Ripple price recovery steadies despite the SEC’s lawsuit uncertainty

- Ripple holds the uptrend in place following a rebound from the primary support at $0.35.

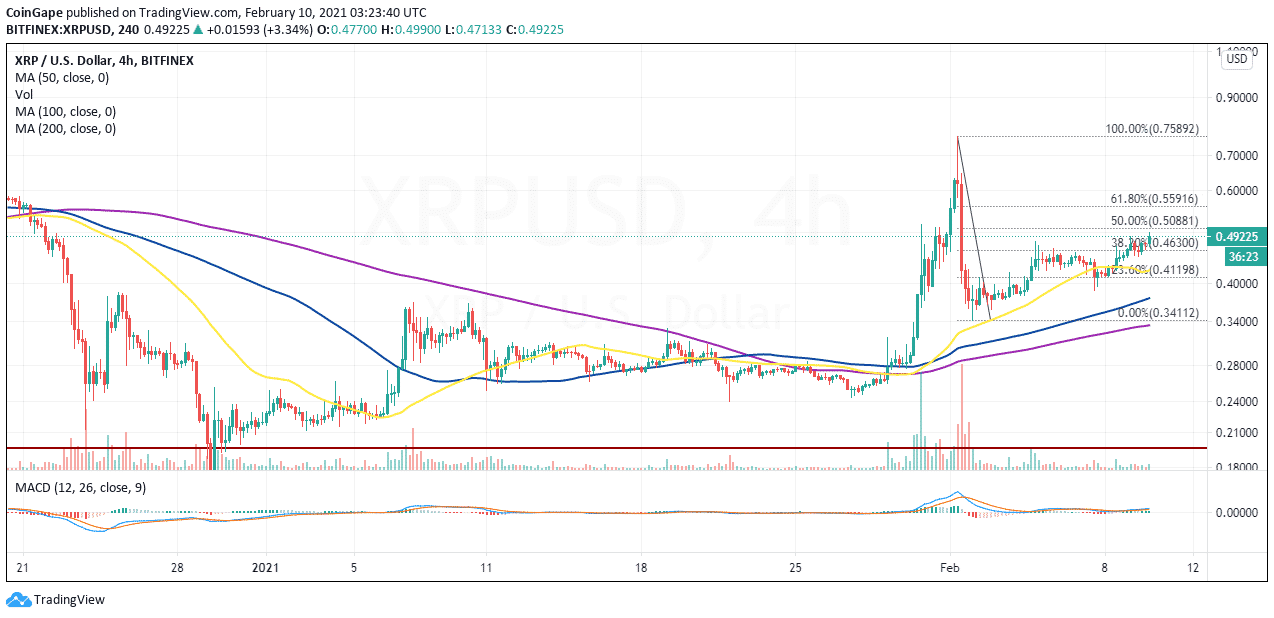

- XRP must break above the 50% Fibonacci level to sustain the recovery eyeing $0.75.

- A correction will come into the picture if XRP’s upside remains capped under $0.5.

Ripple is making a gradual but steady recovery after recently suffering a big blow. The cross-border token was pumped massively early last week although it immediately dropped like a stone in the air. The bulls took refuge at $0.35, assisted by the 50 Simple Moving Average on the 4-hour chart.

Meanwhile, XRP has regained the lost ground above $0.4 and is currently battling the crucial hurdle at $0.5. The steady recovery is happening even with the lawsuit filed by the Securities and Exchange Commission (SEC). The regulator alleges that Ripple together with its top executives sold unregistered tokens to investors.

Ripple maintains that the XRP token is not a security but this lawsuit and other class-action cases filed against the blockchain startup claim the firm breached the Securities Act.

At the time of writing, XRP is dancing at $0.49 and is almost hitting levels above $0.5. Trading past this crucial zone could be a turning point for XRP. More buyers are likely to join the market as their confidence in recovery rebuilds.

Simultaneously, Ripple will have to settle above the 50% Fibonacci retracement level to confirm or validate the expected upswing back to $0.75. The Moving Average Convergence (MACD) is making subtle hints that XRP is having a bullish impulse. It is essential to keep in mind that the uptrend may face other hurdles at $0.6 and $0.7 before running further up toward $1.

XRP/USD 4-hour chart

Failure to break above $0.5 and settle beyond the 50% Fibo may attract increased selling orders. Therefore, XRP is could break down toward the 50 SMA and $0.4. If push comes to shove the bearish leg may extend to the primary support at $0.35.

Ripple intraday levels

Spot rate: $0.48

Relative change: 0.015

Percentage change: 3.2%

Trend: Bullish

Volatility: Low

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs