RBI, SEBI Collaborate To Develop India Crypto Policy, Paper Due In Q3

Highlights

- RBI and SEBI join inter-ministerial group to develop comprehensive crypto policy.

- Discussion paper on cryptocurrency regulations expected before September 2024.

- Move signals potential shift from previous restrictive stance to more inclusive approach.

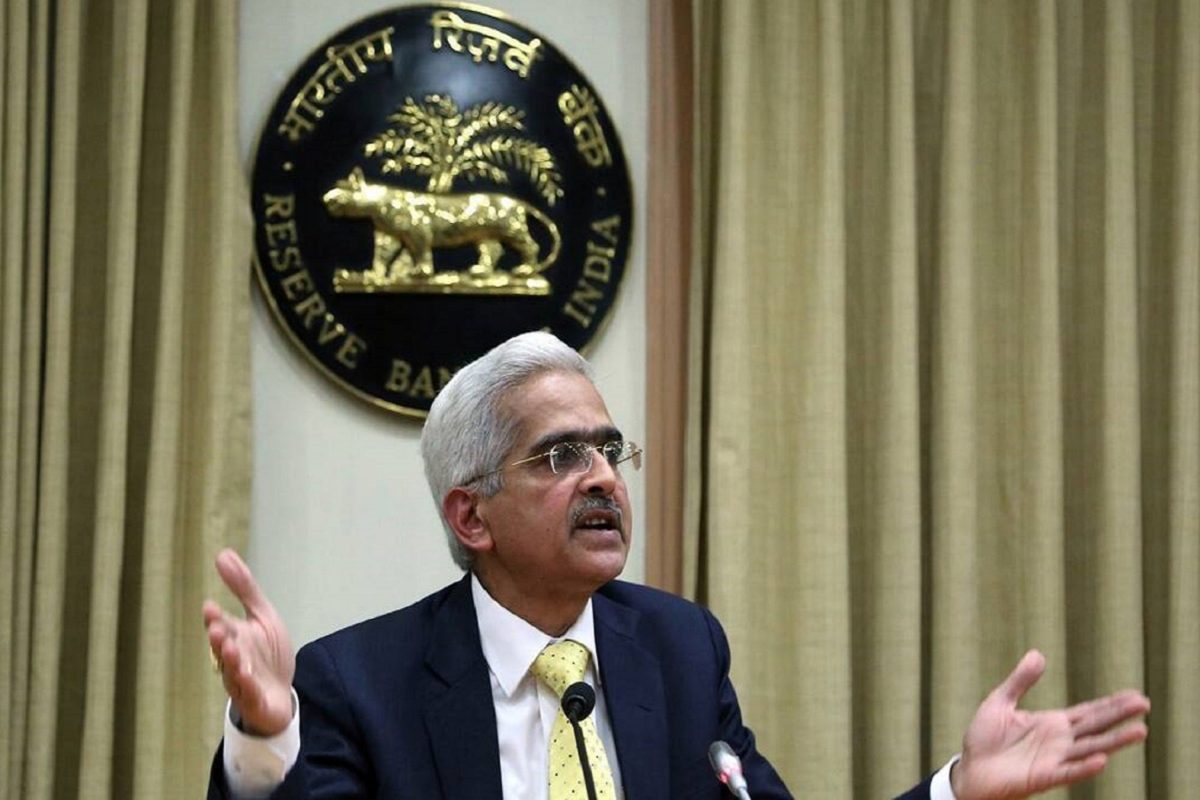

India Crypto Policy: The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have joined an inter-ministerial group tasked with formulating a comprehensive crypto policy. This collaboration marks a potential turning point in their stance on cryptocurrencies, with a discussion paper outlining the government’s position expected to be released in the third quarter of 2024.

India Crypto Policy Development & Regulatory Collaboration

India’s financial regulators, RBI and SEBI, are joining forces with other government bodies to develop the India crypto policy. Economic Affairs Secretary Ajay Seth revealed in an interview that a discussion paper outlining their stance on cryptocurrencies is expected to be released before September 2024.

The paper aims to gather input from stakeholders on potential regulations for India crypto policy. Seth explained that the current regulatory approach focuses solely on anti-money laundering (AML) and counter-terror financing (CTF) measures, which were extended to crypto assets and intermediaries in March 2023.

An inter-ministerial group, including the RBI and SEBI, is working on a broader policy framework. This development follows their G20 presidency in 2023, during which member countries endorsed guidelines set by the International Monetary Fund (IMF) and the Financial Stability Board (FSB).

The discussion paper will address key questions about policy stance and regulatory scope. It comes amid conflicting views within Indian authorities, with SEBI reportedly open to allowing private virtual asset trading, while the RBI maintains concerns about macroeconomic risks.

This initiative marks a significant step in their approach to cryptocurrencies, following the Supreme Court’s 2020 decision to strike down the RBI’s 2018 ban on crypto-related financial services. The government’s stance has evolved since 2021 when a bill proposing a ban on private cryptocurrencies was drafted but never introduced.

The upcoming discussion paper is expected to align with the G20-endorsed IMF-FSB framework, which advises against blanket bans on crypto activities. This development signals their move towards a more nuanced and potentially inclusive approach to cryptocurrency regulation.

Also Read: Steve Forbes Says Kamala Harris Policies Will Ruin The Middle Class

Divergent Regulatory Views and Market Impact

SEBI has shown openness to allowing private virtual asset trading, recommending multiple regulators oversee crypto trading nationwide in May. This stance contrasts with the RBI’s historically tighter grip on cryptocurrencies and its ongoing concerns about macroeconomic risks.

However, SEBI’s recommendation has gained significant traction among crypto market participants, potentially signaling a more inclusive approach to cryptocurrency regulation. This development has created a state of anticipation in the market, as it represents a potential shift from the RBI’s longstanding restrictive stance on cryptocurrencies.

The upcoming discussion paper and the resulting policy framework are expected to navigate these differing viewpoints and establish a balanced approach to cryptocurrency regulation in the country.

Also Read: Bitcoin ETF Inflows Surge As Ether ETF Loses $133M In Hype Shift

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

Buy $GGs

Buy $GGs