XRP Price Analysis: Ripple price poised for another retreat before resuming the uptrend to $1

- Ripple price suffers under the worst pump-and-dump schemes, making recovery an uphill battle.

- XRP price is likely to revisit lower support levels, perhaps to $0.3 before resuming the uptrend to $1.

Ripple price has recently undergone the worst pump-and-dump situation in its history. It is believed that a Telegram group with over 200,000 members was responsible for the pump. However, it appears that XRP whales were ready to cash out and exit the project that had probably locked their funds since the breakdown in December.

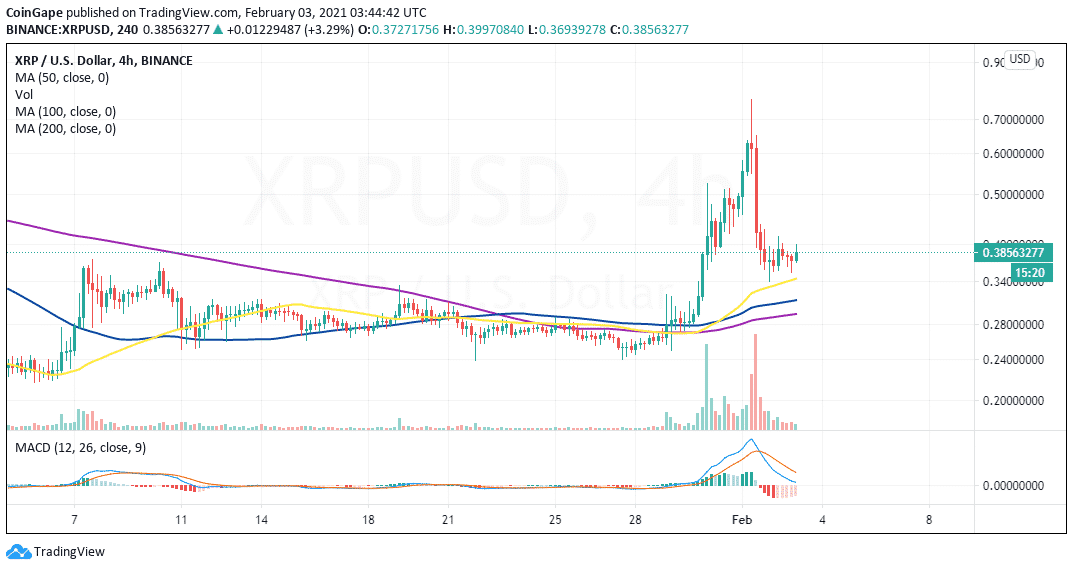

At the time of writing, XRP price is doddering at $0.38 after falling sharply from $0.75. The barrier at this level cut short the expected liftoff to $1. On the bright side, the 50 Simple Moving Average on the 4-hour chart came in handy and preventing the cross-border token from plunging further.

Meanwhile, XRP bulls are working around the clock to break above the resistance at $0.4. However, another daily close under this level may see a selling pressure surge. Support at the 50 SMA ($0.34), might not be strong enough to hold the token in position. Thus paving the way for a further drop to the 200 SMA around $0.29.

XRP Price Analysis: XRP/USD 4-hour chart

The Moving Average Convergence Divergence appears to have validated the bearish outlook. This indicator follows the trend of the asset and also measures its momentum. The MACD can be used to identity buy the dip and sell the dip positions.

If the MACD line (blue) crosses under the signal line, it is best not to enter any new positions, perhaps sell. On the other hand, a cross above the signal line suggests that it is time to buy.

In this case, the MACD divergence under the signal line is still wide. Thus calling for caution because XRP may retreat some more before a significant trend reversal comes into the picture.

Ripple intraday levels

- Spot rate: $0.38

- Relative change: 0.01

- Percentage change: 3%

- Trend: Sideways

- Volatility: Low

- Bitcoin to Drop to $10K? Bloomberg Analyst Makes Bold Prediction

- U.S. Banks May Soon Issue Stablecoins as FDIC Proposes GENIUS Act Framework

- Breaking: U.S. SEC Ends Four-Year Investigation Into Aave Amid Ongoing DAO Saga

- Breaking: U.S. Jobs Data Comes In Above Expectations, Bitcoin Price Rises

- Bitcoin Risks Deeper Fall on $20 Billion Crypto Hedge Fund Redemptions

- Solana Price Outlook After Charles Schwab Adds SOL Futures — What Next?

- Pi Network Stares at a 20% Crash as Whale Buying Pauses and Demand Dries

- Here’s How Dogecoin Price Could Rise After Crossing $0.20

- Is XRP Price Headed for $1.5 as Whales Dump 1.18B XRP in Just Four Weeks?

- Bitcoin Price Weekly Forecast as Gold’s Surge Revives Inverse Correlation — Is $85K Next?

- Ethereum Price Risks $2,600 Drop Despite JPMorgan’s New Fund on its Network