Ripple’s ODL Service In Mexico Hits An All-Time Low

Ripple ventures into the United Kingdom with ODL services for a new pair, GBP/XRP. Ripple’s ODL corridor in Mexico, however, takes a hit as it faces an all-time low.

Pound Sterling Released On Ripple’s ODL

The need for digitalization of cash and utilization of virtual remittances is now more than ever. The pandemic has left many quarantined and away from their families. Focusing on the same, Ripple’s Senior Vice President of Product recently published a blog post suggesting that the platform’s ODL services would converge on aiding transactions of a lower value instead of large payments. Along with this Birla had revealed that Ripple would roll out new ODL corridors this year.

Ripple seems to fact-paced as United Kingdom got another ODL corridor. Luxembourg exchange, Bitstamp had already been supporting the EUR/XRP pair. However, the latest reports reveal that ODL services for the GBP/XRP pair are now live.

Liquidity On Other ODL Corridors Plummet

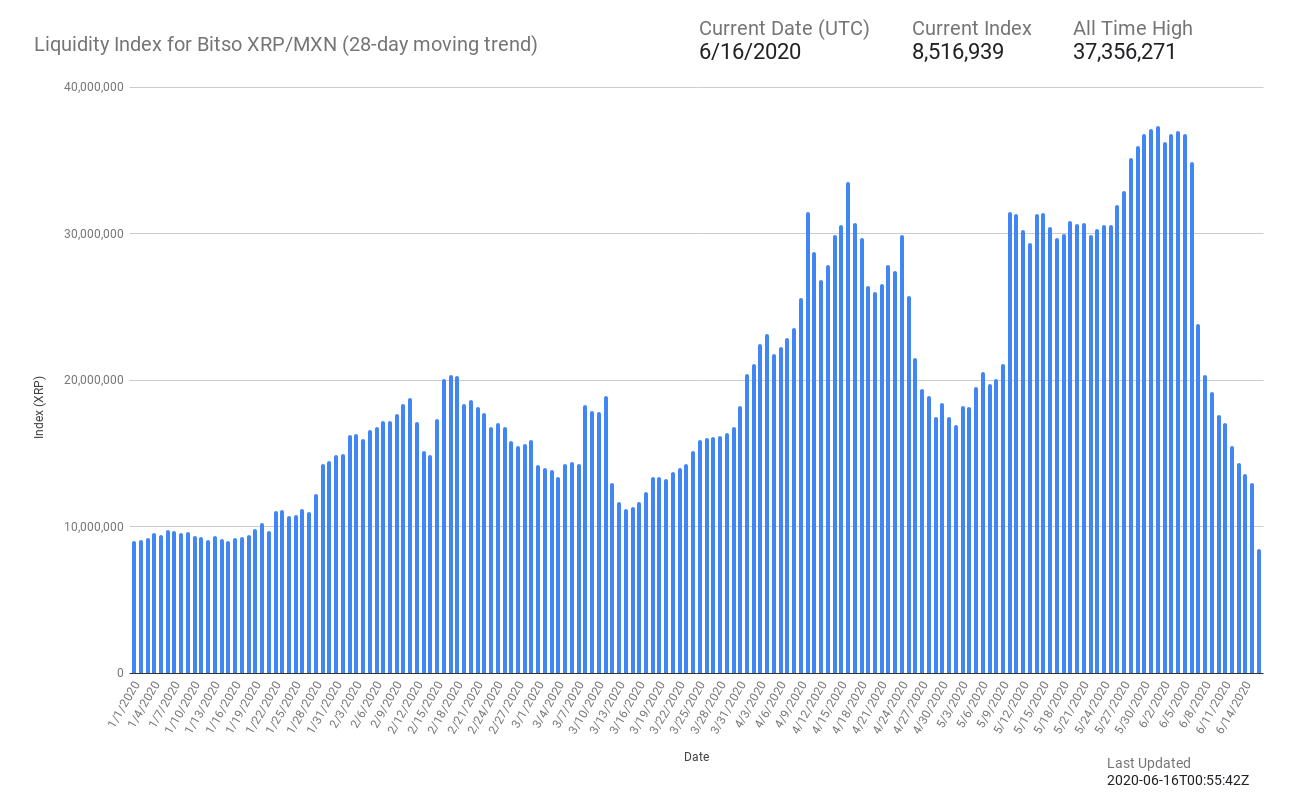

Twitter handle, Liquidity Index Bot, a platform that keeps account of the liquidity index of XRP on different corridors has been sharing charts where the liquidity of the XRP/MXN pair was seen recording significant slumps since the beginning of this month. However, the latest chart reveals that the liquidity index for Bitso XRP/MXN pair hit an all-time low of 8,516,939.

Towards the end of last month, the liquidity index of the pair registered notable highs. The pair even hit an all-time high of 37,356,271 in the last month. Along with this, other pairs like XRP/AUD, XRP/PHP, and XRP/EUR were also witnessing a drop in its liquidity over the past few days.

A few days ago, David Schwartz, the CTO of Ripple explained on Twitter how certain transactions can take place without utilizing XRP. A Twitter user reached out to Schwartz asking if Ripple’s ODL would function without buying or selling XRP. To which Schwartz replied,

“We chose to do fiat-to-fiat first for a few reasons, but the biggest one is that it can work with no XRP infrastructure at all, so could be deployed fastest. Then we could use XRP where it could provide the most impact with a ready supply of customers and payments to tap into.”

- 125 Crypto Firms Mount Unified Defense as Banks Push to Block Stablecoin Rewards

- BlackRock Bitcoin ETF Ranks Among Top ETFs In 2025 Despite Crypto Downturn

- Stablecoin Adoption Deepens as Klarna Turns to Coinbase for Institutional Liquidity

- Ripple, Circle Could Gain Fed Access as Board Seeks Feedback on ‘Skinny Master Account’

- Fed’s Williams Says No Urgency to Cut Rates Further as Crypto Traders Bet Against January Cut

- Will Solana Price Hit $150 as Mangocueticals Partners With Cube Group on $100M SOL Treasury?

- SUI Price Forecast After Bitwise Filed for SUI ETF With U.S. SEC – Is $3 Next?

- Bitcoin Price Alarming Pattern Points to a Dip to $80k as $2.7b Options Expires Today

- Dogecoin Price Prediction Points to $0.20 Rebound as Coinbase Launches Regulated DOGE Futures

- Pi Coin Price Prediction as Expert Warns Bitcoin May Hit $70k After BoJ Rate Hike

- Cardano Price Outlook: Will the NIGHT Token Demand Surge Trigger a Rebound?