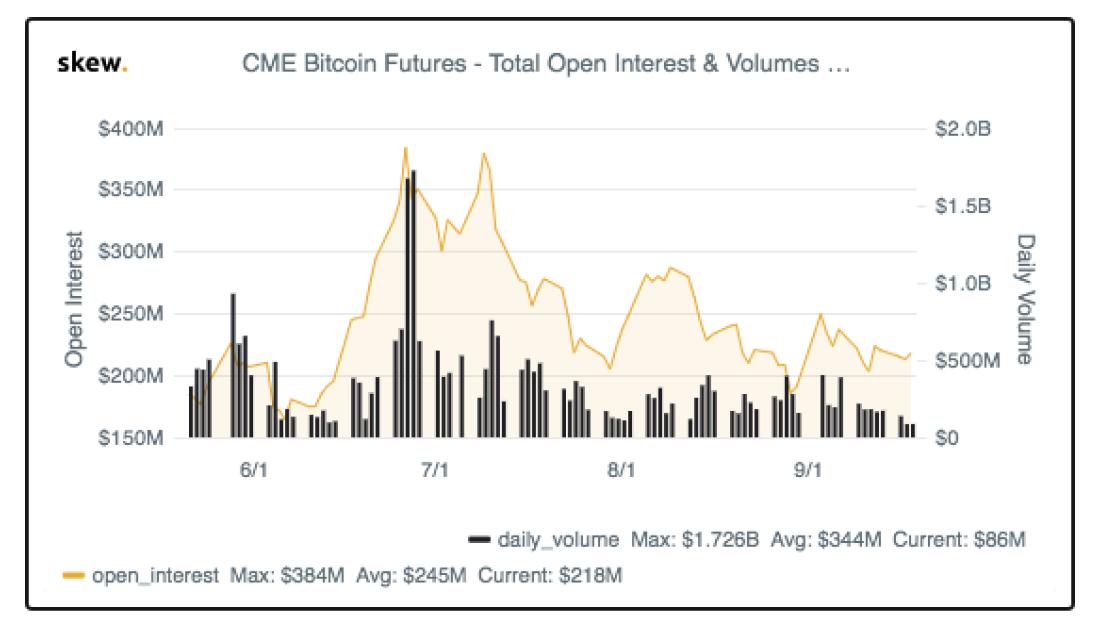

Significant Drop-in Open Interest and Daily Volumes

The previous month recorded a 4-month low amid crashing BTC price. As per the charts which show the relationship between CME’s open interest and daily volumes, there has been a significant fall in open interest from $384 million to the current value of $218 and daily volume has reduced from its maximum value of $1.726 billion to its current value at $86 million.

Will Bitcoin dip further? What will be the long term prospects of CME futures? Let us know what you think in the comments below!

- U.S. CFTC Committee Appoint Ripple, Coinbase, Robinhood CEOs to Boost Crypto Regulation

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter